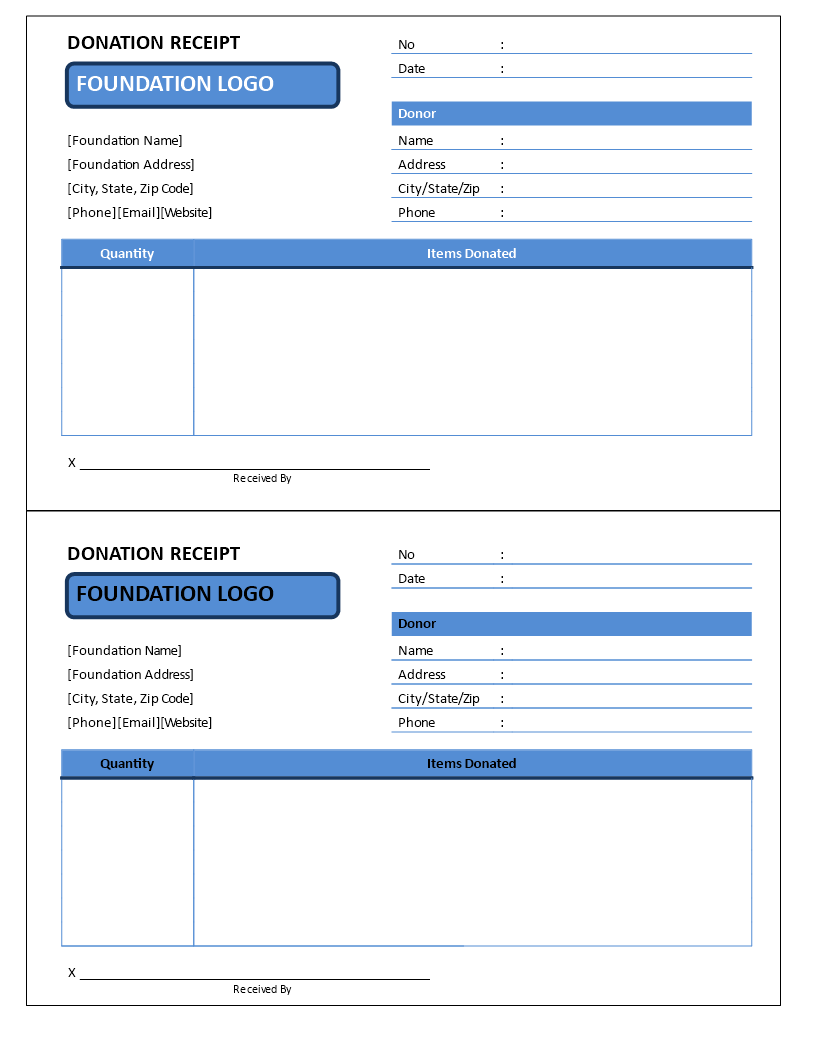

Non profit donation receipt template

I-Save, punan ang mga blanko, i-printa, Tapos na!

Download this Donation Receipt for Item Donations to make a statement for indicating whether any goods or services were provided in exchange for the donation.

Mga magagamit na premium na format ng file:

.docx- Itong dokumento ay sertipikado ng isang Propesyonal

- 100% pwedeng i-customize

Finance Pananalapi accounting donation donation receipt donation receipt sample professional donation receipt financial donation receipt tax charity kawanggawa donor donor administration donation administration ngo donation receipt non profit donation receipt nonprofit donation donation receipt item donation donor receipt chartiy donation charity templates charity documents mga dokumento ng kawanggawa chartiy donation sample charity template charity files charities charities to donate to

Are you looking for suitable Donation Receipts to send to your donors as proof for receipt of charitable items as a donation? Download this Donation Receipt Cash Donation template now!

What is a donation receipt for received items?

This is an e-mail or a letter which is considered proof that a donor made an in-kind contribution to a (nonprofit) organization. Often, NGO’s/nonprofits send receipts out by the end of the year the gift was given or in January of the following year.

Non profit donation receipt template for Donors

- deductions on Tax Returns: this Donation Receipt is important in order to receive the tax deductions associated with charity, a donor needs such proof of donation.

- financial record keeping: donation receipts are an easy way for donors to keep track of their finances when it comes to charitable giving.

- confirmation: it acknowledges the receipt of a donation and let donors know their contributions have been received.

Donation receipt template for Nonprofits

- legal requirements: the IRS requires donation receipts in certain situations. Failure to send a receipt can result in a penalty.

- accounting: donation receipts enable organizations to get clear and accurate financial records.

- tracking donation history

What must be Included in a Donation Receipt?

- name of a donor

- organization’s name, federal tax ID, a statement showing the organization is a registered

- date donation was provided

- the total sum of money or a description (not the value) of the donated item(s). The donor is responsible for assigning a cash value of donated items or in-kind contributions.

- a statement indicating whether any goods or services were provided in exchange for the donation: If no goods or services were given to the donor in return for the contribution, the nonprofit must say so.

- name and signature of authorized legal representative

- a disclosure, if necessary. This depends on local regulations. Double check to make sure you’re including the required disclosure statements for all states that your donors are contributing from.

We provide a Donation Receipt Cash Donation template that will professionalize your way of administration and communication towards the donor organization. Our templates are all screened by financial professionals.

Using this donation receipt template guarantees you will save time, cost and efforts!

DISCLAIMER

Wala sa 'site' na ito ang dapat ituring na legal na payo at walang abogado-kliyenteng relasyon na itinatag.

Mag-iwan ng tugon. Kung mayroon kang anumang mga katanungan o mga komento, maaari mong ilagay ang mga ito sa ibaba.