Amortization Schedule Calculator

Sponsored Link免费模板 保存,填空,打印,三步搞定!

Download Amortization Schedule Calculator

微软电子表格 (.xls)免费文件转换

其他可用语言:

- 本文档已通过专业认证

- 100%可定制

- 这是一个数字下载 (114 kB)

- 语: English

Sponsored Link

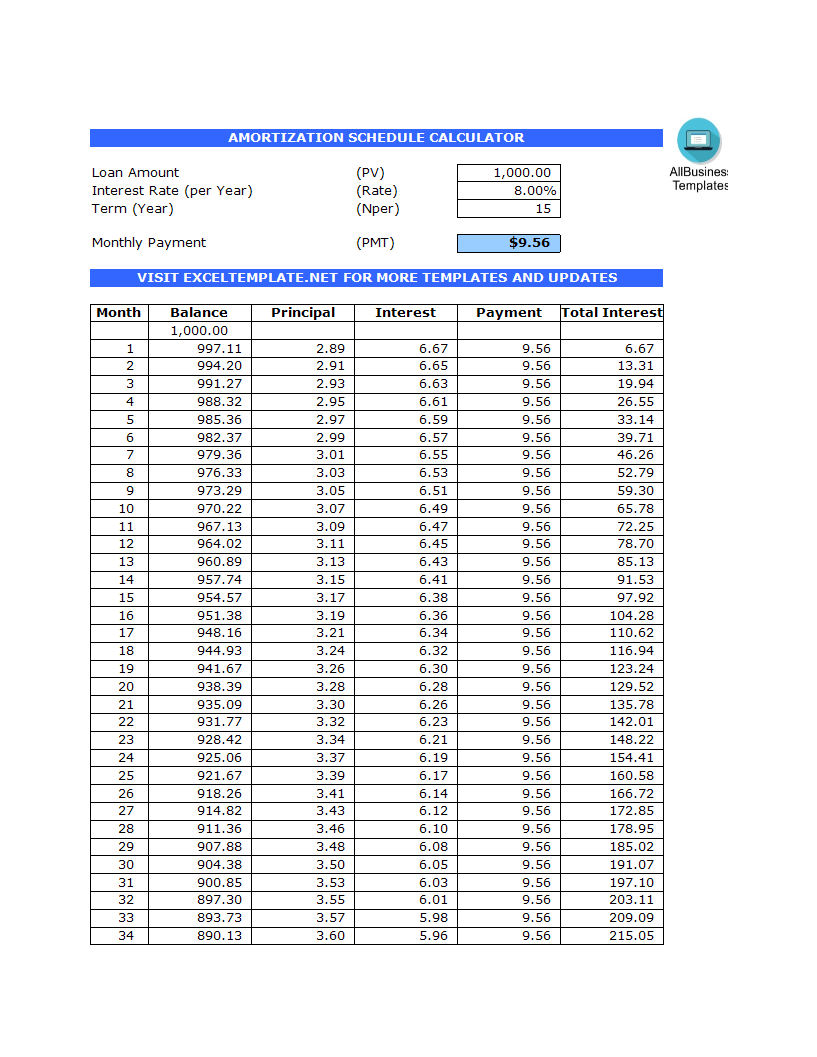

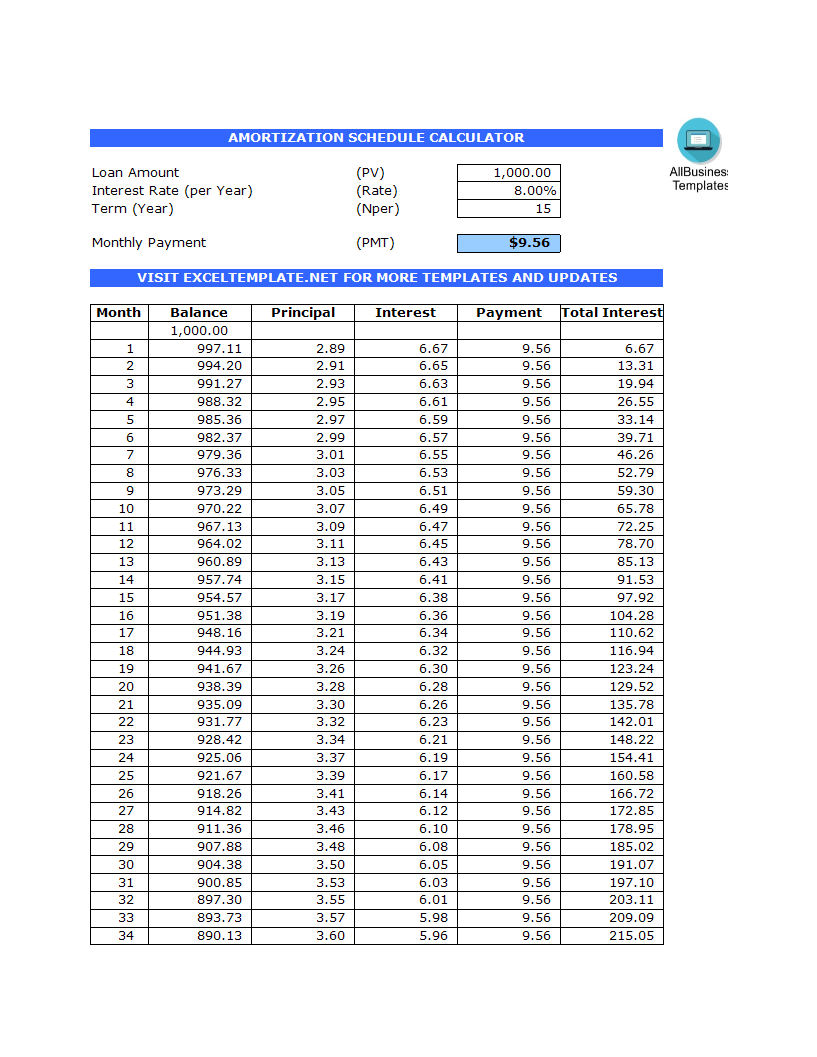

How to make a Amortization Schedule Calculator in Excel? An easy way to create your spreadsheet is by downloading this example Amortization Schedule Calculator Excel spreadsheet template now!

What is amortization?

According to Wikipedia "Amortization refers to the process of paying off a debt (often from a loan or mortgage) over time through regular payments. A portion of each payment is for interest while the remaining amount is applied towards the principal balance."

Further, "an amortization schedule is a table detailing each periodic payment on an amortizing loan (typically a mortgage), as generated by an amortization calculator."

Our amortization schedule calculator will help you to figure out the payment on a loan and will provide you the interest and principal breakdown per payment as well as the annual interest, principal and loan balance after each payment.It shows you how much part of each payment is allocated to interest and to principal.

An amortization schedule is a table detailing every single payment during the life of the loan. Each of these loan payments are split into interest and principal. Principal is the borrowed money, and interest is the amount paid to the lender for borrowing the principal.

An amortization schedule calculator shows:

- How much principal and interest are paid in any particular payment.

- How much total principal and interest have been paid at a specified date.

- How much principal you owe on the mortgage at a specified date.

- How much time you will chop off the end of the mortgage by making one or more extra payments.

This means you can use the mortgage amortization calculator to:

- Determine how much principal you owe now, or will owe at a future date.

- Determine how much extra you would need to pay every month to repay the mortgage in, say, 22 years instead of 30 years.

- See how much interest you have paid over the life of the mortgage, or during a particular year, though this may vary based on when the lender receives your payments.

- Figure how much equity you have.

This Excel template is a great way to increase your productivity and performance. It gives you access to do remarkable new things with Excel, even if you only have a basic understanding of working with formula’s and spreadsheets. If time or quality is of the essence, this ready-made presentation can certainly help you out!

Download this Amortization Schedule Calculator Excel spreadsheet now!

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

发表评论。 如果您有任何问题或意见,请随时在下面发布

相关文件

Sponsored Link