Financial Income Statement Analysis

Enregistrer, Remplir les champs vides, Imprimer, Terminer!

How to create a Financial Income Statement Analysis? Download this Financial Income Statement Analysis template now!

Formats de fichiers gratuits disponibles:

.doc- Ce document a été certifié par un professionnel

- 100% personnalisable

Business Entreprise Finance La finance inventory inventaire financial financier accounting comptabilité statement déclaration cash en espèces income le revenu balance sheet bilan assets les atouts debt dette accounts receivable comptes débiteurs Income Statement Compte de résultat Financial Statements États financiers Asset Atout Cost Of Goods Sold Coût des marchandises vendues Accounts Payable Comptes à payer Cash Flow Statement État des flux de trésorerie Ratio Rapport income statement excel compte de résultat excel Financial Statement Analysis Example Exemple d'analyse d'états financiers Financial Statement Analysis Examples Exemples d'analyse d'états financiers Monthly Income Statement Excel Compte de résultat mensuel Excel xls income statement and balance sheet examples sample income statement exemples de compte de résultat et de bilan simple income statement example exemple simple de compte de résultat monthly income statement template modèle de compte de résultat mensuel income statement pdf income statement template pdf modèle de compte de résultat pdf sample income statement xls exemple de compte de résultat xls simple income statement excel compte de résultat simple excel income statement template xls gross income operating expense depreciati statement of changes in equity

How to create a Financial Income Statement Analysis?

Every day brings new projects, emails, documents, and task lists, and often it is not that different from the work you have done before. Many of our day-to-day tasks are similar to something we have done before. Don't reinvent the wheel when you need to make an accounting file, such as a Financial Income statement.

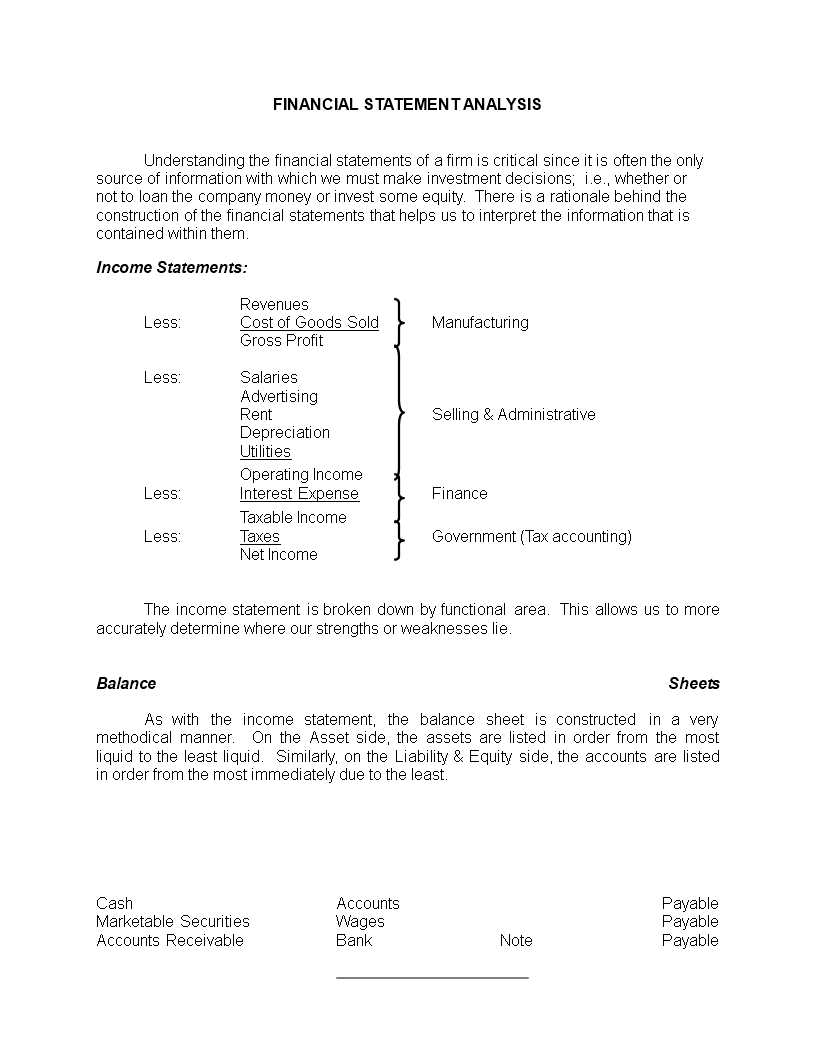

Sample content:

- From Operations

- Net Income Plus

- Depreciation Plus

- Amortization Operating Cash Flow Plus

- Changes in Non-Cash Current Assets Plus

- Changes in Operations-related Current Liabilities

- Total From Operations From Investing Activities

- Changes In Gross Fixed Assets Plus

- Changes in Other Non-Current Assets

- Total From Investing Activities From Financing Activities

- Changes in Non-Operations-related current liabilities Plus

- Changes in Long-Term Debt Plus

- Changes in Other Capital Accounts (except Retained Earnings) Less

- Dividends Paid Total From Financing Activities

- Total Change in Cash Plus

- Beginning Cash Balance Ending Cash Balance

- All Items Expressed as a Percentage of Revenues.

- Interest Rate

- Tax Rate

- DEBT

- EQUITY

- TOTAL ASSETS

- Since the effect of financing does t appear until we go below the Operating Income (EBIT) line, we can jump straight down to the operating income to analyze the effect of financial leverage.

- Consider the same firm when EBIT is only 60

- DEBT EQUITY

- TOTAL ASSETS

- EBIT

- TAX. Which type of debt do you think is riskier for the company to utilize (To answer this, ask yourself whether you would prefer to buy a house using a one-year note that would have to be refinanced in twelve months, or a 30-year mortgage.) Just as in accounting where changes in current liabilities are included as a part of operating cash flows (since accounts payable and accruals such as wages payable arise from operations), sometimes only the long-term portions of debt are considered.

Instead, we provide this standardized Financial Income Statement Analysis template with text and formatting as a starting point to help professionalize the way you are working. Our private, business, and legal document templates are regularly screened by professionals. If time or quality is of the essence, this ready-made template can help you to save time and to focus on the topics that really matter!

Using this document template guarantees you will save time, cost and effort! It comes in Microsoft Office format, is ready to be tailored to your personal needs. Completing your document has never been easier!

Download this Financial Income Statement Analysis template now for your own benefit!

AVERTISSEMENT

Rien sur ce site ne doit être considéré comme un avis juridique et aucune relation avocat-client n'est établie.

Si vous avez des questions ou des commentaires, n'hésitez pas à les poster ci-dessous.