Matching Gift Acknowledgement Letter

I-Save, punan ang mga blanko, i-printa, Tapos na!

How to write a Matching Gift Acknowledgement Letter? Download this Matching Gift Acknowledgement Letter template now!

Mga magagamit na premium na format ng file:

.pdf- Itong dokumento ay sertipikado ng isang Propesyonal

- 100% pwedeng i-customize

Business Negosyo company gift Organization Organisasyon letters Program Programa Gift Acknowledgement Letter

How to draft a Matching Gift Acknowledgement Letter? An easy way to start completing your document is to download this Matching Gift Acknowledgement Letter template now!

Every day brings new projects, emails, documents, and task lists, and often it is not that different from the work you have done before. Many of our day-to-day tasks are similar to something we have done before. Don't reinvent the wheel every time you start to work on something new!

Instead, we provide this standardized Matching Gift Acknowledgement Letter template with text and formatting as a starting point to help professionalize the way you are working. Our private, business and legal document templates are regularly screened by professionals. If time or quality is of the essence, this ready-made template can help you to save time and to focus on the topics that really matter!

Using this document template guarantees you will save time, cost and efforts! It comes in Microsoft Office format, is ready to be tailored to your personal needs. Completing your document has never been easier!

Download this Matching Gift Acknowledgement Letter template now for your own benefit!

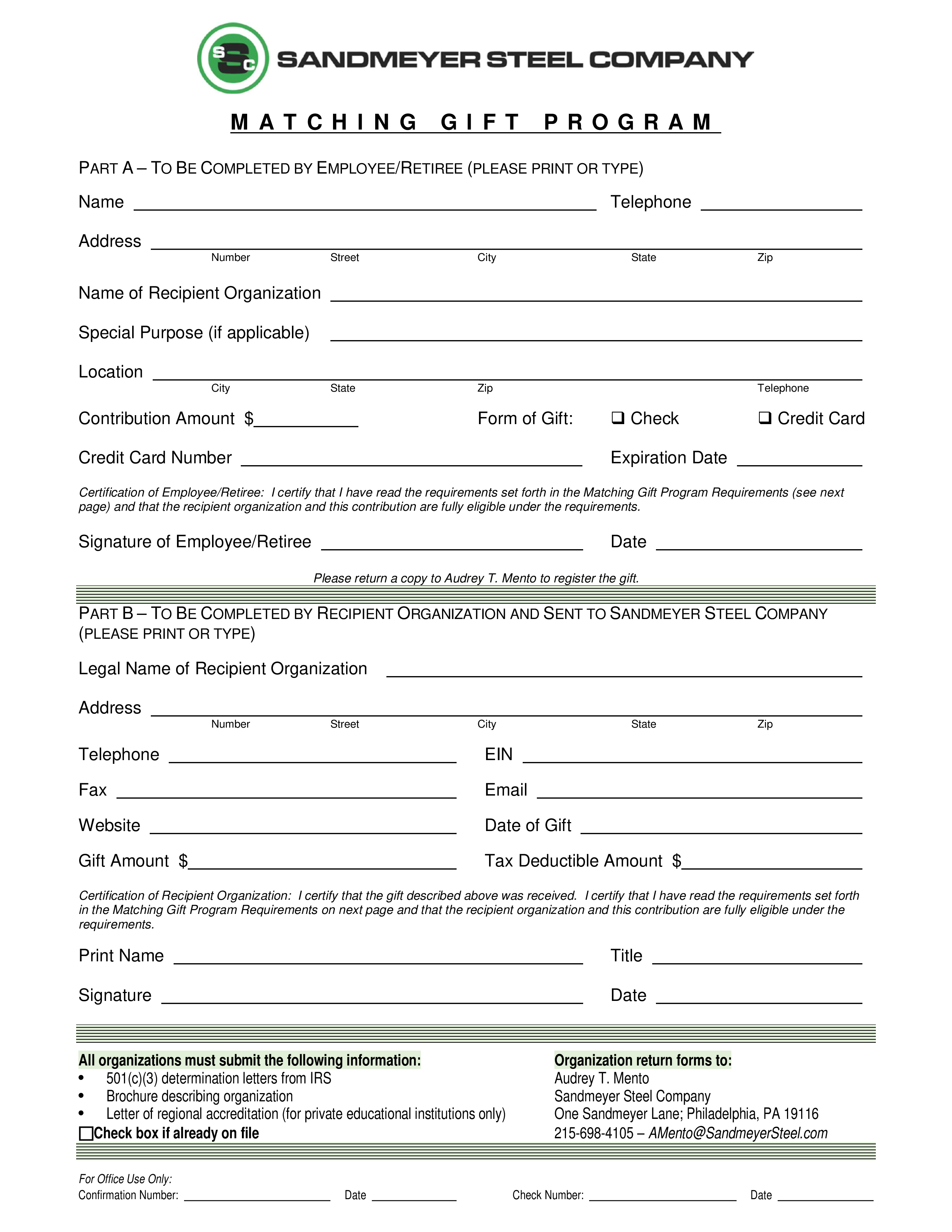

MATCHING GIFT PROGRAM PART A – TO BE COMPLETED BY EMPLOYEE/RETIREE (PLEASE PRINT OR TYPE) Name Telephone Address Number Street City State Zip State Zip Name of Recipient Organization Special Purpose (if applicable) Location City Contribution Amount Telephone Form of Gift: Credit Card Number Check Credit Card Expiration Date Certification of Employee/Retiree: I certify that I have read the requirements set forth in the Matching Gift Program Requirements (see next page) and that the recipient organization and this contribution are fully eligible under the requirements.. Ineligible Gifts • Charitable contributions made as part of a United Way campaign • Charitable contributions made via payroll deduction • Charitable contributions made as bequests or through entities such as charitable remainder or lead trusts or charitable gift annuities • Real estate or in-kind charitable contributions • Charitable contributions given for an event or program where all or part is required for participation (e.g., walk-a-thons, benefit dinners, golf tournaments, etc.) • Contributions to individuals or to charities that benefit a particular individual • Contributions that result in a material benefit or privilege for the Company, an employee or retiree, or his/her family (e.g., benefit dinners, memberships, auction items, event tickets, subscriptions, tuition payments or other student fees, preferential treatment, company sponsorship benefits, etc.)..

DISCLAIMER

Wala sa 'site' na ito ang dapat ituring na legal na payo at walang abogado-kliyenteng relasyon na itinatag.

Mag-iwan ng tugon. Kung mayroon kang anumang mga katanungan o mga komento, maaari mong ilagay ang mga ito sa ibaba.