Ontkenning van Kredietbrief

Opslaan, invullen, afdrukken, klaar!

De beste manier om een Ontkenning van Kredietbrief te maken? Check direct dit professionele Ontkenning van Kredietbrief template!

Beschikbare bestandsformaten:

.pdf- Gevalideerd door een professional

- 100% aanpasbaar

- Taal: English

- Digitale download (104.87 kB)

- Na betaling ontvangt u direct de download link

- We raden aan dit bestand op uw computer te downloaden.

Zakelijk Informatie Naam Sollicitatie brieven Creditbrief

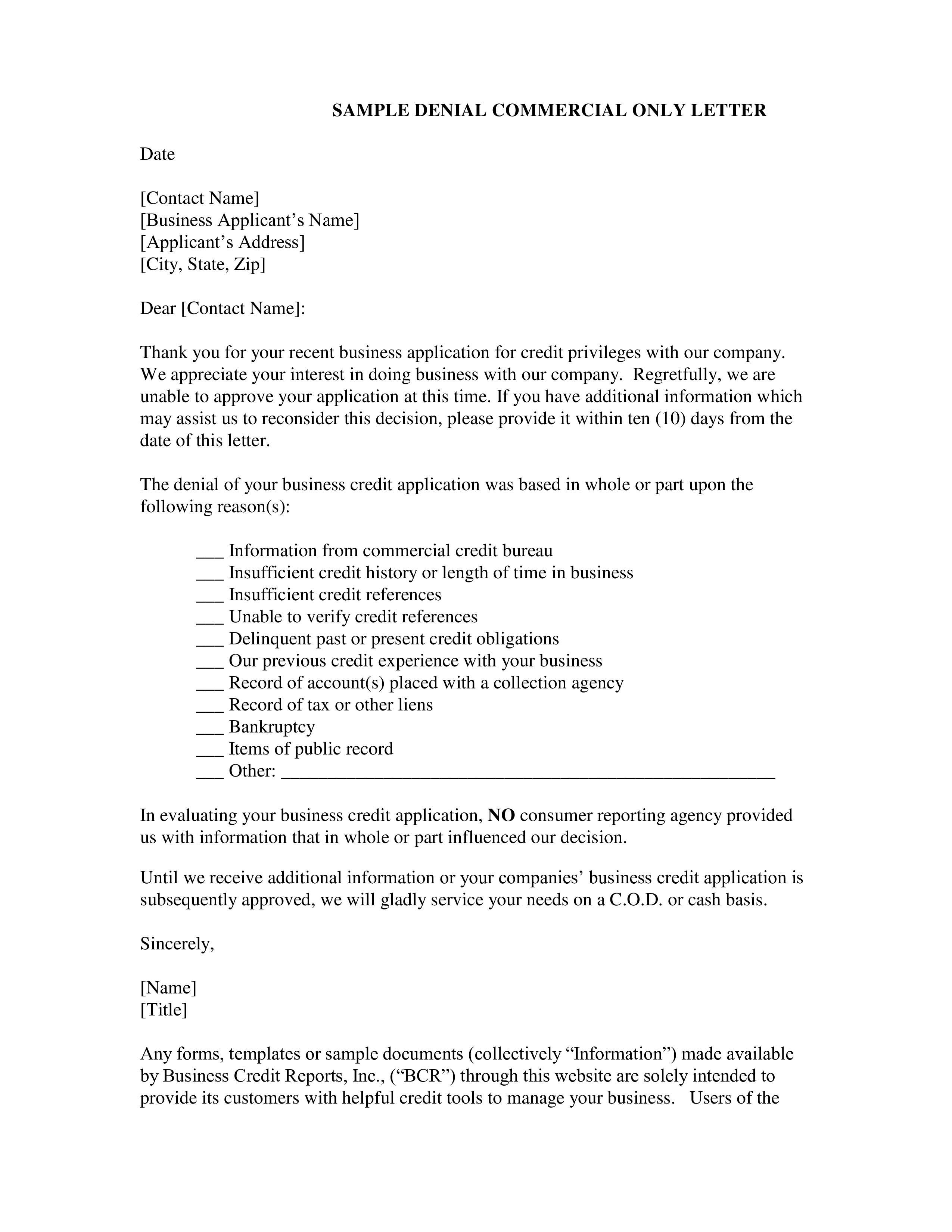

How to draft a Denial Of Credit Letter? An easy way to start completing your document is to download this Denial Of Credit Letter template now!

Every day brings new projects, emails, documents, and task lists, and often it is not that different from the work you have done before. Many of our day-to-day tasks are similar to something we have done before. Don't reinvent the wheel every time you start to work on something new!

Instead, we provide this standardized Denial Of Credit Letter template with text and formatting as a starting point to help professionalize the way you are working. Our private, business and legal document templates are regularly screened by professionals. If time or quality is of the essence, this ready-made template can help you to save time and to focus on the topics that really matter!

Using this document template guarantees you will save time, cost and efforts! It comes in Microsoft Office format, is ready to be tailored to your personal needs. Completing your document has never been easier!

Download this Denial Of Credit Letter template now for your own benefit!

The denial of your business credit application was based in whole or part upon the following reason(s): Information from commercial credit bureau Insufficient credit history or length of time in business Insufficient credit references Unable to verify credit references Delinquent past or present credit obligations Our previous credit experience with your business Record of account(s) placed with a collection agency Record of tax or other liens Bankruptcy Items of public record Other: In evaluating your business credit application, NO consumer reporting agency provided us with information that in whole or part influenced our decision..

DISCLAIMER

Hoewel all content met de grootste zorg is gecreërd, kan niets op deze pagina direct worden aangenomen als juridisch advies, noch is er een advocaat-client relatie van toepassing.

Laat een antwoord achter. Als u nog vragen of opmerkingen hebt, kunt u deze hieronder plaatsen.