Financial Income Statement Analysis

Save, fill-In The Blanks, Print, Done!

Download Financial Income Statement Analysis

Microsoft Word (.doc)Or select the format you want and we convert it for you for free:

- This Document Has Been Certified by a Professional

- 100% customizable

- This is a digital download (86 kB)

- Language: English

- We recommend downloading this file onto your computer.

How to create a Financial Income Statement Analysis?

Every day brings new projects, emails, documents, and task lists, and often it is not that different from the work you have done before. Many of our day-to-day tasks are similar to something we have done before. Don't reinvent the wheel when you need to make an accounting file, such as a Financial Income statement.

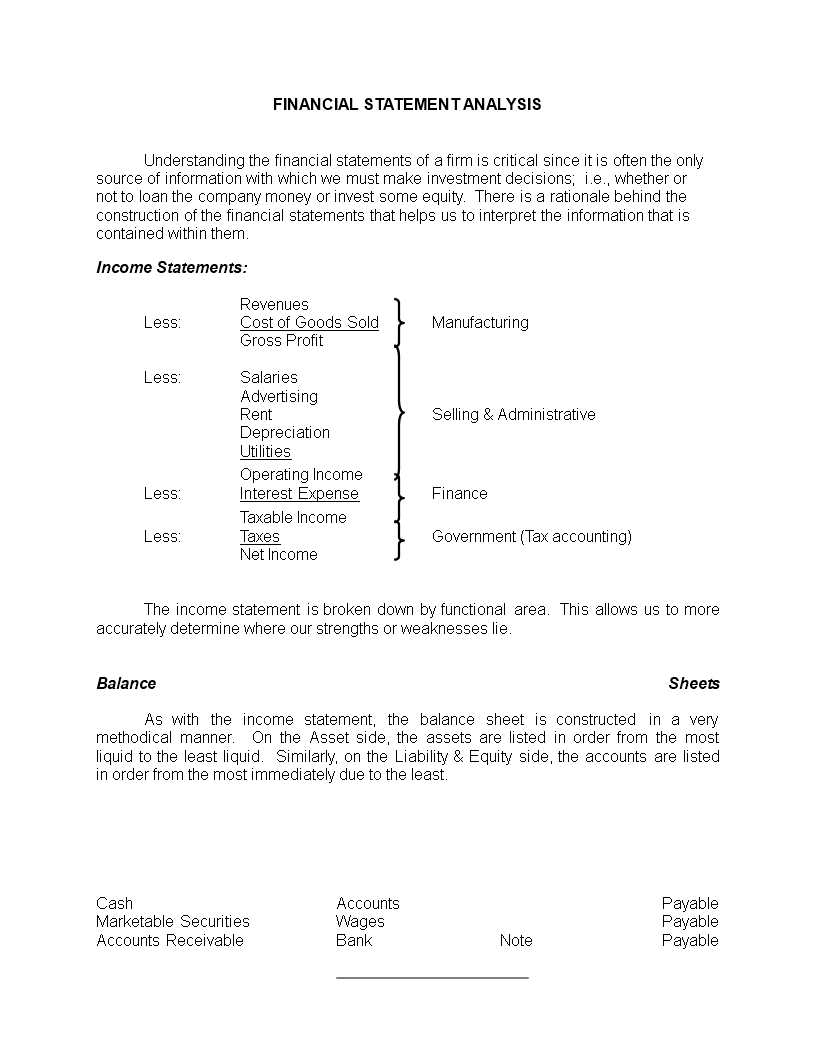

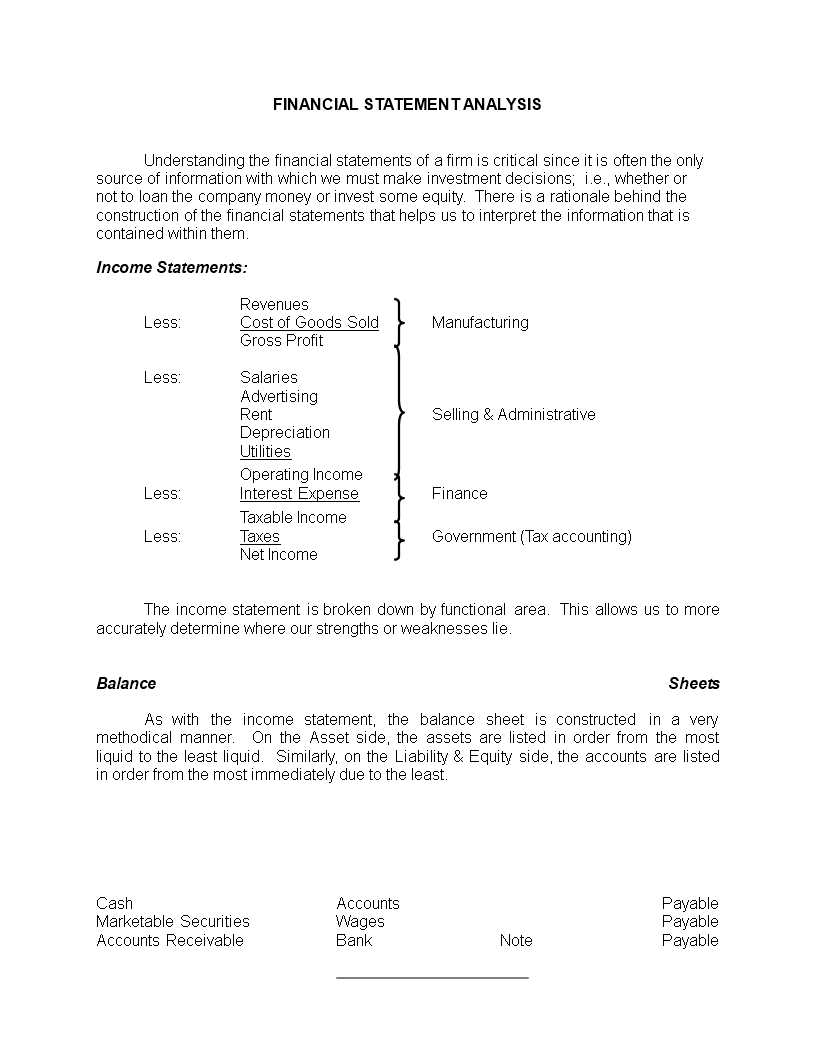

Sample content:

- From Operations

- Net Income Plus

- Depreciation Plus

- Amortization Operating Cash Flow Plus

- Changes in Non-Cash Current Assets Plus

- Changes in Operations-related Current Liabilities

- Total From Operations From Investing Activities

- Changes In Gross Fixed Assets Plus

- Changes in Other Non-Current Assets

- Total From Investing Activities From Financing Activities

- Changes in Non-Operations-related current liabilities Plus

- Changes in Long-Term Debt Plus

- Changes in Other Capital Accounts (except Retained Earnings) Less

- Dividends Paid Total From Financing Activities

- Total Change in Cash Plus

- Beginning Cash Balance Ending Cash Balance

- All Items Expressed as a Percentage of Revenues.

- Interest Rate

- Tax Rate

- DEBT

- EQUITY

- TOTAL ASSETS

- Since the effect of financing does t appear until we go below the Operating Income (EBIT) line, we can jump straight down to the operating income to analyze the effect of financial leverage.

- Consider the same firm when EBIT is only 60

- DEBT EQUITY

- TOTAL ASSETS

- EBIT

- TAX. Which type of debt do you think is riskier for the company to utilize (To answer this, ask yourself whether you would prefer to buy a house using a one-year note that would have to be refinanced in twelve months, or a 30-year mortgage.) Just as in accounting where changes in current liabilities are included as a part of operating cash flows (since accounts payable and accruals such as wages payable arise from operations), sometimes only the long-term portions of debt are considered.

Instead, we provide this standardized Financial Income Statement Analysis template with text and formatting as a starting point to help professionalize the way you are working. Our private, business, and legal document templates are regularly screened by professionals. If time or quality is of the essence, this ready-made template can help you to save time and to focus on the topics that really matter!

Using this document template guarantees you will save time, cost and effort! It comes in Microsoft Office format, is ready to be tailored to your personal needs. Completing your document has never been easier!

Download this Financial Income Statement Analysis template now for your own benefit!

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

Leave a Reply. If you have any questions or remarks, feel free to post them below.

Related templates

Latest templates

Latest topics

- Formal Complaint Letter of Harrasment

How do I write a formal complaint about harassment? Check out these formal complaint letter of harrasment templates here! - Google Sheets Templates

How to work with Google Sheets templates? Where to download useful Google Sheets templates? Check out our samples here. - Letter Format

How to format a letter? Here is a brief overview of common letter formats and templates in USA and UK and get inspirited immediately! - IT Security Standards Kit

What are IT Security Standards? Check out our collection of this newly updated IT Security Kit Standard templates, including policies, controls, processes, checklists, procedures and other documents. - Excel Templates

Where do I find templates for Excel? How do I create a template in Excel? Check these editable and printable Excel Templates and download them directly!

cheese