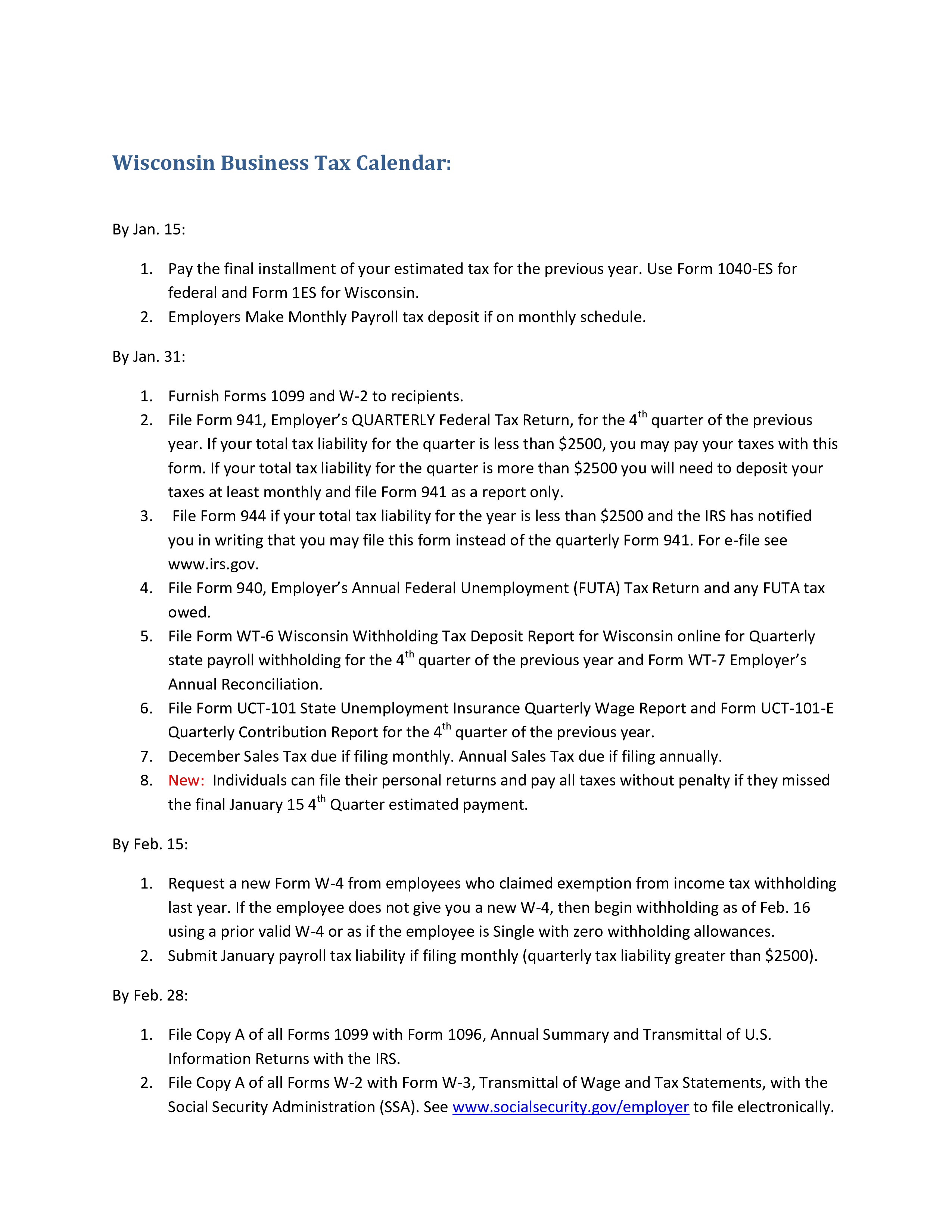

Tax Calendar

Guardar, completar los espacios en blanco, imprimir, listo!

How to create a Tax Calendar? Download this Tax Calendar template now!

Formatos de archivo disponibles:

.pdf- Este documento ha sido certificado por un profesionall

- 100% personalizable

Business Negocio Finance Financiar monthly mensual form formulario tax impuesto Quarterly Trimestral Liability Responsabilidad Calendars Calendarios Accounting Calendar Calendario contable

Do you need a Tax Calendar

? Have a look at this example Calendar!

Customizing your own calendar template is easy. It can be further edited via your own computer after you downloaded it. In our collection, you'll find a variety of monthly or yearly calendar templates that are ready for a free download and after some customization, ready to use in your home, office or school.

Choose from professionally designed templates for Microsoft Excel and Word, PDF, and Google Docs. Options include printable calendars with landscape or portrait.

If this Calendar is not the right one for you, you can find other designs by browsing through our collection of free printable calendars and calendar templates or continue browsing below to find other schedules, planners, etc...

Each printable calendar is a professional-looking template in MS Word, Excel, PDF format.

Download your free printable Tax Calendar

template now!

File Form 944 if your total tax liability for the year is less than 2500 and the IRS has notified you in writing that you may file this form instead of the quarterly Form 941.. File Form WT-6 Wisconsin Withholding Tax Deposit Report for Wisconsin online for Quarterly state payroll withholding for the 4th quarter of the previous year and Form WT-7 Employer’s Annual Reconciliation.. File Form UCT-101 State Unemployment Insurance Quarterly Wage Report and Form UCT-101-E Quarterly Contribution Report for the 4th quarter of the previous year.. If the employee does not give you a new W-4, then begin withholding as of Feb. 16 using a prior valid W-4 or as if the employee is Single with zero withholding allowances..

DESCARGO DE RESPONSABILIDAD

Nada en este sitio se considerará asesoramiento legal y no se establece una relación abogado-cliente.

Deja una respuesta. Si tiene preguntas o comentarios, puede colocarlos a continuación.