Account For Collection Letter

Guardar, completar los espacios en blanco, imprimir, listo!

Looking for an account for a collection of letter templates that can be modified by your writing style? How important it is to write a collection letter? Our sample letter template is just what you need. Download it now to get started!

Vandaag: USD 1.49

Descárgalo ahora

Formatos de archivo premium disponibles:

.docx- Este documento ha sido certificado por un profesionall

- 100% personalizable

Business Negocio Finance Financiar accounting contabilidad

Looking for an account for a collection of letter templates that can be modified by your writing style? How important it is to write a collection letter? Our sample letter template is just what you need. It's easy to use and can be customized to fit your exact needs. Download it now to get started!

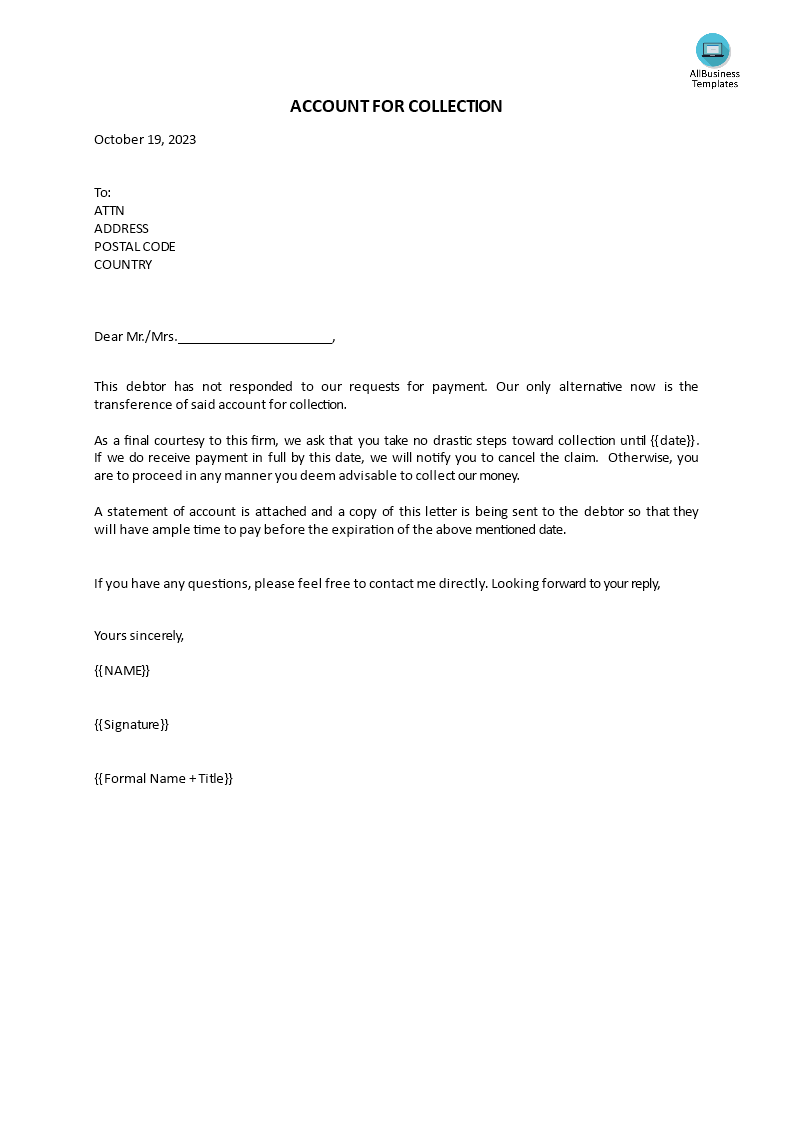

An "Account for Collection Letter," also known as a "Debt Collection Letter," is a formal written communication sent by a creditor or collection agency to a debtor or customer who has an outstanding debt that is past due. This type of letter is used to formally notify the debtor of the overdue amount and request payment or arrangements for payment. It serves as an initial step in the debt collection process. Here's how you can structure an account for a collection letter:

1. Use a Professional Format:

- Begin with a professional letterhead that includes the name and contact information of the creditor or collection agency. Include the date at the top of the letter.

2. Address the Debtor:

- Address the letter to the debtor or customer who owes the outstanding debt. Use their name if available.

3. Reference the Debt:

- Clearly state the amount of the debt that is past due. Include any relevant account numbers, invoice numbers, or transaction details to ensure clarity.

4. Mention the Delinquency:

- Indicate that the debt is past due and specify the date by which the payment was originally due.

5. Explain the Purpose:

- Explain that the purpose of the letter is to collect the overdue debt and bring the account up to date.

6. Request Payment:

- Request that the debtor remit the outstanding amount promptly. Specify the preferred payment methods (e.g., check, credit card, online payment) and provide instructions for making the payment.

7. Offer Payment Options (if applicable):

- If the debtor is unable to pay the entire amount in one lump sum, offer options for setting up a payment plan or negotiating a settlement if your organization allows for such arrangements.

8. Provide Contact Information:

- Include contact information for the creditor or collection agency, including a phone number and email address, for the debtor to reach out with questions or concerns.

9. Mention Consequences of Non-Payment:

- Warn the debtor of potential consequences of non-payment, such as further collection efforts, late fees, interest charges, or legal action.

10. Maintain a Professional Tone:

- Keep the tone of the letter professional and respectful, even while emphasizing the urgency of the situation.

11. Closing and Signature:

- Close the letter with a professional closing, such as "Sincerely" or "Yours truly," followed by the name and contact information of the person or department responsible for collections.

12. Keep Copies:

- Make copies of the letter for your records before sending it.

It's important to note that debt collection practices are subject to laws and regulations that vary by jurisdiction, including consumer protection laws like the Fair Debt Collection Practices Act (FDCPA) in the United States. Ensure that your collection efforts comply with applicable laws and regulations to avoid legal issues. Additionally, always consider ethical and empathetic approaches in dealing with debtors, especially in cases of financial hardship.

Writing a collection letter is important for several reasons:

- Effective Communication: It serves as a formal and documented way to communicate with debtors about overdue payments.

- Documentation: It creates a written record of the debt and collection efforts, which can be vital for legal purposes and dispute resolution.

- Reminder: Collection letters remind debtors of their financial obligations, helping to prevent oversights or neglect of overdue payments.

- Professionalism: It maintains professionalism and respect in the debt collection process, preserving relationships when handled appropriately.

- Legal Compliance: It helps creditors adhere to legal requirements governing debt collection, acting as the first step in the legal debt recovery process.

- Clear Expectations: Collection letters set clear expectations for debtors regarding the amount owed, due dates, and consequences of non-payment.

- Options for Resolution: They often offer options for resolving the debt, such as payment plans or settlements, providing debtors with paths to resolution.

- Time and Cost Efficiency: Collection letters are a time-efficient and cost-effective method of requesting payment compared to other collection methods.

Download this professional

Account For Collection Letter template now!

For more business templates? Just browse

through our database and website! You will have instant access to thousands of

free and premium business templates, legal agreements, documents, forms,

letters, reports, plans, resumes, etc., which are all used by professionals in

your industry. All business templates are ready-made, easy to find, wisely

structured and intuitive.

DESCARGO DE RESPONSABILIDAD

Nada en este sitio se considerará asesoramiento legal y no se establece una relación abogado-cliente.

Deja una respuesta. Si tiene preguntas o comentarios, puede colocarlos a continuación.