Different depreciation methods comparison

I-Save, punan ang mga blanko, i-printa, Tapos na!

How to make a 5 year depreciation calculation in Excel? Download this financial different depreciation methods comparison now!

Mga magagamit na premium na format ng file:

.xlsx- Itong dokumento ay sertipikado ng isang Propesyonal

- 100% pwedeng i-customize

Finance Pananalapi balance Excel Year Years Depreciation Spreadsheet Declining Excel spreadsheet spreadsheet ng Excel Excel template Excel templates for business best excel templates project management excel templates xls xlsx template Excel spreadsheet template ng Excel spreadsheet depreciation schedule template in excel depreciation schedule template in excel sample depreciation schedule template in excel template

Whether you manage the finances at your work or at home, adequate communication is essential and important. Accurately keeping track of financial data is not only critical for running the day-to-day operations of your small or medium-sized business, but it is also important when seeking funds from investors or lenders to grow your business to the next level.

Using this depreciation schedule template in excel template guarantees that you will save time, cost and efforts and enables you to reach the next level of success in your project, education, work, and business. Download it now!

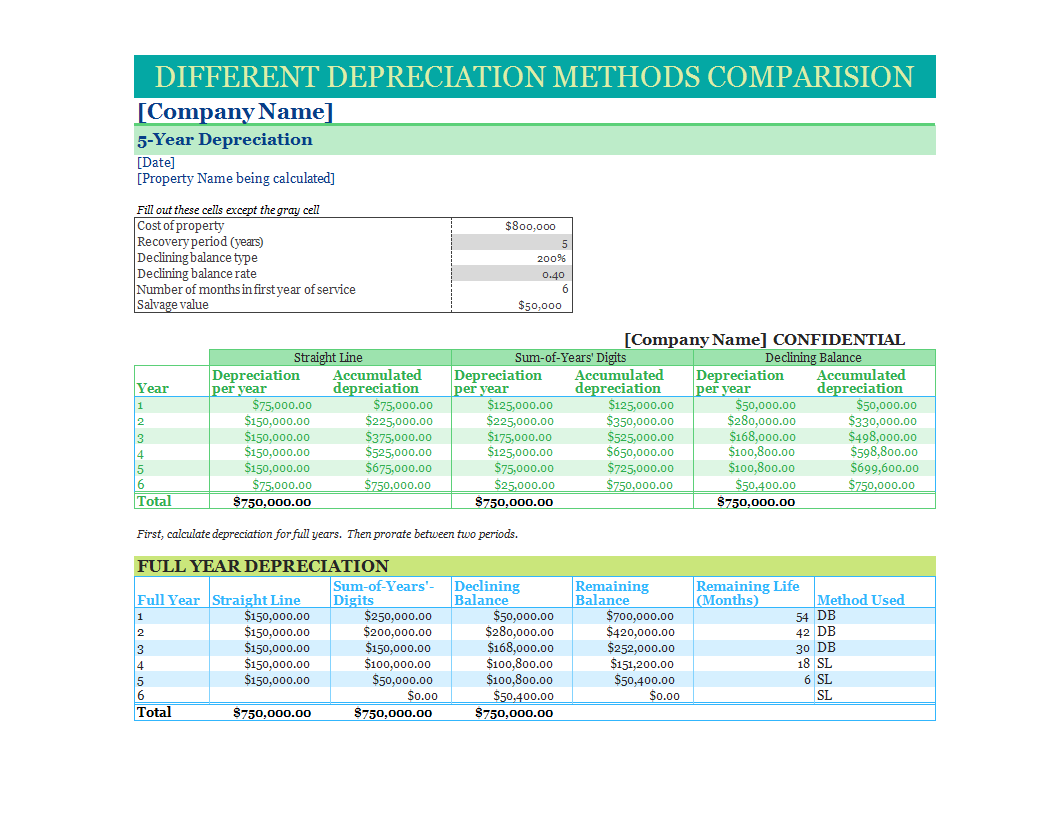

DIFFERENT DEPRECIATION METHODS COMPARISION

Company Name 5-Year Depreciation,,, , Date ,,, , Property Name being calculated ,,, ,,,, ,Fill out these cells except the gray cell,,, ,Cost of property,,800000,, ,Recovery period (years),,5,, ,Declining balance type,,200 ,, ,Declining balance rate,,"0,4",, ,Number of months in first year of service,,6,, ,Salvage value,,50000,, ,,,, ,,,, Company Name CONFIDENTIAL ,Straight Line,Sum-of-Years Digits,Declining Balance, ,Year,Depreciation per year ,Accumulated depreciation,Depreciation per year ,Accumulated depreciation,Depreciation per year ,Accumulated depreciation ,1,75000,75000,125000,125000,50000,50000 ,2,150000,225000,225000,350000,280000,330000 ,3,150000,375000,175000,525000,168000,498000 ,4,150000,525000,125000,650000,100800,598800 ,5,150000,675000,75000,725000,100800,699600 ,6,75000,750000,25000,750000,50400,750000 ,Total,750000,750000,750000, ,,,, ,"First, calculate depreciation for full years..

DISCLAIMER

Wala sa 'site' na ito ang dapat ituring na legal na payo at walang abogado-kliyenteng relasyon na itinatag.

Mag-iwan ng tugon. Kung mayroon kang anumang mga katanungan o mga komento, maaari mong ilagay ang mga ito sa ibaba.