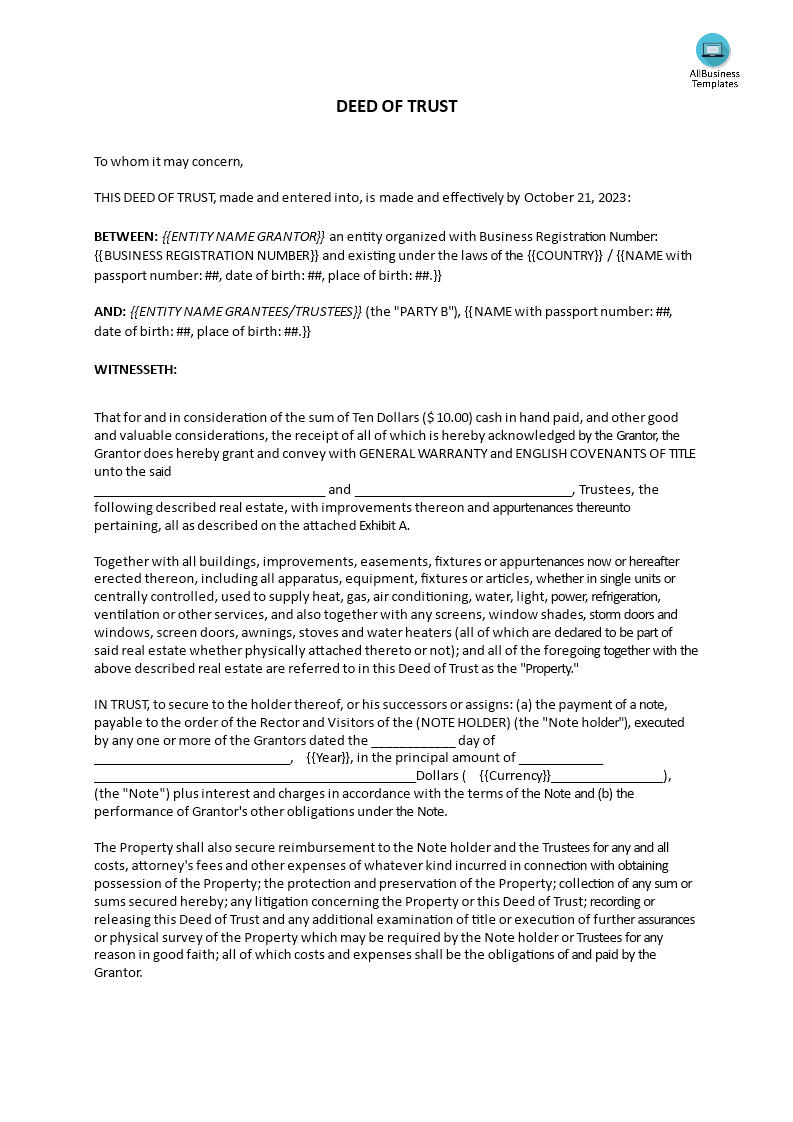

Deed Of Trust Form

Speichern, ausfüllen, drucken, fertig!

How do you make a trust deed document? What are the steps involved? Our deed of trust form template is comprehensive and easy to use. Download this Deed Of Trust Form template now!

Preis: USD 3.99

Jetzt downloaden!

Verfügbare Premium-Dateiformate:

.docx- Dieses Dokument wurde von einem Professional zertifiziert

- 100% anpassbar

Finance Finanzen Legal Gesetzlich contract Vertrag lease mieten Real estate Grundeigentum property Eigentum insurance Versicherung expense Kosten loan Darlehen trust Vertrauen government Regierung law Gesetz Private Law Privatrecht Common Law Gewohnheitsrecht Social Institutions Soziale Institution Justice Gerechtigkeit Government Information Regierungsinformationen Civil Law (Legal System) Zivilrecht (Rechtssystem) Conveyancing Beförderung Grantor Optionsverkäufer Noteholder Nicht Inhaber Trustee Treuhänder Deed Of Trust (Real Estate) Tat des Vertrauens (Immobilien) Foreclosure Abschottung deed of trust Tat des Vertrauens

How do you make a trust deed document? What are the steps involved? Our deed of trust form template is comprehensive and easy to use. It's perfect for those looking for a reliable document to use when entering into a trust agreement. Download this Deed Of Trust Form template now!

A deed of trust form, also known as a trust deed or a deed of trust and assignment of rents, is a legal document used in real estate transactions in some U.S. states. It is a critical component of the process when a borrower is obtaining a real estate loan or mortgage to purchase property. The deed of trust form serves as a security instrument, outlining the terms and conditions under which the lender (often a financial institution like a bank) can secure the loan with the property being purchased.

Here are the key elements and roles involved in a deed of trust:

- Parties Involved:

- Trustor: The borrower or property owner who is obtaining the loan and transferring the property's title into a trust.

- Beneficiary: The lender, typically a financial institution or lender who provides the loan funds to the trustor.

- Trustee: A neutral third party, often a title company or escrow agent, responsible for holding legal title to the property on behalf of the beneficiary and handling the foreclosure process if necessary.

- Property Description: The deed of trust specifies the property being used as collateral for the loan. This includes details like the property's legal description, address, and parcel number.

- Loan Terms and Amount: It outlines the terms and conditions of the loan, including the loan amount, interest rate, repayment schedule, and any other specific terms negotiated between the borrower and lender.

- Security Interest: The document establishes a security interest in the property, effectively granting the lender a lien on the property as collateral for the loan. This lien gives the lender the legal right to take possession of the property in case of loan default.

- Power of Sale Clause: Many deeds of trust include a "power of sale" clause, which gives the trustee the authority to sell the property through a non-judicial foreclosure process if the borrower defaults on the loan.

- Assignment of Rents: In some cases, the deed of trust may include an assignment of rents provision, allowing the lender to collect rental income from the property in the event of default.

- Covenants and Agreements: The document may contain covenants and agreements that the borrower must adhere to during the term of the loan, such as maintaining the property, paying property taxes, and keeping insurance coverage.

- Notary Acknowledgment: The deed of trust typically requires notarization to verify the authenticity of the signatures.

It's important to note that the specific content and requirements of a deed of trust form can vary from state to state in the United States, as different states have different real estate laws and regulations. Additionally, not all states use deeds of trust; some use mortgages instead.

Download this legal Deed Of Trust Form if you find yourself in this situation and save yourself time, and effort and possibly reduce the lawyer fees! Using our legal templates will help you to deal with the situation!

HAFTUNGSAUSSCHLUSS

Nichts auf dieser Website gilt als Rechtsberatung und kein Mandatsverhältnis wird hergestellt.

Wenn Sie Fragen oder Anmerkungen haben, können Sie sie gerne unten veröffentlichen.