Deed Of Trust Form

I-Save, punan ang mga blanko, i-printa, Tapos na!

How do you make a trust deed document? What are the steps involved? Our deed of trust form template is comprehensive and easy to use. Download this Deed Of Trust Form template now!

Ngayon: USD 3.99

I-download ngayon!

Mga magagamit na premium na format ng file:

.docx- Itong dokumento ay sertipikado ng isang Propesyonal

- 100% pwedeng i-customize

Finance Pananalapi Legal Ligal contract kontrata lease Real estate Tunay na ari arina property insurance expense loan 贷款 trust government pamahalaan law Private Law Common Law Social Institutions Justice Government Information Civil Law (Legal System) Batas Sibil (Sistema ng Legal) Conveyancing Grantor Noteholder Trustee Deed Of Trust (Real Estate) Foreclosure deed of trust

How do you make a trust deed document? What are the steps involved? Our deed of trust form template is comprehensive and easy to use. It's perfect for those looking for a reliable document to use when entering into a trust agreement. Download this Deed Of Trust Form template now!

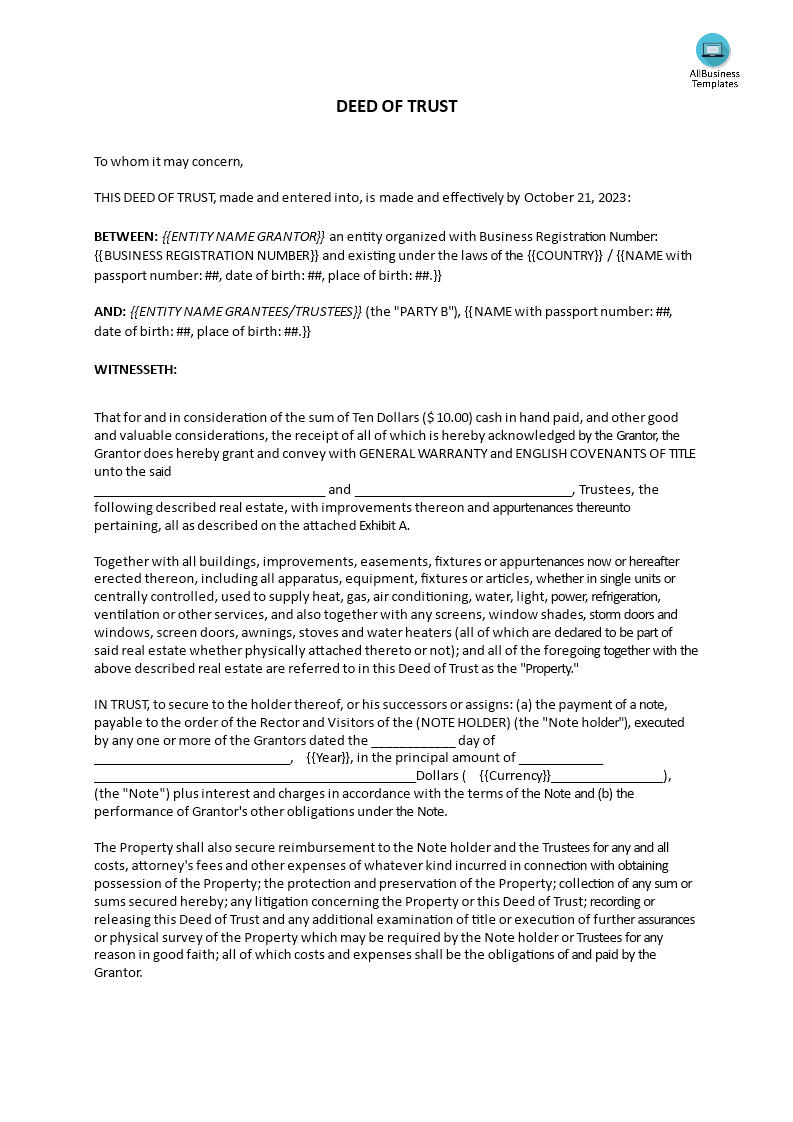

A deed of trust form, also known as a trust deed or a deed of trust and assignment of rents, is a legal document used in real estate transactions in some U.S. states. It is a critical component of the process when a borrower is obtaining a real estate loan or mortgage to purchase property. The deed of trust form serves as a security instrument, outlining the terms and conditions under which the lender (often a financial institution like a bank) can secure the loan with the property being purchased.

Here are the key elements and roles involved in a deed of trust:

- Parties Involved:

- Trustor: The borrower or property owner who is obtaining the loan and transferring the property's title into a trust.

- Beneficiary: The lender, typically a financial institution or lender who provides the loan funds to the trustor.

- Trustee: A neutral third party, often a title company or escrow agent, responsible for holding legal title to the property on behalf of the beneficiary and handling the foreclosure process if necessary.

- Property Description: The deed of trust specifies the property being used as collateral for the loan. This includes details like the property's legal description, address, and parcel number.

- Loan Terms and Amount: It outlines the terms and conditions of the loan, including the loan amount, interest rate, repayment schedule, and any other specific terms negotiated between the borrower and lender.

- Security Interest: The document establishes a security interest in the property, effectively granting the lender a lien on the property as collateral for the loan. This lien gives the lender the legal right to take possession of the property in case of loan default.

- Power of Sale Clause: Many deeds of trust include a "power of sale" clause, which gives the trustee the authority to sell the property through a non-judicial foreclosure process if the borrower defaults on the loan.

- Assignment of Rents: In some cases, the deed of trust may include an assignment of rents provision, allowing the lender to collect rental income from the property in the event of default.

- Covenants and Agreements: The document may contain covenants and agreements that the borrower must adhere to during the term of the loan, such as maintaining the property, paying property taxes, and keeping insurance coverage.

- Notary Acknowledgment: The deed of trust typically requires notarization to verify the authenticity of the signatures.

It's important to note that the specific content and requirements of a deed of trust form can vary from state to state in the United States, as different states have different real estate laws and regulations. Additionally, not all states use deeds of trust; some use mortgages instead.

Download this legal Deed Of Trust Form if you find yourself in this situation and save yourself time, and effort and possibly reduce the lawyer fees! Using our legal templates will help you to deal with the situation!

DISCLAIMER

Wala sa 'site' na ito ang dapat ituring na legal na payo at walang abogado-kliyenteng relasyon na itinatag.

Mag-iwan ng tugon. Kung mayroon kang anumang mga katanungan o mga komento, maaari mong ilagay ang mga ito sa ibaba.