Non-Profit donatie voor geld donatie

Opslaan, invullen, afdrukken, klaar!

De beste manier om een Non-Profit donatie voor geld donatie te maken? Check direct dit professionele Non-Profit donatie voor geld donatie template!

Beschikbare bestandsformaten:

.doc- Gevalideerd door een professional

- 100% aanpasbaar

- Taal: English

- Digitale download (49.5 kB)

- Na betaling ontvangt u direct de download link

- We raden aan dit bestand op uw computer te downloaden.

Zakelijk Financiën boekhouding schenking donatiebewijs contant donatiebewijs ontvangstbewijs monster professionele donatiebon financiële donatiebon belasting liefdadigheid schenker donor administratie donatie administratie donatie bonnetje non profit donatie ontvangstbewijs non profitorganisatie hoe ziet een donatiebon eruit boekhouding boekhouding downloaden beste boekhouding top boekhouding

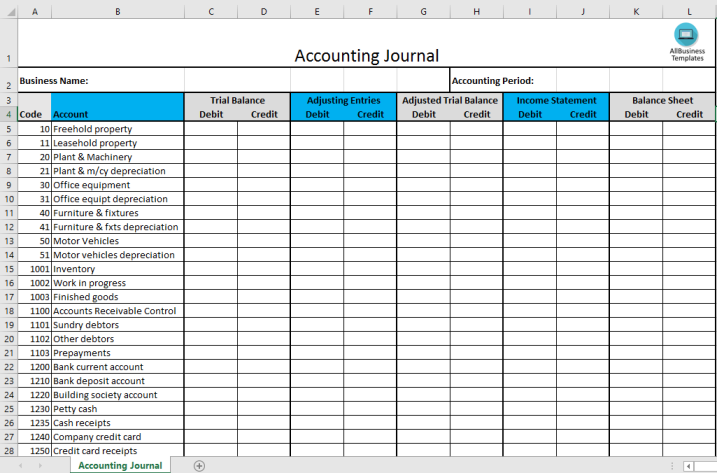

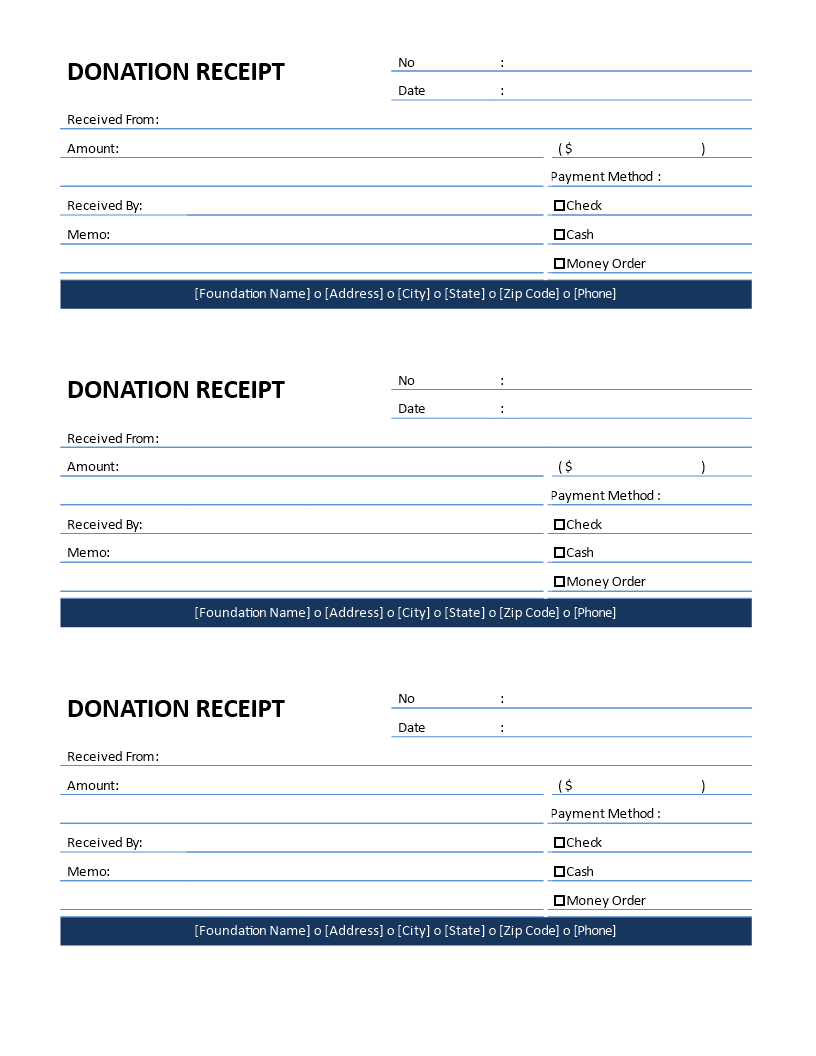

Are you looking for a suitable Donation Receipt template to send to your donors as proof for receipt of charitable monetary donation? Download this Donation Receipt Cash Donation template now!

What is a donation receipt?

This is an e-mail or a letter which is considered proof that a donor made a charitable monetary or in-kind contribution to a (nonprofit) organization.

Often, NGO’s/nonprofits send receipts out by the end of the year the gift was given or in January of the following year.

Non profit Donation Receipt for Cash Donation for Donors:

- Deductions on Tax Returns: this Donation Receipt is important in order to receive the tax deductions associated with charity, a donor needs such proof of donation.

- Financial record keeping: donation receipts are an easy way for donors to keep track of their finances when it comes to charitable giving.

- Confirmation: it acknowledges the receipt of a donation and let donors know their contributions have been received.

Non-profit Donation Receipt for Cash Donation for Nonprofits:

- legal requirements: the IRS requires donation receipts in certain situations. Failure to send a receipt can result in a penalty.

- accounting: donation receipts enable organizations to get clear and accurate financial records.

- tracking the donation history overtime

What must be Included in a Donation Receipt?

- name of a donor

- organization’s name, federal tax ID, the statement showing the organization is a registered

- date donation was provided

- the total sum of money or a description (not the value) of the donated item(s). The donor is responsible for assigning a cash value of donated items or in-kind contributions.

- a statement indicating whether any goods or services were provided in exchange for the donation: If no goods or services were given to the donor in return for the contribution, the nonprofit must say so.

- name and signature of authorized legal representative

- a disclosure, if necessary. This depends on local regulations. Double check to make sure you’re including the required disclosure statements for all states that your donors are contributing from.

We provide a Donation Receipt Cash Donation template that will professionalize your way of administration and communication towards the donor organization. Our templates are all screened by financial professionals.

Using this donation receipt template guarantees you will save time, cost and efforts!

DISCLAIMER

Hoewel all content met de grootste zorg is gecreërd, kan niets op deze pagina direct worden aangenomen als juridisch advies, noch is er een advocaat-client relatie van toepassing.

Laat een antwoord achter. Als u nog vragen of opmerkingen hebt, kunt u deze hieronder plaatsen.