Budget Template

Speichern, ausfüllen, drucken, fertig!

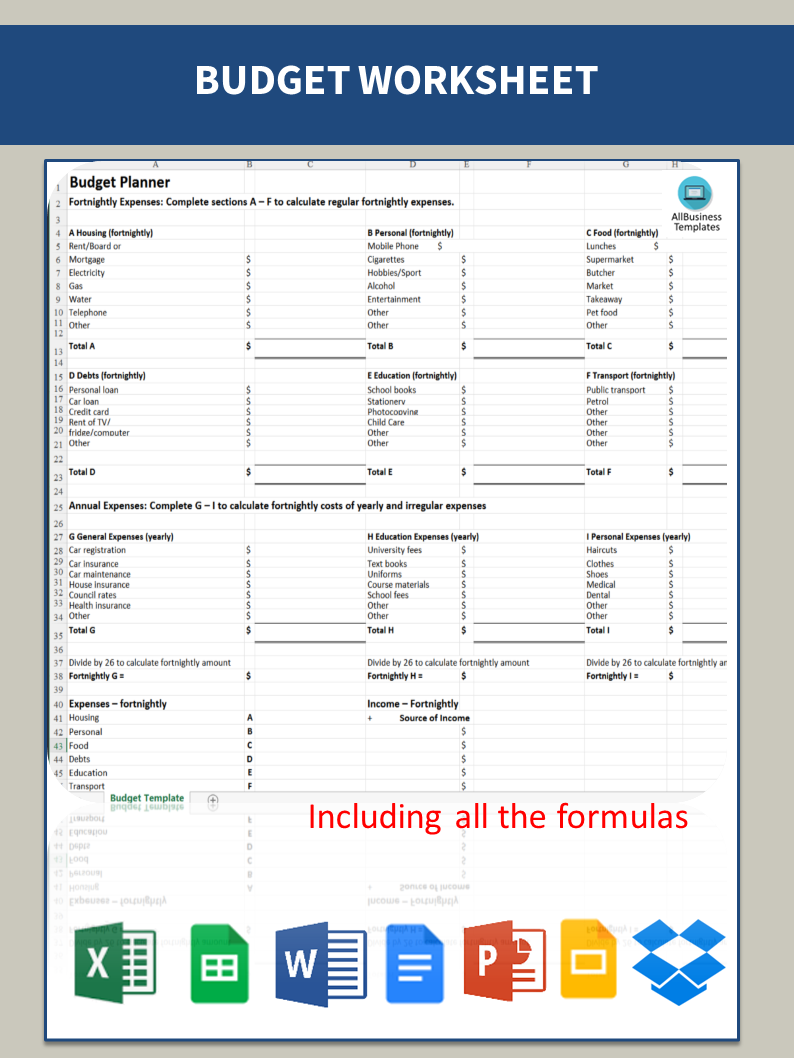

What is a Budget? Who needs a Budget? Virtually everybody should working with a Budget Worksheet Template like this one. Download it now.

Verfügbare Gratis-Dateiformate:

.xlsxWeitere verfügbare Sprachen:

- Dieses Dokument wurde von einem Professional zertifiziert

- 100% anpassbar

Finance Finanzen budget Haushaltsetat sheet Blatt Excel Google Sheets Budget Template Google Sheets-Budgetvorlage Monthly Budget Template Monatliche Budgetvorlage Budget Sheet Budgetblatt Budget Excel Excel Budget Personal Budget Persönliches Budget Biweekly Budget Zweiwöchentliches Budget excel budget Excel Budget budget spreadsheet Budgettabelle xls budget template Budgetvorlage personal budget template Persönliche Budgetvorlage google sheets Google Tabellen what is a budget was ist ein budget Excel budget template Excel Budget vorlage budget spreadsheet template Budget Tabellen vorlage budget sheet template budget template Excel Budget vorlage Excel budget calculator personal budget biweekly Persönliches Budget zweiwöchentlich personal budget forthnight Persönliches Budget vierzehn Tage week budget how to make a budget in excel budget google sheets Budget Google Sheets

How do you make a Budget Worksheet Template? Download this financial template now!

Whether you manage the finances at work or at home, adequate communication is essential and important. Accurately keeping track of financial data is not only critical for running the day-to-day operations of your small or medium-sized business, but it is also important when seeking funds from investors or lenders to grow your business to the next level. For those working in Finance, it's important to use accurate data and have every detail double-checked. Our basic or advanced finance document templates are intuitive and available in several kinds of formats (such as PDF, WORD, PPT, XLS. The Excel spreadsheets include the necessary formulas as well.) Therefore, we recommend that you download this example Budget Worksheet template now.

What is a Budget?

A budget is simply an organized way of managing your finances. It enables you to identify and balance money coming in (income) and money going out (expenditure). A budget assists you to plan for the week, month or year ahead and identify the type of lifestyle you will be able to afford.

Who needs a Budget?

Virtually everybody should working with a budget, since most people don't have the luxury to make use of a bottomless wallet! As a student with a very limited income you might think that budgeting is a pointless activity. In fact, the less money you have to live on, the greater the necessity to budget. Budgeting enables you to make the best use of the limited resources you have. Steps in working out a budget

1. You first need to identify where your money is going so that your budget will be based on realistic estimates of your expenses. In a diary, record for one month exactly where every cent of your money goes.

2. Keep an accurate record of your income for the same month. Write down any income on the day that your receive it – this can include salary, government assistance, assistance from parents/partner, etc.

3. In your diary also keep track of your bank balance. Record your balance at the beginning of each week. Then you can tell whether you are relying on savings at any time during your pay periods.

4. Use the above information to work out your budget on the Budget Planner over the page. Budgeting Tips

- Begin by overestimating your expenditures – focus on wants as well as needs. Once you compare this with your income, make some decisions about where to cut back as needed. The fallback position is “What do I need?”

- Don’t make your budget too inflexible or too tight – if you do, the time will come when you won’t be able to stick to it any longer.

- Follow your budget for three months and then review – can it be improved?

- Budgets often fail because people don’t plan for irregular predictable expenses. Plan for unexpected costs (medical, car repairs, etc.) by regularly putting money aside for ‘emergencies’ (miscellaneous, unsure cost).

- If your budget ends up in the red, don’t panic!! Ask yourself the following questions and make the necessary adjustments:

- Can you remove any of the expenses?

- Can you reduce some of the expenses?

- Could you handle a part-time job?

- Could you ask your family for some (more) money?

- Would a Student Loan be of any help?

- Would you consider being a part-time student for a while and working fulltime? This may allow you to accumulate some savings.

Keeping a family budget can provide numerous benefits, including:

- Planning get's manageable; Maintaining a budget makes it easier to keep track of your spending and find areas where you may reduce costs. By doing so, you can prevent overspending and make wise financial judgments.

- Save sufficient money; By understanding where your money is going, you can find opportunities to reduce spending. For instance, you might become aware that you are overspending on dining out or entertainment and decide to reduce those costs to save money.

- A budget can assist you in making future plans, such as those related to establishing a family, purchasing a home, or taking a vacation. You may save money over time and be more ready for the future by setting a budget for these costs.

- Stress reduction; Having a budget might help reduce some of the tension that families may experience because of money. You can make wise decisions and feel more in control of your financial situation when you have a thorough understanding of your finances.

- Communication between family members must be improved in order to create and manage a budget. This can develop a sense of teamwork and collaboration within the family, which is also beneficial to improve the family relationship.

Using this Budget Worksheet Template guarantees that you will save time, cost, and effort and enables you to reach the next level of success in your project, education, work, and business. These financial templates also work with OpenOffice and Google Spreadsheets, so if you are operating your business on a very tight budget, hopefully, you'll be able to make these financial templates work for you as well.

Download this Budget Worksheet now!

Looking for more? Our collection of financial documents, templates, forms, and spreadsheets includes templates designed specifically for small business owners, private individuals, or Finance Staff. Find financial projections to calculate your startup expenses, payroll costs, sales forecast, cash flow, income statement, balance sheet, break-even analysis, financial ratios, cost of goods sold, amortization, and depreciation for your company.

HAFTUNGSAUSSCHLUSS

Nichts auf dieser Website gilt als Rechtsberatung und kein Mandatsverhältnis wird hergestellt.

Wenn Sie Fragen oder Anmerkungen haben, können Sie sie gerne unten veröffentlichen.