Mortgage Payment Calculator

Speichern, ausfüllen, drucken, fertig!

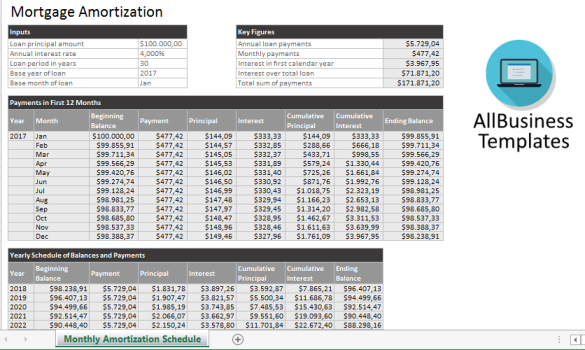

How to make a Mortgage Payment Calculator in Excel? Download this example Mortgage Payment Calculator Excel spreadsheet template now!

Verfügbare Gratis-Dateiformate:

.xls- Dieses Dokument wurde von einem Professional zertifiziert

- 100% anpassbar

Finance Finanzen mortgage calculator Hypothekenrechner loan amortization calculator Tilgungsrechner für Kredite

How to make a Mortgage Payment Calculator in Excel? An easy way to create your spreadsheet is by downloading this example Mortgage Payment Calculator Excel spreadsheet template now!

Mortgage Calculator Help

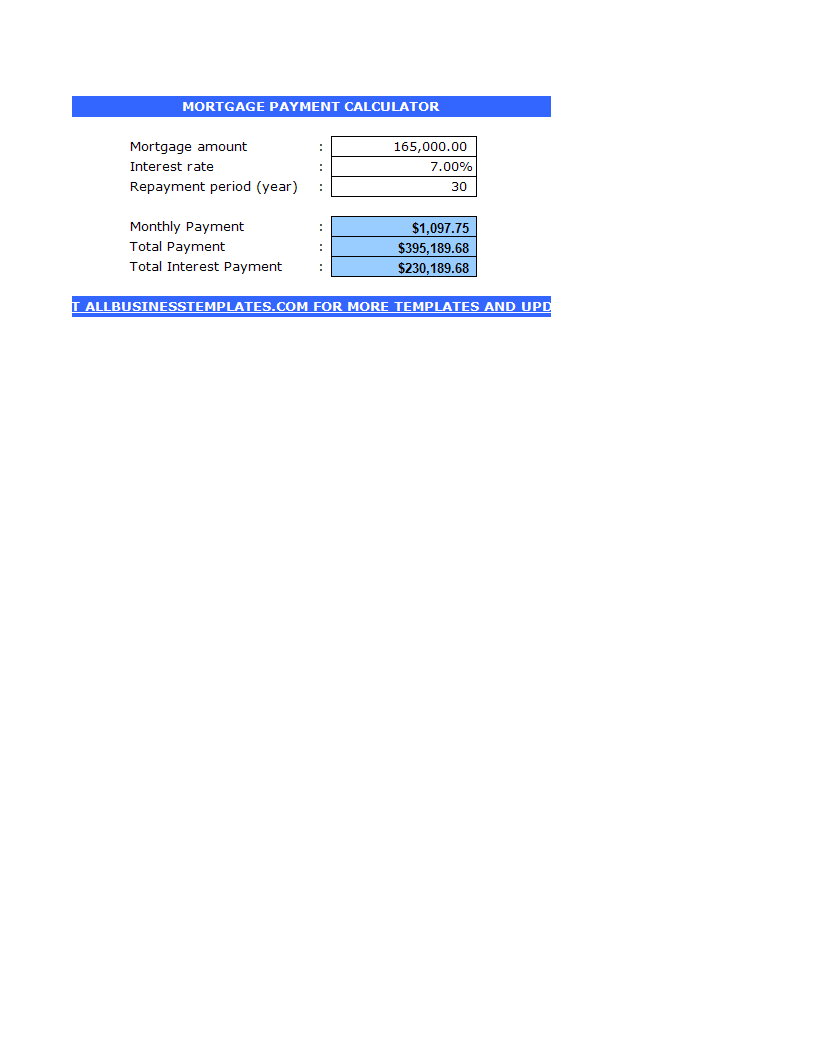

Using an online mortgage calculator can help you quickly and accurately predict your monthly mortgage payment with just a few pieces of information. It can also show you the total amount of interest you"ll pay over the life of your mortgage. To use this calculator, you"ll need the following information:

Mortgage Amount - If you're getting a mortgage to buy a new home, you can find this number by subtracting your down payment from the home's price. If you're refinancing, this number will be the outstanding balance on your mortgage.

Repayment Period (Year) - This is the length of the mortgage you're considering. For example, if you're buying new, you may choose a mortgage loan that lasts 30 years. On the other hand, a homeowner who is refinancing may opt of a loan that lasts 15 years.

Interest Rate - Estimate the interest rate on a new mortgage by checking Bankrate's mortgage rate tables for your area. Once you have a projected rate (your real-life rate may be different depending on your overall credit picture) you can plug it into the calculator.

Calculating Your Mortgage

Want to figure out how much your mortgage payment will be? Here’s a formula to help you calculate your mortgage payment manually:

M= P[r(1+r)^n/((1+r)^n)-1)]

- M = the total monthly mortgage payment.

- P = the principal loan amount.

- r = your monthly interest rate. Lenders provide you an annual rate so you’ll need to divide that figure by 12 (the number of months in a year) to get the monthly rate. If your interest rate is 5%, your monthly rate would be 0.004167 (0.05/12=0.004167)

- n = number of payments over the loan’s lifetime. Multiply the number of years in your loan term by 12 (the number of months in a year) to get the number of payments for your loan. For example, a 30-year fixed mortgage would have 360 payments (30x12=360)

This calculation can help you crunch numbers to get your monthly mortgage payment. Using Bankrate.com’s tool to calculate your mortgage payment can take the work out of it for you and help you decide whether you’re putting enough money down or if you need to adjust your loan term. It’s always a good idea to rate-shop with several lenders to ensure you’re getting the best deal available.

Our Excel templates are grid-based files designed to organize information and perform calculations with scalable entries. Beginners and professionals from all over the world are now using spreadsheets to create tables, calculations, comparisons, overviews, etc for any personal or business need.

This Excel template is a great way to increase your productivity and performance. It gives you access to do remarkable new things with Excel, even if you only have a basic understanding of working with formula’s and spreadsheets. If time or quality is of the essence, this ready-made presentation can certainly help you out!

Download this Mortgage Payment Calculator Excel spreadsheet now!

HAFTUNGSAUSSCHLUSS

Nichts auf dieser Website gilt als Rechtsberatung und kein Mandatsverhältnis wird hergestellt.

Wenn Sie Fragen oder Anmerkungen haben, können Sie sie gerne unten veröffentlichen.