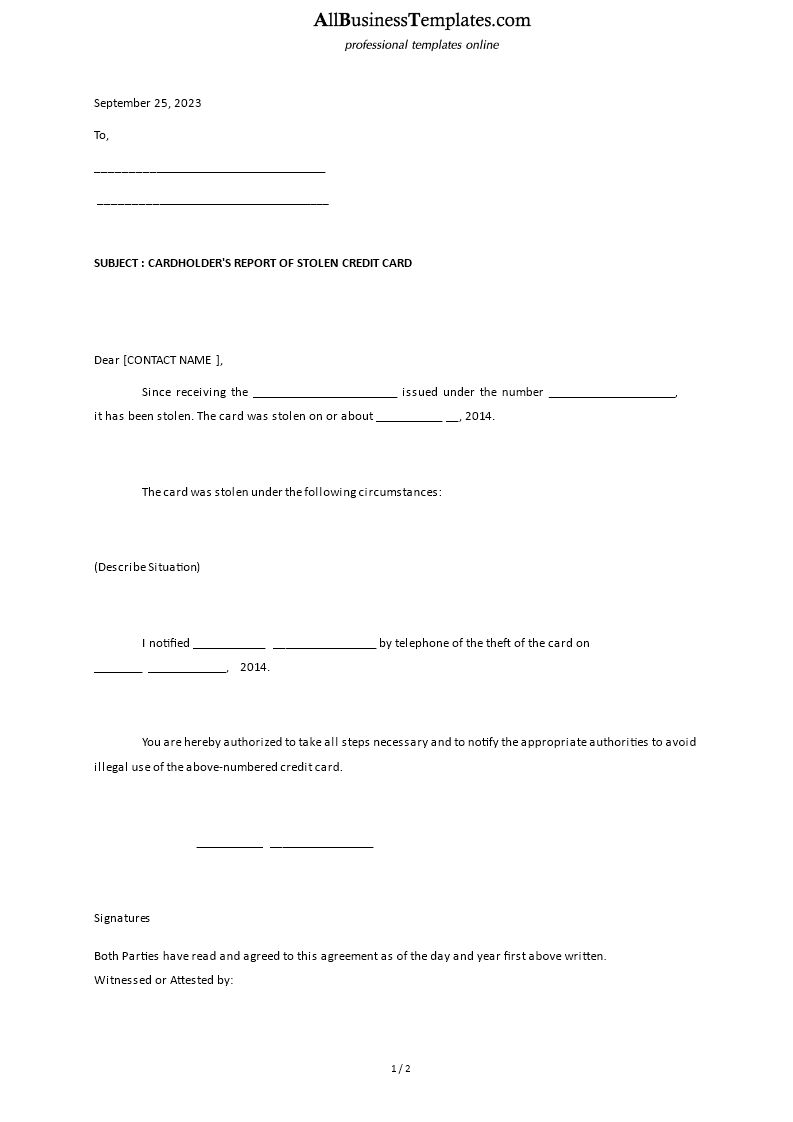

Card Holder's Stolen Credit Card Report

I-Save, punan ang mga blanko, i-printa, Tapos na!

Did you lose your credit card? Need to produce a formal report? This template you can download for free and use it as an example how to do the report.

Mga magagamit na premium na format ng file:

.doc- Itong dokumento ay sertipikado ng isang Propesyonal

- 100% pwedeng i-customize

Life Buhay credit card stolen

Did you lose your credit card? Need to produce a formal report? When is the best time to report a stolen credit card? Download our Stolen Credit Card Report template now which is designed to help you quickly identify and address any discrepancies in your credit cards. It includes a list of items to be checked, such as balances, transactions, and alerts. It also includes a section for recommendations and conclusions.

A Stolen Credit Card Report is a formal notification made by the cardholder to their credit card issuer or bank to report that their credit card has been stolen or lost. This report is a crucial step to take in the event that a credit card goes missing, as it helps protect the cardholder from unauthorized use of the card and potential financial losses.

Key components of a Stolen Credit Card Report typically include:

- Cardholder Information: The cardholder provides their name, contact information (phone number and address), and any other identifying details as requested by the card issuer.

- Card Details: The cardholder provides information about the stolen or lost credit card, including the card number, the card's expiration date, and the name on the card.

- Description of the Incident: The cardholder describes when and where the card was stolen or lost, and any circumstances surrounding the incident. This information can be helpful for any subsequent investigations.

- Notification Timing: The cardholder specifies when they first noticed that the card was missing and when they are reporting the incident.

- Request for Card Cancellation: The cardholder typically requests that the credit card issuer immediately cancel or deactivate the stolen or lost card to prevent unauthorized transactions.

- Replacement Card Request: The cardholder may request a replacement card to be issued with a new card number and expiration date.

- Security Measures: The cardholder may inquire about additional security measures, such as setting up fraud alerts or monitoring their account for suspicious activity.

- Confirmation: The card issuer typically provides a confirmation or reference number for the reported incident. This reference number can be important for tracking the status of the report and any subsequent actions taken by the card issuer.

- Follow-up Actions: The card issuer may provide instructions on what steps the cardholder should take next, such as reviewing recent transactions, monitoring their credit report, and cooperating with any investigations.

- Contact Information: The card issuer's contact information, including a customer service phone number and email address, may be provided for further communication and assistance.

It's crucial for cardholders to report a stolen or lost credit card as soon as possible to minimize the risk of fraudulent transactions and protect their financial interests. In many cases, credit card issuers offer protection against unauthorized transactions, provided the cardholder promptly reports the loss or theft.

If your ATM, credit, or debit card is lost or stolen, federal law in the US limits your liability for unauthorized charges. Your protection against unauthorized charges depends on the type of card — and when you report the loss. That's why it is so important to report the loss as soon as possible. Acting fast for sure limits your liability for charges you didn’t authorize. Many companies have support numbers to report the loss by telephone. They even have toll-free numbers and 24-hour service to help you.

Once you report the loss of your card, federal law in the US says you cannot be held liable for unauthorized transfers that occur after that time.

It is also advisable to do a follow-up in the form of a letter. This template is a good example how such a letter should be written. Feel free to download this template and change it to your needs.

Not to forget to always get a police statement.

DISCLAIMER

Wala sa 'site' na ito ang dapat ituring na legal na payo at walang abogado-kliyenteng relasyon na itinatag.

Mag-iwan ng tugon. Kung mayroon kang anumang mga katanungan o mga komento, maaari mong ilagay ang mga ito sa ibaba.