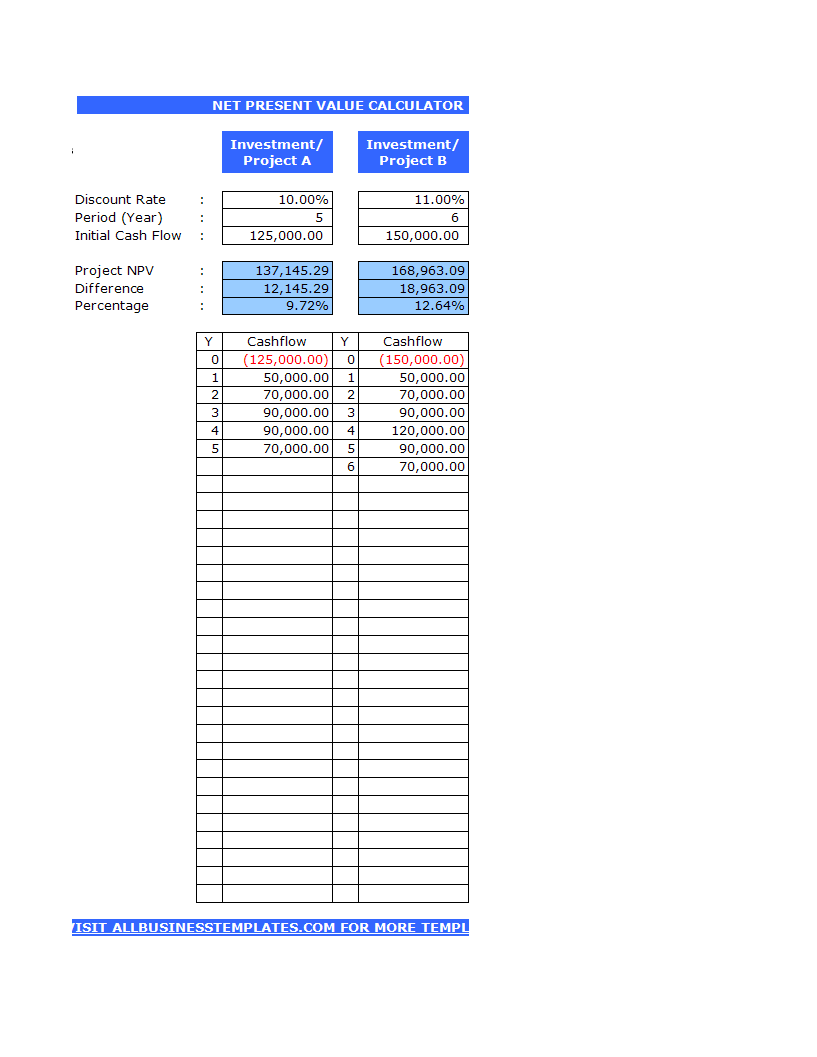

Net Present Value Calculator

Speichern, ausfüllen, drucken, fertig!

How to calculate Net Present Value in Excel? An easy way is by using this Excel spreadsheet Net Present Value (NPV) Calculator Excel spreadsheet template now!

Verfügbare Gratis-Dateiformate:

.xls- Dieses Dokument wurde von einem Professional zertifiziert

- 100% anpassbar

Business Unternehmen Finance Finanzen Net Present Value Barwert Npv net present value calculator Barwertrechner npv caculator NPV-Rechner value proposition canvas value proposition template ppt value proposition template free value proposition canvas template how to write a value proposition value proposition template pdf value proposition builder value proposition presentation value proposition picture cover letter value proposition format value proposition business model canvas

How to calculate Net Present Value in Excel? An easy way is by using this Excel spreadsheet Net Present Value (NPV) Calculator Excel spreadsheet template now!

What is NPV or Net Present Value?

NPV or Net Present Value is a financial metric in capital budgeting that is used to evaluate whether a project or an investment is going to yield a good return in the future or not. It can be simply represented as the difference between the present value of cash inflows and the present value of cash outflows. In the long run, a positive NPV value indicates good potential return over investment, while the negative NPV value means that the investment is likely to lose money. Sometimes NPV is also referred to as NPW or Net Present Worth.

NPV is useful in capital budgeting for analyzing the profitability of project investment. It also aids in assessing the return of interest. Project or investment with a higher NPV, is profitable while negative NPV results in a loss. NPV generally has practical uses in everyday life. It is a common metric used in financial analysis and accounting.

Here’s the Net Present Value NPV formula (when cash arrivals are even):

NPVt=1 to T = ∑ Xt/(1 + R)t – Xo

Xt = total cash inflow for period t

Xo = net initial investment expenditures

R = discount rate, finally

t = total time period count

The NPV formula (when cash arrivals are uneven):

NPV = [Ci1/ (1+r)1 + Ci2/(1+r)2 + Ci3/(1+r)3 + …] – Xo

R is the specified return rate per period;

Ci1 is the consolidated cash arrival during the first period;

Ci2 is the consolidated cash arrival during the second period;

Ci3 is the consolidated cash arrival during the third period, etc…

Use of NPV Formula

By using this NPV formula, the investors find out the difference between the cash inflows from the investments and the cost of investments.

If the difference is positive, it’s a great project. If the difference is negative, it’s not worthy for the investors.

It is used for making prudent business decisions for the following reasons –

First of all, NPV formula is very easy to calculate. Before making any decisions regarding investments, if you know how to calculate NPV; you will be able to make better decisions.

Secondly, it compares the present value of both cash inflow and cash outflow. As a result, the comparison provides the right perspective for the investors to make the right decision.

Thirdly, NPV offers you a conclusive decision. After calculating this, you will directly get to know whether to go for the investments or not.

Our Excel templates are grid-based files designed to organize information and perform calculations with scalable entries. Beginners and professionals from all over the world are now using spreadsheets to create tables, calculations, comparisons, overviews, etc for any personal or business need.

This Excel template is a great way to increase your productivity and performance. It gives you access to do remarkable new things with Excel, even if you only have a basic understanding of working with formula’s and spreadsheets. If time or quality is of the essence, this ready-made presentation can certainly help you out!

You will see that finishing such an Excel spreadsheet has never been easier! Use this net present value calculator to calculate the NPV of cash inflows and cash outflows. Download this Net Present Value Calculator Excel spreadsheet now!

HAFTUNGSAUSSCHLUSS

Nichts auf dieser Website gilt als Rechtsberatung und kein Mandatsverhältnis wird hergestellt.

Wenn Sie Fragen oder Anmerkungen haben, können Sie sie gerne unten veröffentlichen.