Startup Acquisition Timeline

Speichern, ausfüllen, drucken, fertig!

What happens equity when startup gets acquired? How long does a startup acquisition take? Download this Startup Acquisition Timeline now!

Verfügbare Gratis-Dateiformate:

.pptx- Dieses Dokument wurde von einem Professional zertifiziert

- 100% anpassbar

Business Unternehmen Startup Neugründung Cac startup aquisition timeline startup acquisition price how long does a startup acquisition take my startup just got acquired early stage startup acquisitions startup exit statistics startup acquisition marketplace website aquisition timeline webshop aquisition timeline start up acquisition how long startup acquisition when a startup gets acquired what happens startup gets acquired startup just got acquired stage startup acquisitions startup exit startup acquisition what happens equity when startup gets acquired

What happens equity when startup gets acquired? How long does a startup acquisition take?

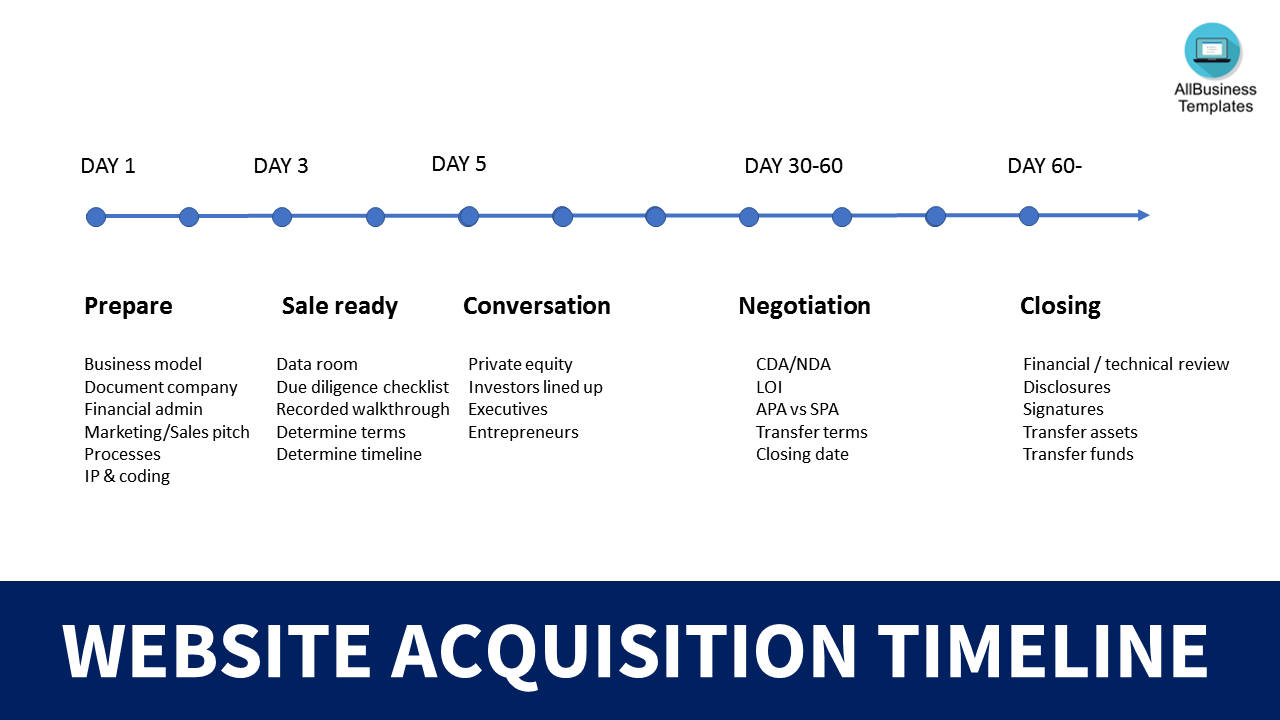

This ready-made and easy-to-customize startup or company acquisition timeline template is PowerPoint slide with all the common phases, such as:

- Preparation phase,

- Sale ready phase,

- Conversation phase,

- Negotiation phase,

- Closing phase.

How long does a startup acquisition take?

A common timeline is 3 to 6 months.

How to decide on a multiple for your startup?

Deciding on the multiple of your annual revenue or profit. Consider to take 3 to 6 times valuation of your gross profit. It's very important to explain how you come to the valuation and to study the market. If it's a growing market, and you grow faster than the competition, this will be a good position. The initial valuation is very important to show investors that you have good knowledge of the market. The more growth you have, the more chance you have to get a higher valuation (higher multiple). Make sure you show evidence of the growth of your startup and of the growth of the market. What is the Lifetime Value of Customer (LTV)?, what is Customer Acquisition Costs (CAC) for each customer? Explain possibilities to increase the growth and success of the company, in growth scenarios for the coming 5 years. Potential to pay in Also ask the investors what budget they work with.

It doesn't matter if you are selling or buying, in both situations it requires you to communicate in a professional way with the other party and by using a timeframe, you will see the closing will be done much faster and smoother. Using a Startup Acquisition plan, such as this PPT, you will get the other parties respect and it will bring you further in life and business. Using our ready to use Acquisition Checklist brings you inspiration, and gives you more time to focus on important subjects in the transfer of business or startup.

We support you by providing this checklist for Startup Acquisition Timeline which will save you time, cost and effort and help you to reach the next level of success in your career and business! It's very important that you are capable of explaining the investor what your company is worth and show the investor you understand the market.

Download this Startup Acquisition Timeline for buying a business template now and enhance your business!

Also, have a look at this Due Diligence Checklist.

HAFTUNGSAUSSCHLUSS

Nichts auf dieser Website gilt als Rechtsberatung und kein Mandatsverhältnis wird hergestellt.

Wenn Sie Fragen oder Anmerkungen haben, können Sie sie gerne unten veröffentlichen.