Independent Landlord

I-Save, punan ang mga blanko, i-printa, Tapos na!

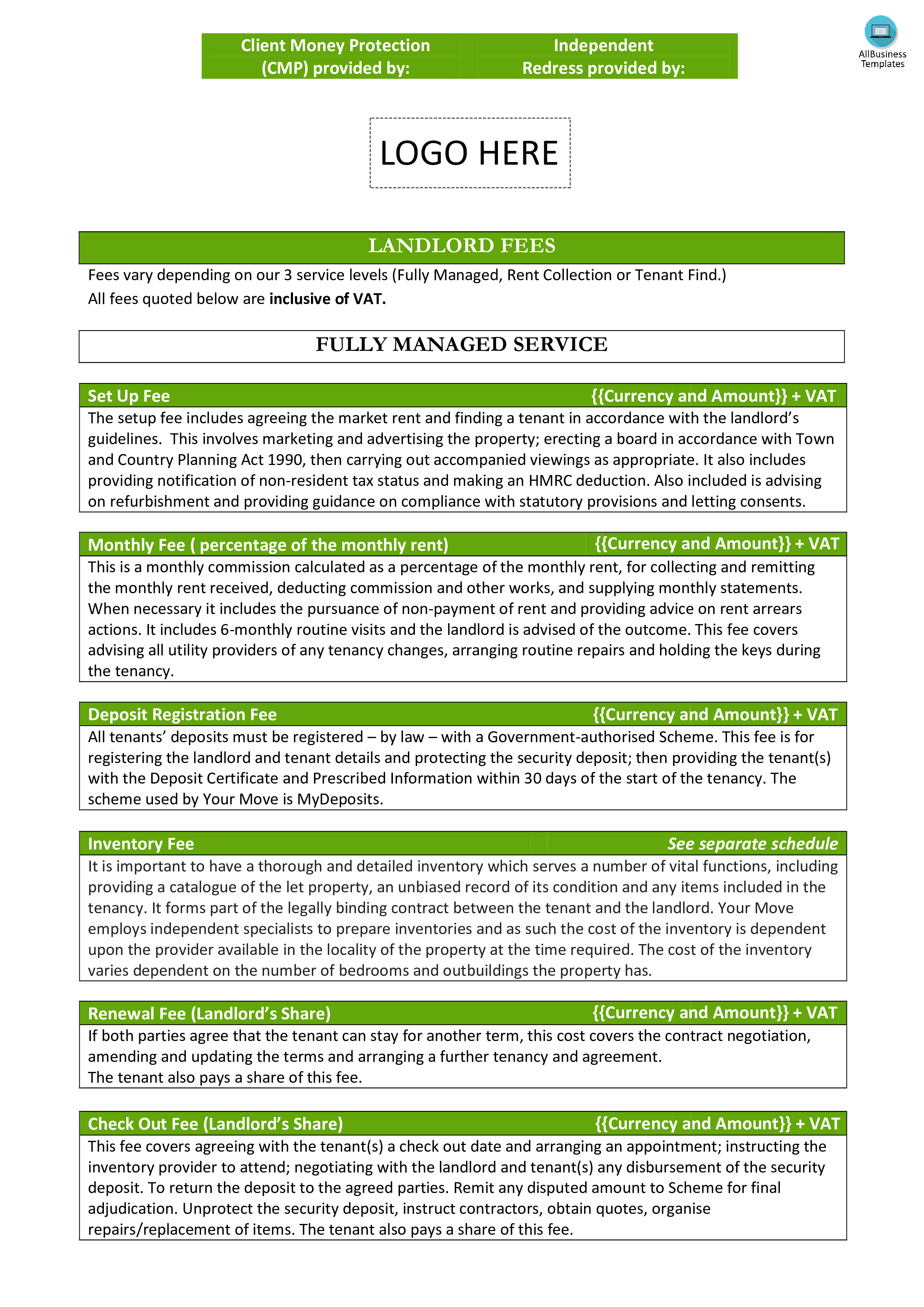

What is the process of becoming an independent landlord? Are you looking for a template for an Independent Landlord? We have a comprehensive template that you can download and customize to fit your needs.

Mga magagamit na premium na format ng file:

.pdf- Itong dokumento ay sertipikado ng isang Propesyonal

- 100% pwedeng i-customize

Business Negosyo rent Real estate Tunay na ari arina inventory landlord tenant Fee Sample Landlord Inventory Landlord Inventory Templates Sample Example Vat 10

What is the process of becoming an independent landlord? Are you looking for a template for an Independent Landlord? We have a comprehensive template that you can download and customize to fit your needs. It includes all the information you need to collect from your landlord, including contact information, rent payments, and any other relevant details. It's easy to use and will help you manage your rental properties more efficiently.

Client Money Protection (CMP) is a measure in real estate and property management to safeguard the money that clients (landlords and tenants) entrust to letting agents. In the context of real estate and property management, a "Client Money Protection application" could refer to the process or system through which letting agents apply for, obtain, and demonstrate compliance with a Client Money Protection scheme.

Protecting client money is crucial in various industries, especially in fields where professionals handle funds on behalf of clients, such as real estate or financial services. Here are some general principles and practices for protecting client money:

- Segregation of Funds:

- Keep client funds separate from the business's operational funds.

- Maintain separate bank accounts for client money and business operations.

- Trust Accounts:

- Use designated trust or escrow accounts to hold client funds.

- Clearly label accounts to indicate that they are trust accounts for client funds.

- Compliance with Regulations:

- Stay informed about and comply with relevant laws and regulations governing the handling of client money in your industry.

- In real estate, for example, adhere to any Client Money Protection (CMP) schemes mandated by regulatory authorities.

- Regular Reconciliations:

- Conduct regular reconciliations of accounts to ensure that the amount of money in trust accounts matches the records of client transactions.

- Promptly investigate and address any discrepancies.

- Transparent Record Keeping:

- Maintain detailed and transparent records of all financial transactions related to client money.

- Provide clients with clear and accurate statements regarding their funds.

- Insurance and Bonds:

- Consider obtaining professional indemnity insurance or bonding to provide additional protection for clients in case of financial loss resulting from malpractice or mismanagement.

- Security Measures:

- Implement robust security measures to protect electronic systems and data related to client funds.

- Educate staff on cybersecurity best practices to prevent fraud or unauthorized access.

- Training and Compliance:

- Train staff on the importance of safeguarding client money and compliance with relevant regulations.

- Stay up-to-date on industry best practices and regulatory changes.

- Audit and Oversight:

- Conduct regular internal and external audits to ensure compliance with established procedures.

- Establish oversight mechanisms to monitor and review financial activities.

- Ethical Practices:

- Foster a culture of ethics and integrity within the organization.

- Encourage reporting of any suspected or observed misconduct related to client funds.

It's essential to tailor these principles to the specific requirements and regulations of your industry and jurisdiction. Consult with legal and financial professionals to ensure that your practices align with the applicable laws and standards.

Download this independent landlord sample template now and customize it to fit your rental needs. Make sure to include all the necessary information, such as the property address, lease terms, and other relevant details. Print it out and use it whenever you need to rent out a property.

DISCLAIMER

Wala sa 'site' na ito ang dapat ituring na legal na payo at walang abogado-kliyenteng relasyon na itinatag.

Mag-iwan ng tugon. Kung mayroon kang anumang mga katanungan o mga komento, maaari mong ilagay ang mga ito sa ibaba.