Basis Lening Sollicitatiebrief

Opslaan, invullen, afdrukken, klaar!

De beste manier om een Basis Lening Sollicitatiebrief te maken? Check direct dit professionele Basis Lening Sollicitatiebrief template!

Beschikbare bestandsformaten:

.docx- Gevalideerd door een professional

- 100% aanpasbaar

- Taal: English

- Digitale download (29.72 kB)

- Na betaling ontvangt u direct de download link

- We raden aan dit bestand op uw computer te downloaden.

Zakelijk Financiën brief lening Van Sollicitatie brieven lening aanvraag brief Wijziging Aanvraag voor een lening

How to write an effective Loan Application Letter to a bank?

When drafting a loan application to a bank, it's important to consider several key elements to ensure your request is clear, professional, and persuasive. Here are some crucial aspects to keep in mind:

- Clarity and Specificity: Clearly state the purpose of the loan and the amount you are requesting. Be specific about how the funds will be used. This helps the lender understand your needs and assess your application appropriately.

- Personal and Financial Information: Include essential personal information such as your full name, address, and contact details. Financial information should cover your employment status, income, financial obligations, and any assets you might have. This helps the bank evaluate your creditworthiness and ability to repay the loan.

- Documentation: Reference any documents you are attaching or have previously submitted that support your application. This may include proof of income, tax returns, employment verification, financial statements, and a list of assets and liabilities.

- Credit History: Be honest about your credit situation. If there are issues, such as a low credit score or previous defaults, address these upfront and explain any mitigating circumstances. This openness can help build trust with the lender.

- Reason for the Loan: Explain why you need the loan and why it is important for you. If the loan is for something like a business investment, detail how the investment will contribute to your financial stability or growth.

- Repayment Plan: Articulate your plan for repaying the loan. Include information about your income and budgeting strategies that will enable you to meet monthly payments. This reassures the bank of your commitment and ability to manage the loan responsibly.

- Professional Tone: Maintain a formal and respectful tone throughout the letter. Address the recipient properly and use a professional closing statement.

- Request for Action: Conclude with a polite request for the lender to consider your application and suggest a follow-up meeting or call to discuss the application in further detail.

- Proofreading: Before submitting, carefully proofread your letter to correct any grammatical errors and ensure the information is accurate and well-presented. Errors can detract from your credibility and reduce the likelihood of approval.

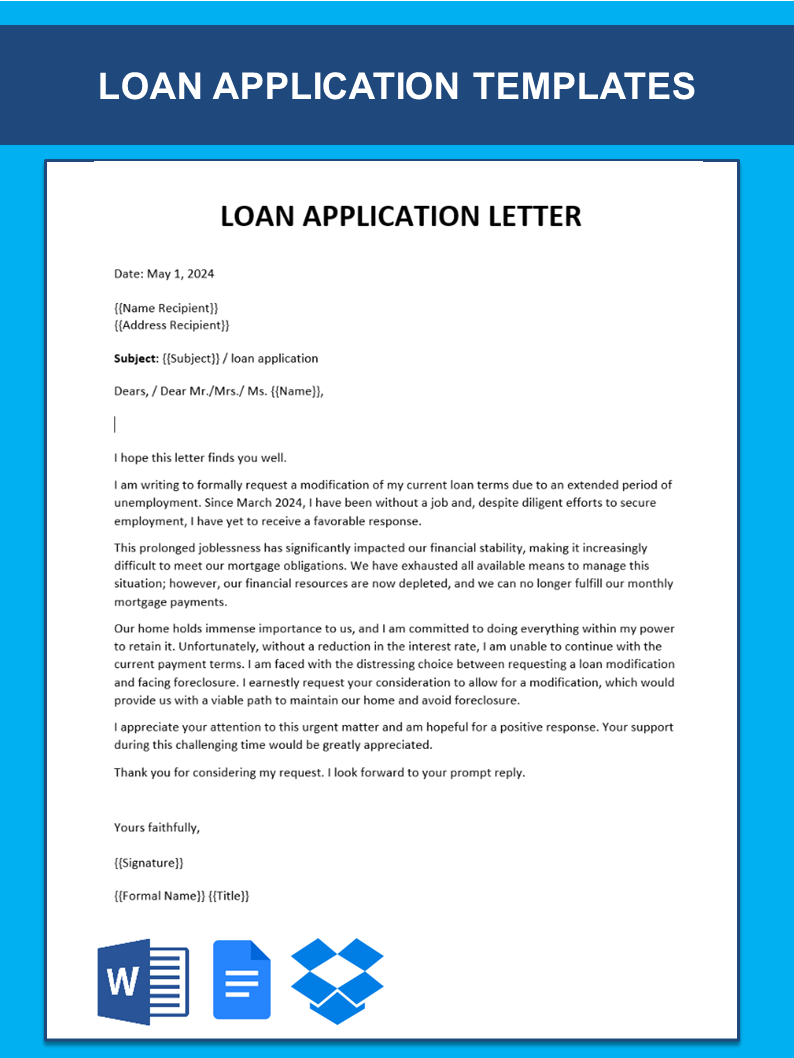

Sample Loan Application Letter:

I hope this letter finds you well. I am writing to formally request a modification of my current loan terms due to an extended period of unemployment. Since March 2024, I have been without a job and, despite diligent efforts to secure employment, I have yet to receive a favorable response.

This prolonged joblessness has significantly impacted our financial stability, making it increasingly difficult to meet our mortgage obligations. We have exhausted all available means to manage this situation; however, our financial resources are now depleted, and we can no longer fulfill our monthly mortgage payments.

Our home holds immense importance to us, and I am committed to doing everything within my power to retain it. Unfortunately, without a reduction in the interest rate, I am unable to continue with the current payment terms. I am faced with the distressing choice between requesting a loan modification and facing foreclosure. I earnestly request your consideration to allow for a modification, which would provide us with a viable path to maintain our home and avoid...

Using this Loan Application Letter template guarantees you will save time, cost and efforts! Completing documents has never been easier!

Download this Basic Loan Application Letter template now for your own benefit!

DISCLAIMER

Hoewel all content met de grootste zorg is gecreërd, kan niets op deze pagina direct worden aangenomen als juridisch advies, noch is er een advocaat-client relatie van toepassing.

Laat een antwoord achter. Als u nog vragen of opmerkingen hebt, kunt u deze hieronder plaatsen.