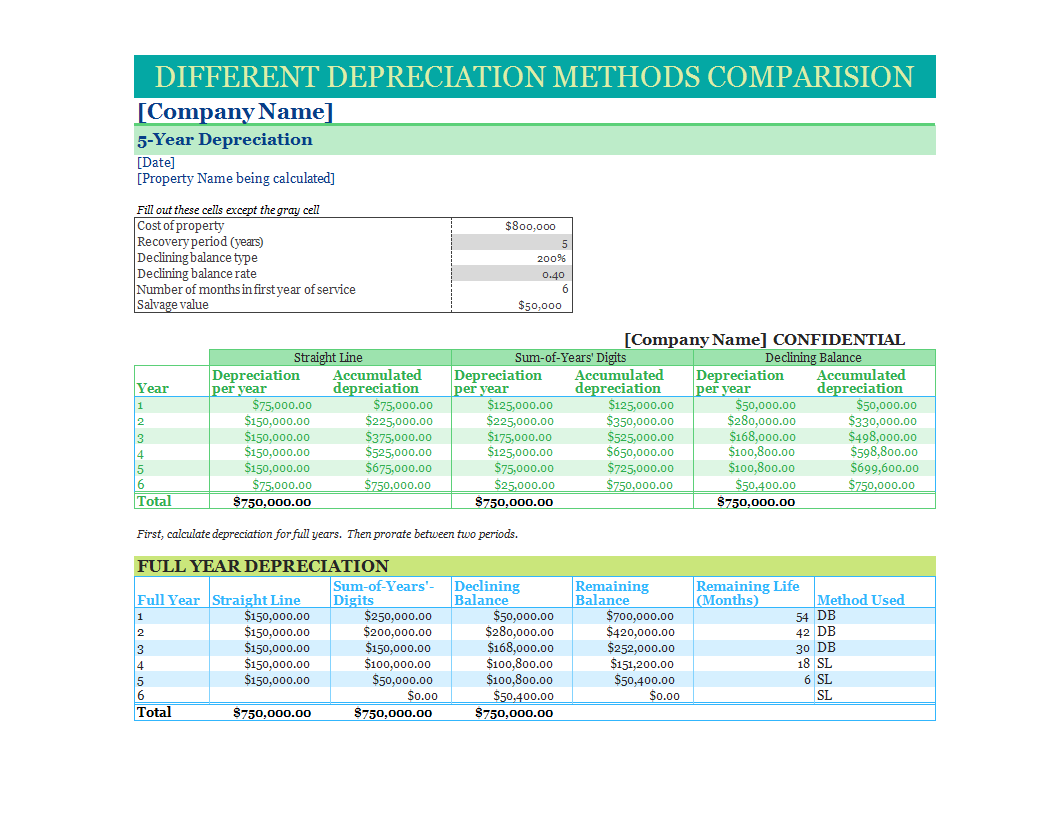

Different depreciation methods comparison

Enregistrer, Remplir les champs vides, Imprimer, Terminer!

How to make a 5 year depreciation calculation in Excel? Download this financial different depreciation methods comparison now!

Formats de fichiers gratuits disponibles:

.xlsx- Ce document a été certifié par un professionnel

- 100% personnalisable

Finance La finance balance équilibre Excel Year Année Years Années Depreciation Dépréciation Spreadsheet Tableur Declining En déclin Excel spreadsheet Feuille de calcul Excel Excel template Excel modèle Excel templates for business best excel templates meilleurs modèles Excel project management excel templates modèles de gestion de projet excel xls xlsx template Excel spreadsheet modèle de feuille de calcul Excel depreciation schedule template in excel depreciation schedule template in excel sample depreciation schedule template in excel template

Whether you manage the finances at your work or at home, adequate communication is essential and important. Accurately keeping track of financial data is not only critical for running the day-to-day operations of your small or medium-sized business, but it is also important when seeking funds from investors or lenders to grow your business to the next level.

Using this depreciation schedule template in excel template guarantees that you will save time, cost and efforts and enables you to reach the next level of success in your project, education, work, and business. Download it now!

DIFFERENT DEPRECIATION METHODS COMPARISION

Company Name 5-Year Depreciation,,, , Date ,,, , Property Name being calculated ,,, ,,,, ,Fill out these cells except the gray cell,,, ,Cost of property,,800000,, ,Recovery period (years),,5,, ,Declining balance type,,200 ,, ,Declining balance rate,,"0,4",, ,Number of months in first year of service,,6,, ,Salvage value,,50000,, ,,,, ,,,, Company Name CONFIDENTIAL ,Straight Line,Sum-of-Years Digits,Declining Balance, ,Year,Depreciation per year ,Accumulated depreciation,Depreciation per year ,Accumulated depreciation,Depreciation per year ,Accumulated depreciation ,1,75000,75000,125000,125000,50000,50000 ,2,150000,225000,225000,350000,280000,330000 ,3,150000,375000,175000,525000,168000,498000 ,4,150000,525000,125000,650000,100800,598800 ,5,150000,675000,75000,725000,100800,699600 ,6,75000,750000,25000,750000,50400,750000 ,Total,750000,750000,750000, ,,,, ,"First, calculate depreciation for full years..

AVERTISSEMENT

Rien sur ce site ne doit être considéré comme un avis juridique et aucune relation avocat-client n'est établie.

Si vous avez des questions ou des commentaires, n'hésitez pas à les poster ci-dessous.