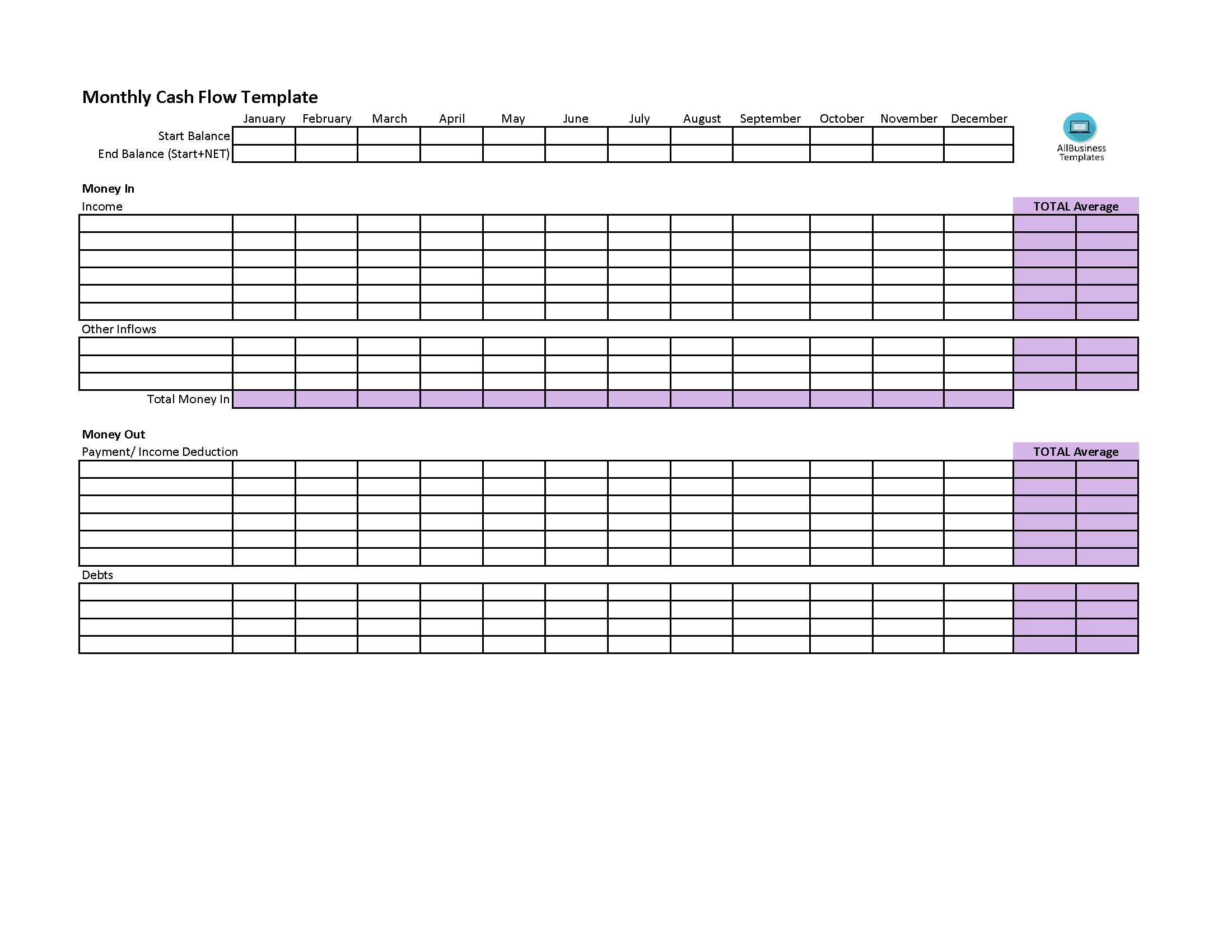

Monthly Cash Flow Chart

Enregistrer, Remplir les champs vides, Imprimer, Terminer!

Are you looking for a sample monthly cash flow template? Our cash flow template will help you organize your income and expenses, so you can see where your money is going every month.

Formats de fichiers gratuits disponibles:

.xlsx- Ce document a été certifié par un professionnel

- 100% personnalisable

Business Entreprise Finance La finance insurance Assurance food aliments envelope enveloppe Charts Graphiques Budgeted Budgétisé Cash Flow Chart Tableau de flux de trésorerie Spent Dépensé

How to create a monthly cash flow chart? Are you looking for a sample monthly cash flow template? Our cash flow template will help you organize your income and expenses, so you can see where your money is going every month. This will help you plan your spending better and gain insight into your finances. Maximizing your monthly cash flow with our comprehensive worksheet!

Monthly cash flow refers to the net amount of money that enters and exits a person's or entity's financial accounts during a specific month. It represents the difference between the incoming cash (income) and outgoing cash (expenses) over that period.

Here's a breakdown:

- Income: This includes money received during the month from various sources, such as salary, rental income, dividends, interest, or any other form of earnings.

- Expenses: These are the costs and payments made during the month, including rent or mortgage payments, utilities, groceries, transportation, insurance, loan repayments, and other regular or one-time expenditures.

- Net Cash Flow: The net cash flow is calculated by subtracting total expenses from total income. The result can be either positive or negative:

- A positive cash flow indicates that the entity has more money coming in than going out during that month. This surplus can be used for savings, investments, or other financial goals.

- A negative cash flow means that expenses exceed income for the month. This situation may require using savings or obtaining additional funds to cover the shortfall.

Analyzing monthly cash flow is crucial for individuals, businesses, and organizations to understand their financial health, manage budgets effectively, and make informed decisions. It helps in identifying trends, planning for future expenses, and ensuring financial stability over time.

Financial empowerment begins with effective cash flow management. Our Monthly Cash Flow Chart template is designed to inspire and motivate you on your financial journey. Whether you're an individual or a business owner, this chart covers essential topics, helping you structure and communicate your financial plans professionally.

Features of this Monthly Cash Flow Chart:

- Categories Coverage: Our chart comprehensively covers various categories crucial for managing your monthly cash flow effectively. From housing and transportation to food, medical expenses, and savings, every significant aspect is meticulously included.

- Budgeted vs. Actual: Clearly distinguish between budgeted and actual expenses in each category. This feature allows you to assess your financial performance accurately, identify areas for improvement, and make informed decisions.

- Reality Check: Evaluate your spending against recommended percentages and benchmarks, providing a reality check on your financial habits. This insight can guide adjustments for a more balanced and sustainable financial plan.

- Icons for Easy Reference: Intuitive icons represent good options for allocating cash in envelopes, facilitating quick and easy reference. Visual cues make it simpler to understand and adhere to your budgeting strategy.

- Debt Management: Effectively manage debts with dedicated sections for tracking different credit cards and loans. This empowers you to take control of your debt repayment plan and work towards financial freedom.

- Savings and Retirement Planning: Plan for the future by allocating funds for savings, retirement, and other long-term financial goals. Our chart provides a structured approach to building a secure financial foundation.

- Personalization Options: Tailor the chart to your unique needs with customizable sections. Whether you're focused on a specific savings goal or have unique expense categories, our template allows for flexibility to suit your financial aspirations.

We believe in empowering individuals and businesses to achieve financial success. With proper planning and execution, you can optimize your cash flow, build wealth, and secure a prosperous future.

Embark on your journey to financial well-being with the help of our Monthly Cash Flow Chart.

Download our free Monthly Cash Flow Chart template now and gain valuable insights into your financial landscape and take the first step towards financial empowerment!

AVERTISSEMENT

Rien sur ce site ne doit être considéré comme un avis juridique et aucune relation avocat-client n'est établie.

Si vous avez des questions ou des commentaires, n'hésitez pas à les poster ci-dessous.