cash flow statement example

Enregistrer, Remplir les champs vides, Imprimer, Terminer!

How to make a cash flow statement example in Excel? An easy way to create your personalized spreadsheet is by downloading this Excel sheet now!

Formats de fichiers gratuits disponibles:

.xlsx- Ce document a été certifié par un professionnel

- 100% personnalisable

Finance La finance cash en espèces flow couler Excel personal personnel Will Volonté Start Début Spreadsheet Tableur Excel spreadsheet Feuille de calcul Excel Excel template Excel modèle Excel templates for business best excel templates meilleurs modèles Excel project management excel templates modèles de gestion de projet excel xls xlsx template Excel spreadsheet modèle de feuille de calcul Excel

Whether you manage the finances at your work or at home, adequate communication is essential and important. Accurately keeping track of financial data is not only critical for running the day-to-day operations of your small or medium-sized business, but it is also important when seeking funds from investors or lenders to grow your business to the next level.

Using this cash flow statement example template guarantees that you will save time, cost and efforts and enables you to reach the next level of success in your project, education, work, and business. Download it now!

Looking for more? Our collection of financial documents, templates, forms, and spreadsheets includes templates designed specifically for small business owners, private individuals, or Finance Staff. Find financial projections to calculate your startup expenses, payroll costs, sales forecast, cash flow, income statement, balance sheet, break-even analysis, financial ratios, cost of goods sold, amortization and depreciation for your company. These financial templates also work with OpenOffice and Google Spreadsheets, so if you are operating your business on a very tight budget, hopefully, you'll be able to make these financial templates work for you as well.

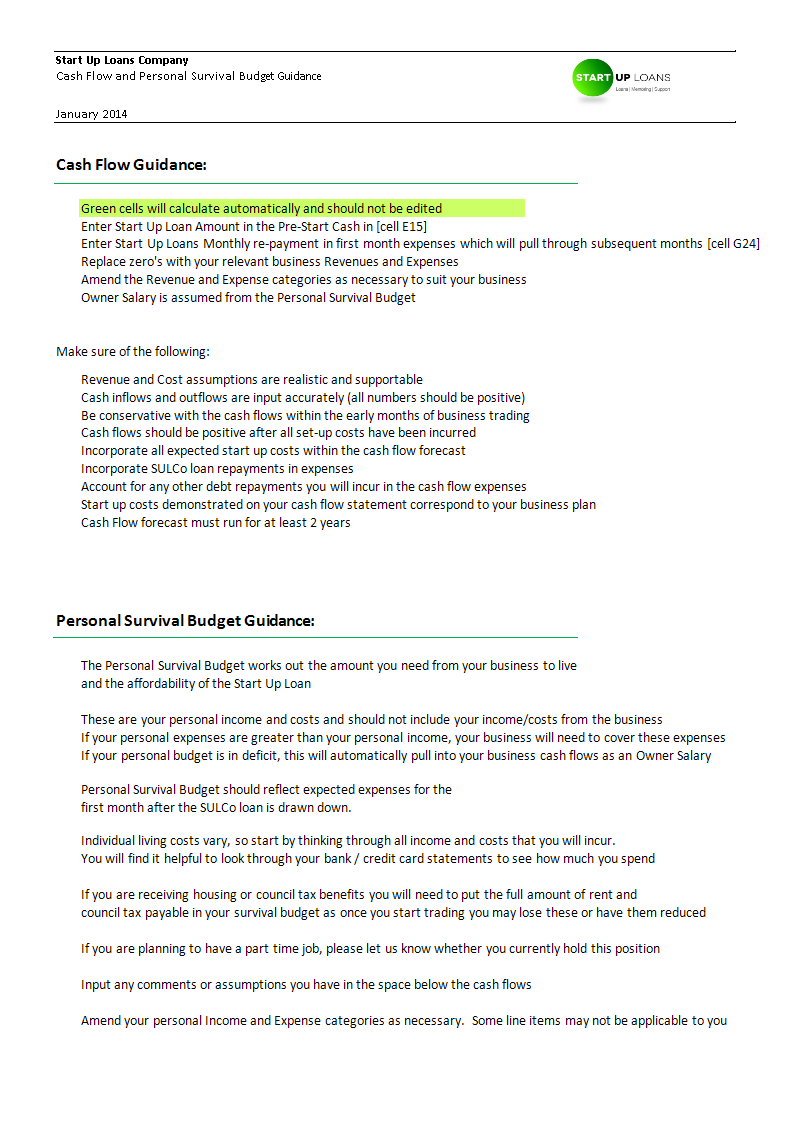

, ,Start Up Loans Company, ,Cash Flow and Personal Survival Budget Guidance, , ,January 2014, , , ,Cash Flow Guidance:, , , ,Green cells will calculate automatically and should not be edited ,Enter Start Up Loan Amount in the Pre-Start Cash in cell E15 ,Enter Start Up Loans Monthly re-payment in first month expenses which will pull through subsequent months cell G24 ,Replace zero s with your relevant business Revenues and Expenses ,Amend the Revenue and Expense categories as necessary to suit your business ,Owner Salary is assumed from the Personal Survival Budget , , ,Make sure of the following:, , ,Revenue and Cost assumptions are realistic and supportable ,Cash inflows and outflows are input accurately (all numbers should be positive) ,Be conservative with the cash flows within the early months of business trading ,Cash flows should be positive after all set-up costs have been incurred ,Incorporate all expected start up costs within the cash flow forecast ,Incorporate SULCo loan repayments in expenses ,Account for any other debt repayments you will incur in the cash flow expenses ,Start up costs demonstrated on your cash flow statement correspond to your business plan ,Cash Flow forecast must run for at least 2 years , , , , , ,Personal Survival Budget Guidance:, , , ,The Personal Survival Budget works out the amount you need from your business to live ,and the affordability of the Start Up Loan , ,These are your personal income and costs and should not include your income/costs from the business ,"If your personal expenses are greater than your personal income, your business will need to cover these expenses" ,"If your personal budget is in deficit, this will automatically pull into your business cash flows as an Owner Salary" , ,Personal Survival Budget should reflect expected expenses for the ,first month after the SULCo loan is drawn down..

AVERTISSEMENT

Rien sur ce site ne doit être considéré comme un avis juridique et aucune relation avocat-client n'est établie.

Si vous avez des questions ou des commentaires, n'hésitez pas à les poster ci-dessous.