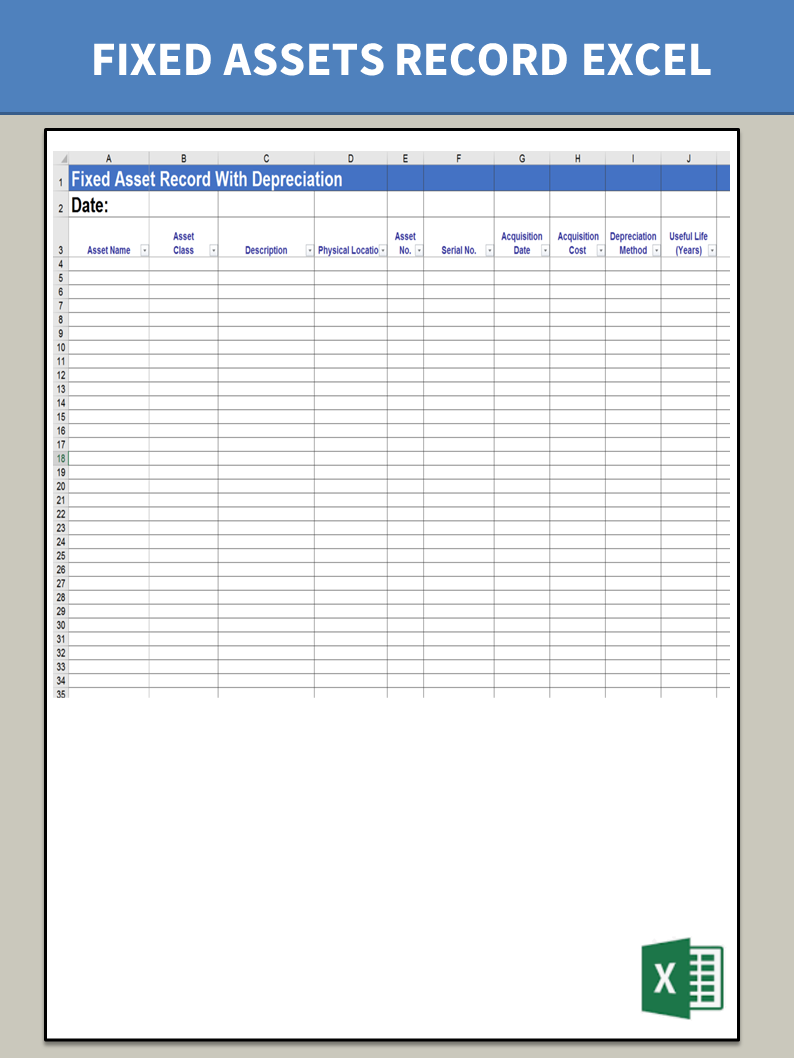

Fixed Asset template

I-Save, punan ang mga blanko, i-printa, Tapos na!

How to create a Fixed Asset in Excel? An easy way to start completing your document is to download this example Fixed Asset template now!

Mga magagamit na premium na format ng file:

.xls- Itong dokumento ay sertipikado ng isang Propesyonal

- 100% pwedeng i-customize

Business Negosyo Finance Pananalapi inventory accounting expense balance sheet class investment tax Business Law Business Economics Income Statement Pahayag ng Kita Financial Accounting Financial Statements Corporations Depreciation Asset Financial Economics Corporate Finance Corporate Taxation Capital Budgeting Method Fixed Asset Inventory Template Excel Inventory Templates In Fixed Asset Example Fixed Asset Sample

How to create a Fixed Asset in Excel? An easy way to start completing your document is to download this example Fixed Asset template now!

We provide this Fixed Asset template to help professionalize the way you are working. Our business and legal templates are regularly screened and used by professionals.

What is a fixed asset register format?

- Asset Name

- Asset Class

- Description

- Physical Location

- Asset Number

- Serial Number

- Acquisition Date

- Acquisition Cost

- Depreciation Method

- Useful Life (Years)

- Salvage Value

- Previous Depreciation

- First Year %

- Depreciation

- Period

If time or quality is of the essence, this ready-made template can help you to save time and to focus on the topics that really matter!

Abbreviation Depreciation Method descriptions:

- Straight-line depreciation: Calculates straight-line depreciation based on the asset's cost, salvage value, and estimated economic life.

- "150% declining balance depreciation" Calculates 150% declining balance depreciation based on the asset's cost, salvage value, and estimated economic life. It switches to straight-line depreciation at the point when straight-line depreciation exceeds declining balance depreciation.

- "200% declining balance depreciation" Calculates 200% declining balance depreciation based on the asset's cost, salvage value, and estimated economic life. It switches to straight-line depreciation at the point when straight-line depreciation exceeds declining balance depreciation.

Using this Fixed Asset template guarantees you will save time, cost and effort! Completing documents has never been easier!

Download this Fixed Asset template now for your own benefit!

DISCLAIMER

Wala sa 'site' na ito ang dapat ituring na legal na payo at walang abogado-kliyenteng relasyon na itinatag.

Mag-iwan ng tugon. Kung mayroon kang anumang mga katanungan o mga komento, maaari mong ilagay ang mga ito sa ibaba.