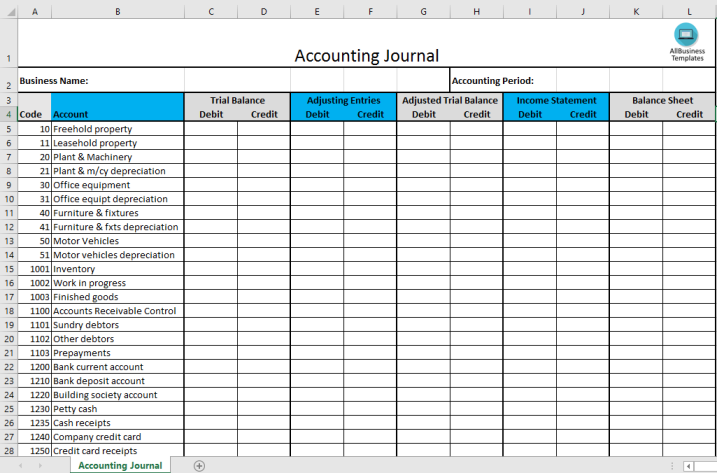

Donation Receipt Cash and Items

Guardar, completar los espacios en blanco, imprimir, listo!

Are you looking for Donation Receipts to send to your donors as proof for receipt of charitable monetary or items donation? Download this Donation Receipt template

Formatos de archivo disponibles:

.doc- Este documento ha sido certificado por un profesionall

- 100% personalizable

Finance Financiar accounting contabilidad bookkeeping teneduría de libros donation donación donation receipt cash recibo de donación en efectivo donation receipt recibo de donación donation receipt sample muestra de recibo de donación professional donation receipt recibo de donación profesional financial donation receipt recibo de donación financiera tax impuesto charity caridad donor donante donor administration administración de donantes donation administration administracion de donacion ngo donation receipt ngo recibo de donación non profit donation receipt recibo de donación sin fines de lucro nonprofit donation donación sin fines de lucro book keeping mantenimiento de libros download accounting descarga de contabilidad

Are you looking for suitable Donation Receipts to send to your donors as proof for receipt of charitable monetary or physical products as a donation? Download this Donation Receipt Cash Donation template now!

What is a donation receipt for received items?

This is an e-mail or a letter which is considered proof that a donor made an in-kind contribution to a (nonprofit) organization. Often, NGO’s/nonprofits send receipts out by the end of the year the gift was given or in January of the following year.

Donation Receipt Cash and Items for Donors

- deductions on Tax Returns: this Donation Receipt is important in order to receive the tax deductions associated with charity, a donor needs such proof of donation.

- financial record keeping: donation receipts are an easy way for donors to keep track of their finances when it comes to charitable giving.

- confirmation: it acknowledges the receipt of a donation and let donors know their contributions have been received.

Donation Receipt Cash and Items for Nonprofits

- legal requirements: the IRS requires donation receipts in certain situations. Failure to send a receipt can result in a penalty.

- accounting: donation receipts enable organizations to get clear and accurate financial records.

- tracking donation history

What must be Included in a Donation Receipt?

- name of a donor

- organization’s name, federal tax ID, a statement showing the organization is a registered

- date donation was provided

- the total sum of money or a description (not the value) of the donated item(s). The donor is responsible for assigning a cash value of donated items or in-kind contributions.

- a statement indicating whether any goods or services were provided in exchange for the donation: If no goods or services were given to the donor in return for the contribution, the nonprofit must say so.

- name and signature of authorized legal representative

- a disclosure, if necessary. This depends on local regulations. Double check to make sure you’re including the required disclosure statements for all states that your donors are contributing from.

We provide a Donation Receipt Cash Donation template that will professionalize your way of administration and communication towards the donor organization. Our templates are all screened by financial professionals.

Using this donation receipt template guarantees you will save time, cost and efforts!

DESCARGO DE RESPONSABILIDAD

Nada en este sitio se considerará asesoramiento legal y no se establece una relación abogado-cliente.

Deja una respuesta. Si tiene preguntas o comentarios, puede colocarlos a continuación.