Annual Plan

Guardar, completar los espacios en blanco, imprimir, listo!

How to create an Annual Budget plan for a company? An easy way to start your planning is to download this Annual Plan template now!

Formatos de archivo disponibles:

.pdf- Este documento ha sido certificado por un profesionall

- 100% personalizable

Business Negocio budget presupuesto planning planificación schedule programar planner planificador plan el plan Should Debería Annual Anual Plan Sample Muestra del plan Plan Samples Plan de muestras Initiatives Iniciativas how many weeks in a school year? shool schedule year 1 year medical school schedule 2 year old school schedule school plan year plan year planning yearly plan

How to create an Annual Budget plan for a company? An easy way to start your planning is to download this Annual Plan template now!

Creating an annual budget plan is a crucial aspect of financial management for any organization. It serves as a roadmap for allocating resources, making financial decisions, and achieving financial goals. Here are key elements that are important to include in an annual budget plan:

Revenue Projections:

Sales forecasts: Estimate the expected sales for each product or service.

Other income sources: Include any additional sources of revenue, such as interest, investments, grants, or partnerships.

Operating Expenses:

Fixed Costs: Include rent, utilities, salaries, insurance, and other fixed monthly expenses.

Variable Costs: Account for costs that fluctuate with business activity, such as raw materials, marketing, and travel expenses.

Capital Expenditures:

Plan for significant investments in assets like equipment, technology, or property.

Cash Flow Projections:

Predict the inflow and outflow of cash to ensure that the organization maintains healthy liquidity.

Budget for Departments or Projects:

Allocate funds to different departments or specific projects within the organization.

Ensure that each department or project has a clear understanding of its budgetary constraints.

Contingency Fund:

Set aside a portion of the budget for unforeseen expenses or emergencies.

Debt Service:

Include payments for loans or other forms of debt, specifying the amounts and payment schedules.

Income and Corporate Taxes:

Plan for tax obligations and set aside funds for tax payments.

Budget Assumptions:

Clearly state the assumptions underlying the budget, such as economic conditions, market trends, and any factors that may impact revenue or expenses.

Performance Metrics:

Define key performance indicators (KPIs) to measure the success and financial health of the organization.

Regularly track and evaluate these metrics throughout the fiscal year.

Budget Review and Approval Process:

Outline the process for reviewing and approving the budget, involving key stakeholders and decision-makers.

Communication Plan:

Develop a plan for communicating the budget to relevant stakeholders, both internally and externally.

Monitoring and Adjustments:

Establish a system for regularly monitoring actual performance against the budget.

Define a process for making adjustments to the budget if unforeseen circumstances arise.

Financial Goals and Objectives:

Clearly articulate the financial goals and objectives that the budget aims to achieve.

Align the budget with the organization's overall strategic plan.

Risk Management:

Identify potential risks that could impact the budget and develop strategies to mitigate those risks.

Investment Strategies:

If applicable, outline strategies for investing surplus funds to generate additional income.

Compliance:

Ensure that the budget complies with relevant laws, regulations, and accounting standards.

Documentation:

Maintain thorough documentation of the budgeting process, assumptions, and decisions for future reference and audits.

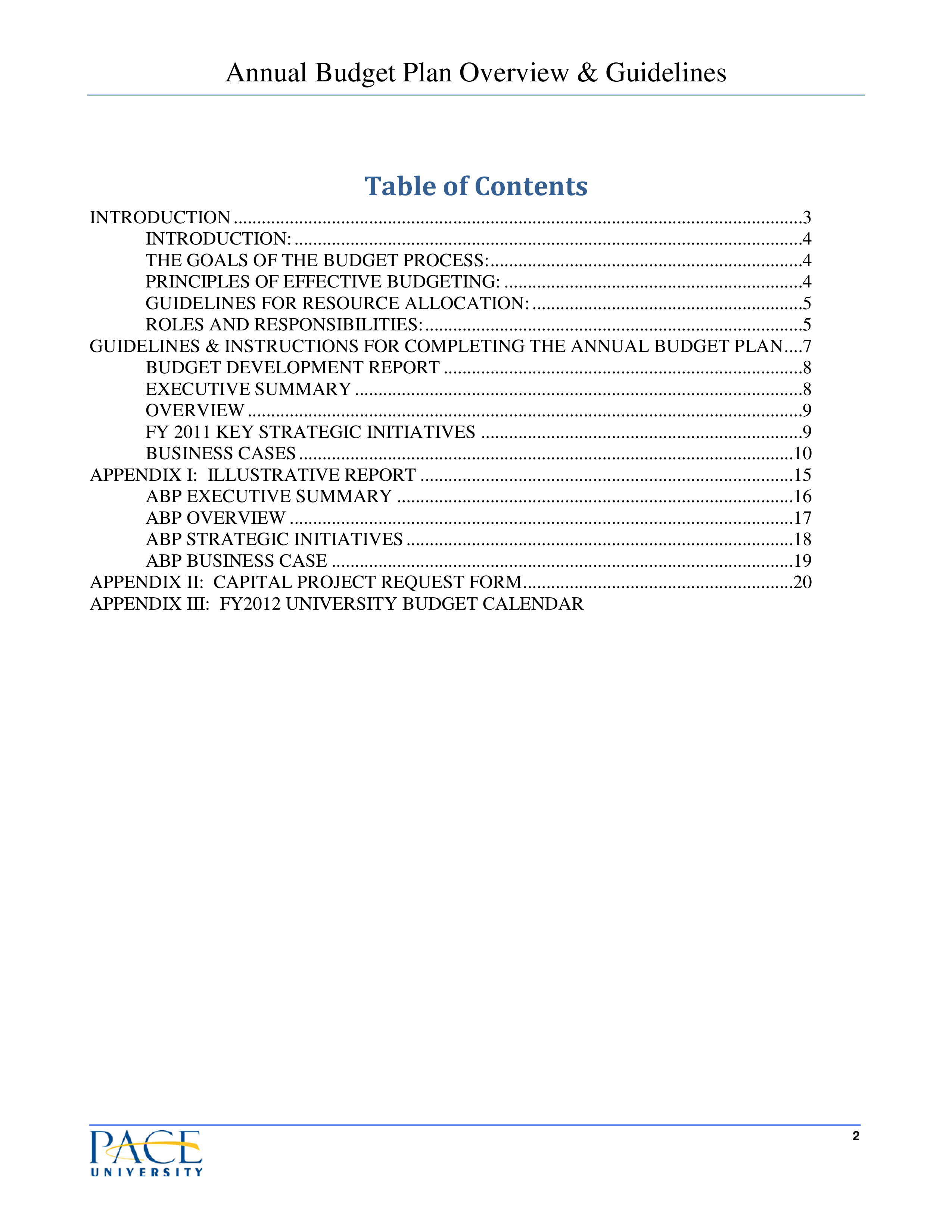

The TOC of this Annual Budget plan includes:

- Introduction

- The goals of the budget process

- Principles of effective budgeting

- Guidelines for resource allocation

- Roles and responsibilities

- Guidelines instructions for completing the annual budget plan

- Budget development report

- Executive summary

- Overview

- Fy 2024

- Key strategic initiatives

- Business cases

- Appendix I: illustrative report

- Executive summary

- Overview

- Strategic initiatives

- Business case

Creating a comprehensive annual budget plan involves a thoughtful and strategic approach, considering both short-term and long-term financial goals. Regularly reviewing and updating the budget throughout the year ensures that it remains relevant and effective in guiding the organization toward financial success.

Download this Annual Budget Plan template now!

DESCARGO DE RESPONSABILIDAD

Nada en este sitio se considerará asesoramiento legal y no se establece una relación abogado-cliente.

Deja una respuesta. Si tiene preguntas o comentarios, puede colocarlos a continuación.