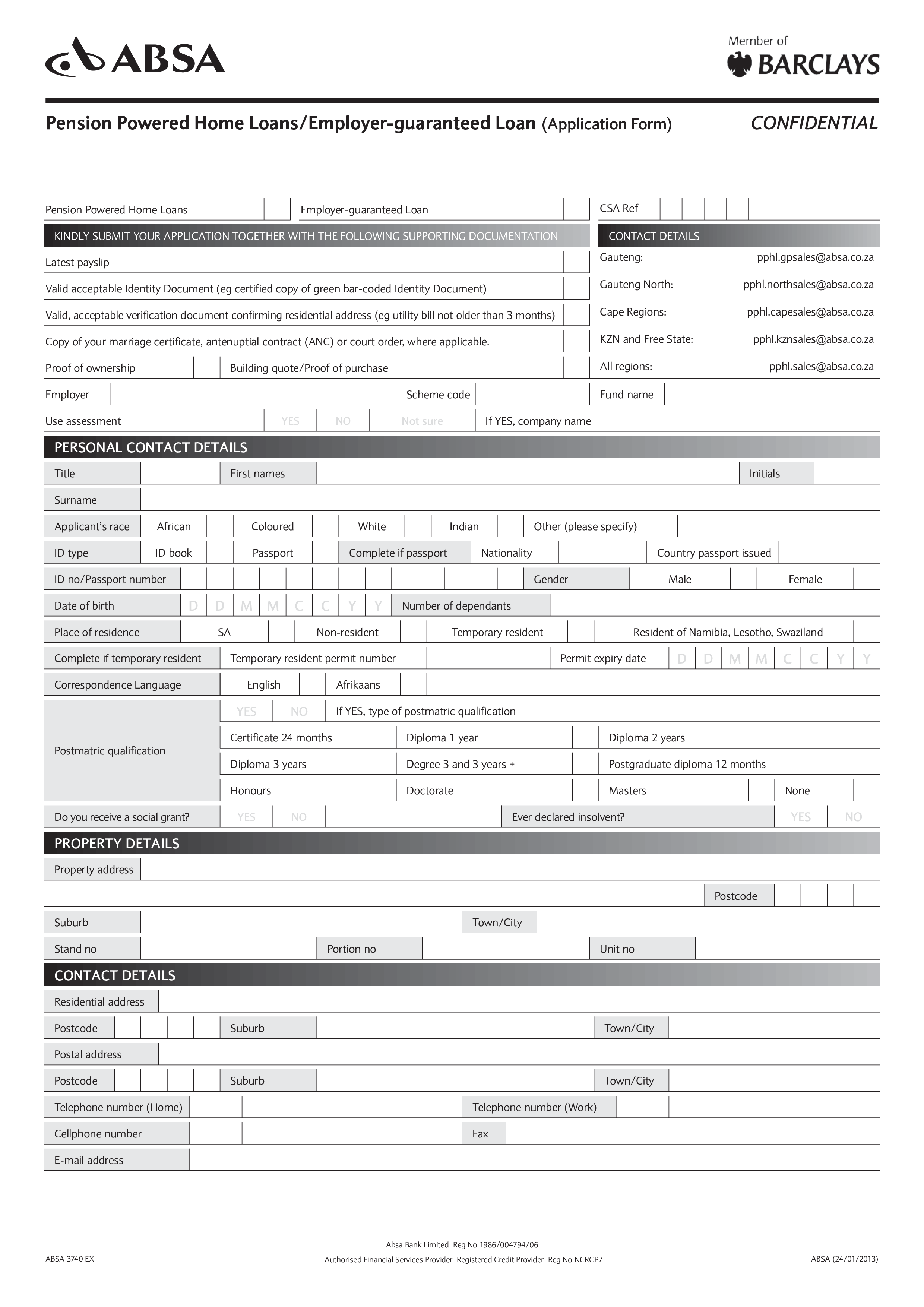

Pension Powered Home Guaranteed Loan application

Enregistrer, Remplir les champs vides, Imprimer, Terminer!

Are you interested in applying for a loan, and already entitled to a pension? What does a standard loan application form look like? Download our application form template that is tailored to the needs of our customers.

Formats de fichiers gratuits disponibles:

.pdf- Ce document a été certifié par un professionnel

- 100% personnalisable

Life Privé pension powered loan prêt de pension alimenté

Are you interested in applying for a loan, and already entitled to a pension? What does a standard loan application form look like? Download our application form template that is tailored to the needs of our customers. Our template is user-friendly and makes it easy to complete all the necessary information. We guarantee that our application form template is secure and confidential.

Using our business templates guarantees you will save time, costs, and effort! They are based on years of experience and are professionally written. All templates are customizable and can be tailored to your specific needs. We guarantee that you will find the perfect template for your business.

A guaranteed loan application form is a document used by individuals and businesses to apply for loans that are guaranteed or backed by a government agency or a financial institution. These loans are often offered to borrowers who may not meet traditional lending criteria or require additional support to secure financing. The term "guaranteed" refers to the assurance that in case of default by the borrower, the guarantor (usually a government agency or lender) will cover a portion or all of the loan amount.

Here are some key points to understand about guaranteed loan application forms:

- Government Guarantees: In many cases, guaranteed loans are backed by government agencies, such as the Small Business Administration (SBA) in the United States or similar agencies in other countries. These agencies provide a guarantee to the lender, reducing the lender's risk and making it easier for borrowers to access credit.

- Purpose: Guaranteed loans can serve various purposes, including small business financing, agricultural loans, education loans, and housing loans. The specific purpose of the loan may determine the application process and eligibility criteria.

- Application Information: A guaranteed loan application form typically requests detailed information about the borrower, including personal or business details, financial information, and the purpose of the loan.

- Financial Documents: Applicants may be required to submit financial documents, such as tax returns, bank statements, income statements, and business plans, to support their application.

- Credit History: Lenders and guarantors may assess the applicant's credit history as part of the evaluation process. Some guaranteed loans may have more lenient credit requirements than traditional loans.

- Collateral: Depending on the type of guaranteed loan, collateral may be required to secure the loan. Collateral can be personal or business assets that the lender can claim if the borrower defaults.

- Guarantor's Role: The guarantor, whether it's a government agency or a financial institution, plays a key role in the loan application process. They evaluate the application, assess risk, and provide the necessary guarantee to the lender.

- Approval and Disbursement: Once the loan application is approved, funds are disbursed to the borrower. The borrower is then responsible for repaying the loan according to the terms and conditions specified in the loan agreement.

- Repayment Terms: Guaranteed loans come with specific repayment terms, including interest rates, repayment schedules, and the duration of the loan. Borrowers must adhere to these terms to avoid default.

- Default and Guarantees: In the event of default, the guarantor steps in to cover the outstanding loan amount. However, this does not relieve the borrower of their obligation to repay the debt, as they may still be responsible for repayment to the guarantor.

- Application Fees: Some guaranteed loan programs may have application fees or other associated costs that borrowers need to consider.

It's important for applicants to carefully review and complete the guaranteed loan application form, provide accurate information, and understand the terms and conditions of the loan. Additionally, applicants should be aware of the responsibilities and obligations associated with borrowing a guaranteed loan, as well as the consequences of default.

Using our business templates guarantees you will save time, costs, and effort! They are based on years of experience and are professionally written. All templates are customizable and can be tailored to your specific needs. We guarantee that you will find the perfect template for your business.

AVERTISSEMENT

Rien sur ce site ne doit être considéré comme un avis juridique et aucune relation avocat-client n'est établie.

Si vous avez des questions ou des commentaires, n'hésitez pas à les poster ci-dessous.