Basic Excel Balance Sheet

I-Save, punan ang mga blanko, i-printa, Tapos na!

Download this Basic Financial Balance Overview including ratios template and after downloading you can change every detail and appearance according your needs.

Mga magagamit na premium na format ng file:

.xlsx- Itong dokumento ay sertipikado ng isang Propesyonal

- 100% pwedeng i-customize

Finance Pananalapi financial overview balance sheet investors position working capital SME Small and medium sized enterprises small and medium sized enterprises Small and medium sized enterprise small and medium sized enterprise SMES small and medium enterprises SME companies Mga kumpanya ng SME

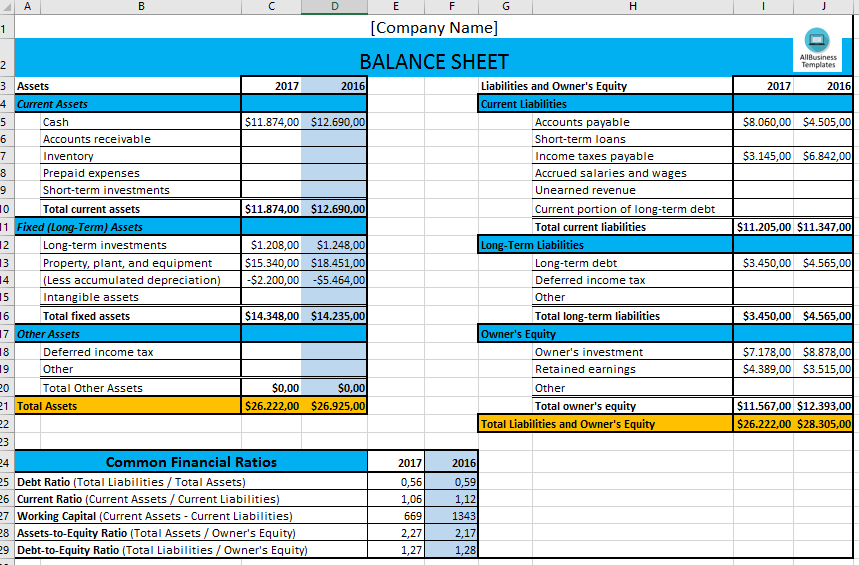

How does a balance sheet work in Excel? Are you in charge of accounting for your company and have you started to manage all the financial records of the business? No worries, this basic financial balance sheet template is one of the best accounting templates for your situation! Our template can be downloaded and easy to use. It also allows you to easily make changes and customize the templates to fit your needs.

A basic Excel balance sheet is a financial statement that provides a snapshot of a company's financial position at a specific point in time. It presents an overview of a company's assets, liabilities, and shareholders' equity. Excel is a popular tool for creating balance sheets due to its flexibility and ease of use.

Here's how you can create a basic Excel balance sheet:

- Column Headings:

- In an Excel spreadsheet, set up column headings to label the different sections of the balance sheet. Typically, these headings include:

- Assets:

- Current Assets

- Cash

- Accounts Receivable

- Inventory

- Prepaid Expenses

- Non-current Assets

- Property, Plant, and Equipment (PPE)

- Intangible Assets

- Investments

- Other Assets

- Liabilities:

- Current Liabilities

- Accounts Payable

- Short-Term Loans

- Accrued Liabilities

- Non-current Liabilities

- Long-Term Debt

- Deferred Tax Liabilities

- Other Long-Term Liabilities

- Shareholders' Equity:

- Common Stock

- Retained Earnings

- Additional Paid-In Capital (if applicable)

- Assets: In the "Assets" section, list all the company's assets under the relevant subheadings (current or non-current). Enter the values for each asset category in the adjacent column.

- Liabilities: In the "Liabilities" section, list all the company's liabilities under the relevant subheadings (current or non-current). Enter the values for each liability category in the adjacent column.

- Shareholders' Equity: In the "Shareholders' Equity" section, list the various components of shareholders' equity, including common stock, retained earnings, and additional paid-in capital. Enter the values for each component.

- Total Assets: In the cell below the "Total Assets" label, use the SUM function to calculate the total value of all assets (both current and non-current). For example, you can enter "=SUM(C2:C10)" if your assets are listed in cells C2 to C10.

- Total Liabilities: In the cell below the "Total Liabilities" label, use the SUM function to calculate the total value of all liabilities (both current and non-current).

- Total Shareholders' Equity: In the cell below the "Total Shareholders' Equity" label, calculate the total shareholders' equity by adding the values of common stock, retained earnings, and additional paid-in capital (if applicable).

- Total Liabilities and Equity: In the cell below the "Total Liabilities and Equity" label, sum the total liabilities and total shareholders' equity to calculate the total liabilities and equity.

- Format the balance sheet for clarity and readability. You can use bold fonts for headings, currency formatting for monetary values, and borders to separate sections.

- Ensure that the total assets equal the total liabilities and equity, as the balance sheet must adhere to the fundamental accounting equation: Assets = Liabilities + Shareholders' Equity.

Creating a basic Excel balance sheet provides a clear financial overview of a company's financial health at a specific point in time. It is a valuable tool for internal analysis, external reporting, and financial decision-making. Depending on the complexity and reporting requirements of your organization, you can customize the balance sheet to include additional details or classifications.

Nicely formatted and ready to print. Easy to customize to your business style. Feel free to edit and change the formulas to your needs.

Using this financial and accounting basic financial balance sheet template guarantees you will save time, cost and effort!

Download this Basic Financial Balance Overview including the ratios template and after downloading you can change every detail and appearance according to your needs.

DISCLAIMER

Wala sa 'site' na ito ang dapat ituring na legal na payo at walang abogado-kliyenteng relasyon na itinatag.

Mag-iwan ng tugon. Kung mayroon kang anumang mga katanungan o mga komento, maaari mong ilagay ang mga ito sa ibaba.