Demand for Payment Letter

Enregistrer, Remplir les champs vides, Imprimer, Terminer!

How to write a demand for payment letter? Useful when you attempt to collect a debt. Download this example collection demand letter now!

Prix: USD 4.99

Téléchargez-le maintenant

Formats de fichiers premium disponibles:

.docx- Ce document a été certifié par un professionnel

- 100% personnalisable

Finance La finance Life Privé payment Paiement Letter lettre formal demand for payment letter lettre de demande formelle de paiement letter of demand for outstanding payment demand for payment letter demand for payment letter pdf strong demand letter for payment sample demand letter for payment of debt sample letter of demand for money owed demand for payment letter sample what is a letter of demand for payment how do i write a demanding payment letter can you ignore demand letter demand for payment demand for payment letter uk demand for payment letter california demand for payment letter dmv demand for payment letter colorado demand for payment letter construction demand for payment letter canada final demand for payment letter how to write a demand for payment letter free demand for payment letter legal demand for payment letter subcontractor demand for payment letter contractor demand for payment letter response to demand for payment letter demanding for payment letter

How to write a demand for payment letter? Download this example collection demand letter now!

Remember, you do not need a lawyer to write your demand letter; you can write the demand letter yourself and save yourself the cost of hiring an attorney. However, if you have any reservations about drafting a demand letter yourself, you should at least talk to an attorney about your situation. If you have any questions about our sample demand letter, feel free to shoot us an email.

A debt collection letter template is also known as “letter of demand”. It demands the subject of debt to settle the outstanding bill, which is by default, within the certain time specified, and informs him about the total debt amount.

Often such demand letters are sent from a recovery agency (debt collector agency) on behalf of a creditor to the subjects of debt. Depending on the letter (general reminder/court action informative letter), it can either threaten legal proceedings or inform the second party (debtor) that such actions have already come into operation.

Often demand letters are written to:

- demand for personal injury

- payment request

- legal claims

- settlement demand

- insurance demand letter

- auto accident demand letter

- property destroyed without reimbursement

- etc

While collection demand letters may be written for several causes, most are written when somebody else owes you some money. There is not one single layout for crafting a letter of demand. However, the following guidelines are applicable and will help you to draft an effective collection demand letter. In general, a collection demand letter includes:

- what payment or action is demanded;

- why the payment or action is being demanded;

- what are the consequences for non-payment; and,

- a time limit to comply with the collection demand letter.

The aim of the letter is often to persuade the other party into paying up, so we advise using a formal tone which will have more impact. However, if the relationship is very personal (friend or relative), it won’t be effective. Before you start compiling the letter, consider the relationship you have with the person who owes you the money. This consideration will help to determine the tone of the demand letter. If you are not going to hire an attorney to do this for you, it’s important to draft the demand letter with a rational tone, and with little emotion as possible, which is based on actual facts.

Note that after this collection demand letter is received, the relationship with this person is damaged, and might never be back to the level as it was before. If this demand letter is sent to a business, contractor, freelancer, individual with whom you may have future dealings, please consider these consequences.

Structure of a Collection Demand letter

The first part, the introduction of the reason for the demand letter, will be a review of the facts that caused writing this letter. The facts are the important component and the basis of your demand. Therefore we advise getting the facts straight, which is also a good preparation if this matter ends up in court.

The next part will discuss the services or actions you performed, that caused why the person owes you the money. It can be that you did work for him/her, which was never paid for? Often a demand letter is written because someone borrowed money and the debtor refused to pay it back. Also if personal injuries occur, or if the property is destroyed without having any reimbursement. This section should be flawless, clear, and summarizing.

In the next part, you will outline the consequences of non-payment. Remember here that you catch more flies with honey than vinegar; so you want to be polite and respectful. Considering the collection demand letter is by nature a threatening letter, it’s better to keep the facts straight and there’s no need to express extra aggression. The aim is to reach an agreement, which both parties can live with.

Instead of threatening to take them to court, you could suggest a meeting to discuss options or perhaps enter mediation. Remember that an angry letter may bring about an aggressive response and further postponement of a resolution. If the aim is to put the matter to rest as fast as possible, writing an offensive demand letter is not a good approach.

Finally, in the last part of the collection demand letter, you should always mention a period of time that this matter must be solved: the deadline. Always consider giving a reasonable time frame that is workable to receive the payment of a debt, or agree to a payment schedule. Make it very clear that he/she must respond to the letter within a set time period. If you leave it ambiguous, you are setting yourself up for further delays.

Make sure you are drafting a collection demand letter that is professional-looking. Now that the letter is written and sent (preferably registered mail) sit back and wait until the offered time is expired. In any case, do not call or harass or try to intimidate the other party.

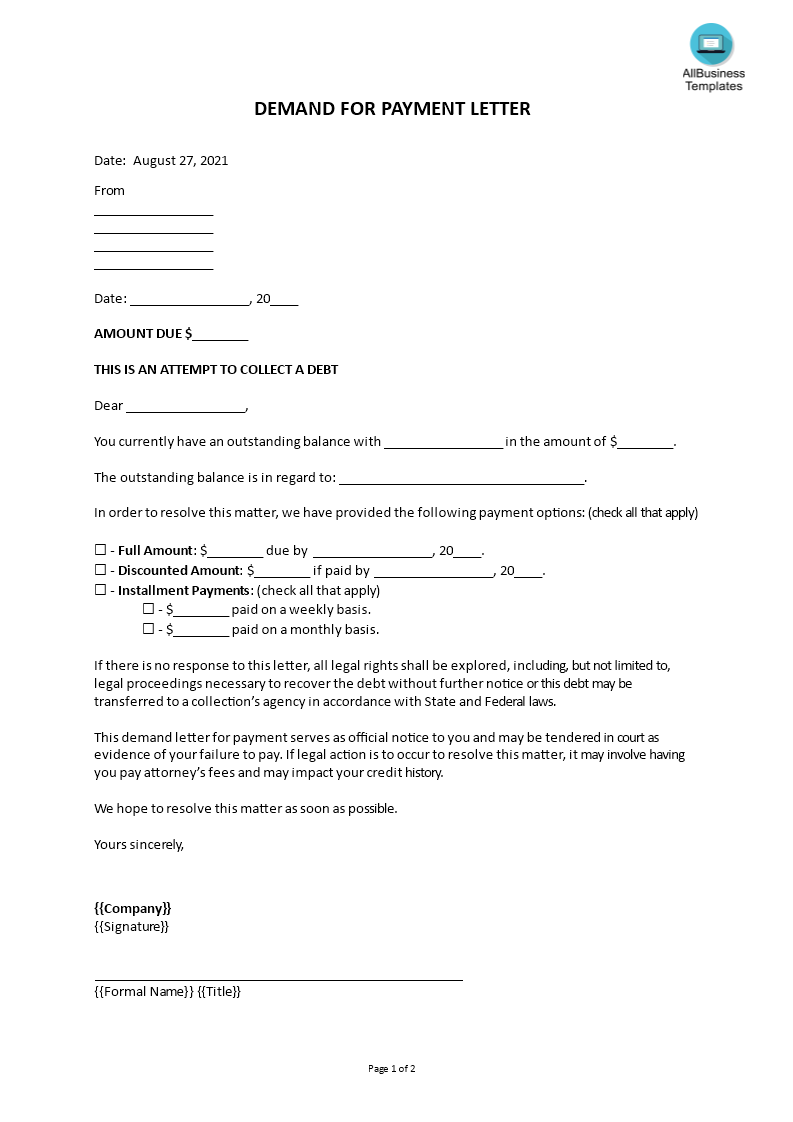

If you need a useful attempt to collect a debt, consider this Demand for Payment Letter:

Dear person,

You currently have an outstanding balance within the amount of $

The outstanding balance is in regard to:

In order to resolve this matter, we have provided the following payment options:

- Full Amount: $________ due by _________________, 20____.

- Discounted Amount: $________ if paid by _________________, 20____.

- Installment Payments: (check all that apply)

- $________ paid on a weekly basis.

- $________ paid on a monthly basis.

If there is no response to this letter, all legal rights shall be explored, including, but not limited to, legal proceedings necessary to recover the debt without further notice, or this debt may be transferred to a collection agency in accordance with State and Federal laws.

This demand letter for payment serves as official notice to you and maybe tendered in court as evidence of your failure to pay. If legal action is to occur to resolve this matter, it may involve having you pay attorney’s fees and may impact your credit history.

We hope to resolve this matter as soon as possible.

Yours sincerely,

Our legal templates are all screened by a Legal professional. Download this Demand for Payment Letter and save yourself the time, costs or effort!

AVERTISSEMENT

Rien sur ce site ne doit être considéré comme un avis juridique et aucune relation avocat-client n'est établie.

Si vous avez des questions ou des commentaires, n'hésitez pas à les poster ci-dessous.