HTML Preview Home Loan Offer Letter page number 1.

Page 1 of 14

|

INGD DM393

|

11/15

ING DIRECT a division of ING Bank (Australia) Limited

|

ABN 24 000 893 292

|

AFSL and Australian Credit Licence 229823

Introducer code Home loan specialist name

Telephone number Fax number

Email Application date Estimated settlement date

/ / / /

(DD/MM/YY) (DD/MM/YY)

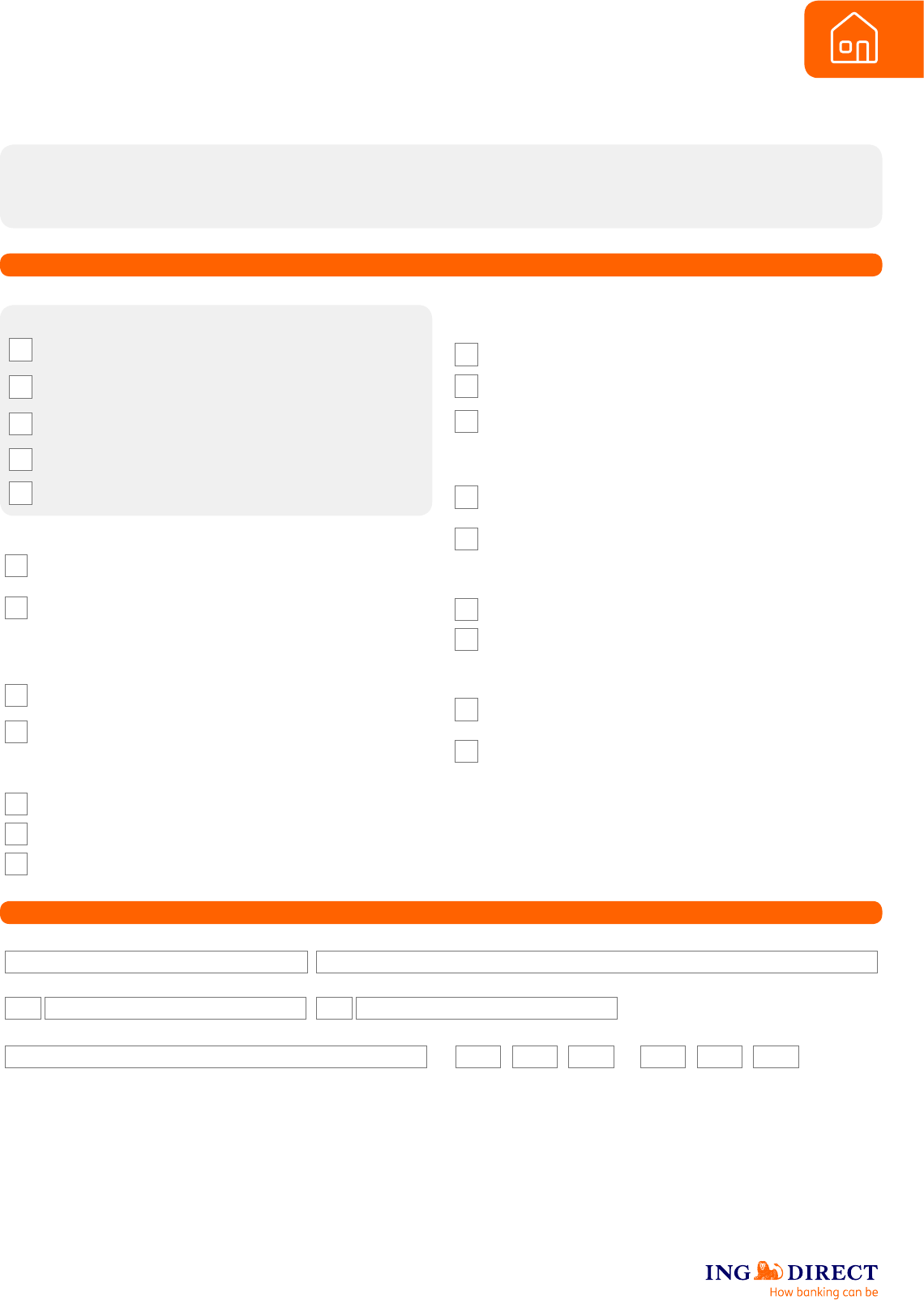

All applications

Verifying Your Identity Form (completed for each Applicant/

Guarantor/Director)

Any applicable up-front fee (e.g. valuation, fixed rate lock in).

Additional fees section is to be completed.

Rates Notice for all properties owned

Fixed Rate Lock-in form (if applicable)

Company and Trust Appendix (if applicable)

PAYG applications

Payslip less than 1 month old (if payslip does not contain ABN,

evidence of salary crediting must be provided), PLUS

Latest Group Certificate or Taxation Return for all applicants who

have

been in their current job for 12 months or more. (Last 2 years Group

Certificate or Tax Returns required if less than 12 months in current job)

Self-employed applications

Last two years’ worth of full business/company Taxation Returns and

financials, PLUS

Last two years’ worth of full personal Taxation Returns

Trusts

Trust Deed, PLUS

Last two years full Taxation Returns of the Trustee

Company and Trust Appendix

New purchase applications

Front page of the Contract of Sale/Contract Note (must show

purchase price, finance date and settlement date)

Evidence of funds to complete the purchase of the property

ING DIRECT Statutory Declaration stating that funds being gifted

are non-refundable including a statement confirming the funds are

available. If funds are to be repayed, details must be provided (if

applicable)

Last 3 months’ worth of bank statements confirming genuine

savings (loans involving Lenders Mortgage Insurance) (if applicable)

Completed application for First Home Owners Grant (if applicable).

Refer to our website for instructions applicable to each state

Refinance applications

Last 6 months’ worth of statements for loans being refinanced

Last month’s statement for credit/store cards being refinanced

Investment property applications

Letter/statement from Real Estate Agent confirming proposed/

existing rental income or lease agreement

Description of property e.g. warehouse, oce, factory, studio

apartment (if not residential house/unit)

Loan application

- Direct

Step 1: Checklist

Step 2: Home loan specialist details

Important note

• Complete additional application forms where dierent borrowers and/or guarantors with dierent security properties are required.

• Forms and calculators mentioned in this checklist can be located on our website.

• Printouts of online transaction histories are not acceptable unless accompanied with an original bank statement.

Please attach the following documents and information relating to your loan requirements and employment status.