HTML Preview Cash Payment Process Flow Chart page number 1.

TMI

|

ING Guide to Financial Supply Chain Optimisation

1

Section Three:

Purchase-to-Pay Processes

Gregory Cronie, Head Sales, Payments and Cash Management, ING

M

aking payments efficiently,

cost-effectively and securely is

pivotal to every well-managed

finance function. Many of the discus-

sions on payments in banks’ brochures

and media articles surround payments

processing, particularly straight-

through-processing, security and bank

connectivity. These issues are, of course,

very important in achieving a best-in-

class payments operation. However, in

addition to processing, managing

payments is also a strategic element of

working capital to ensure that the

company is able to take advantage of

early payment discounts offered by

suppliers where these are beneficial,

manage FX risk created by foreign

currency payment obligations and time

payments with cash inflows to avoid

liquidity issues. Furthermore, the cash

management organisation needs to be

structured to minimize the number of

cross-border payments to manage

payment costs.

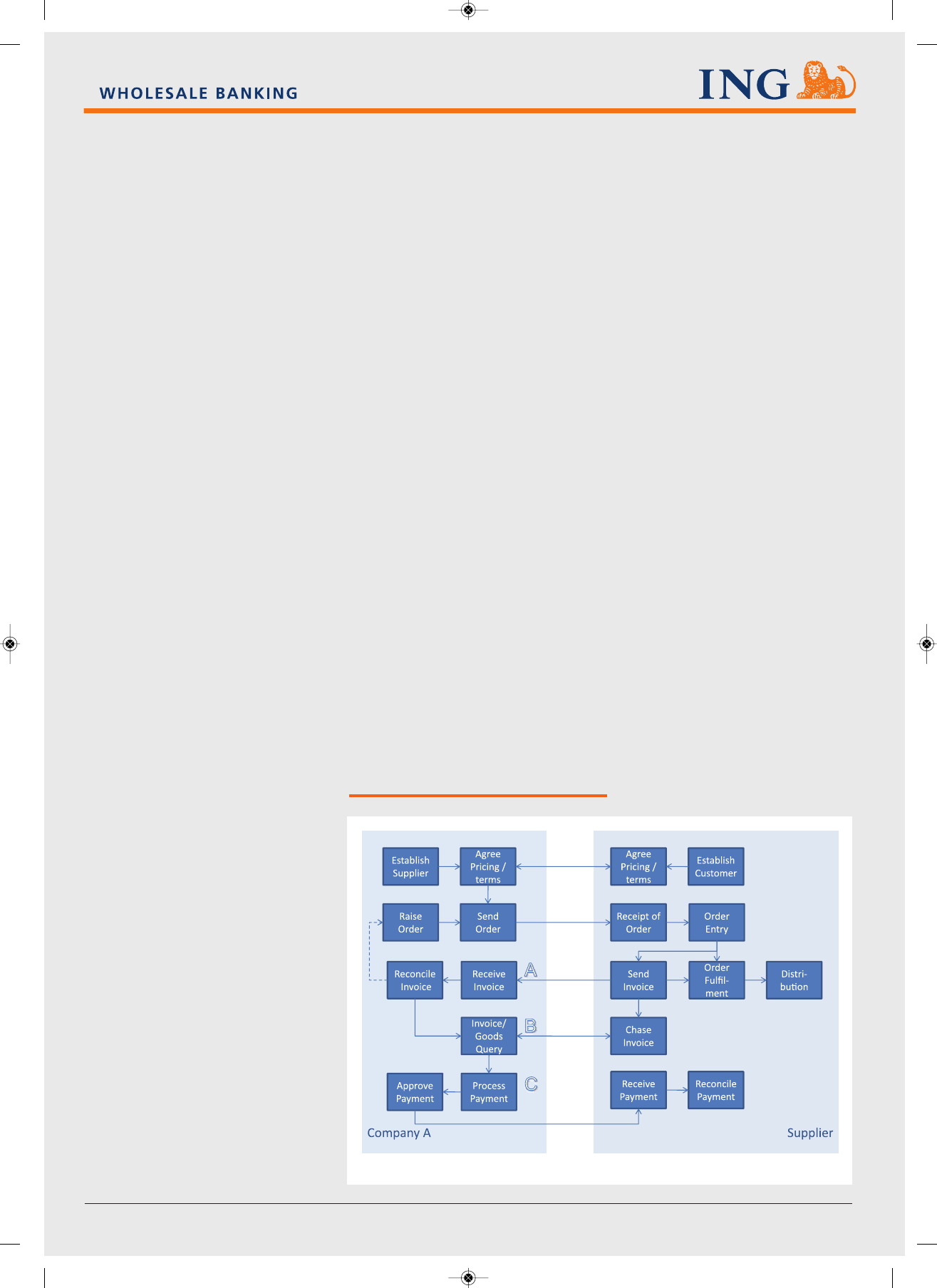

As fig 6 illustrates, this time with

Company A on the left and the supplier

on the right, the purchase-to-pay

process mirrors the order-to-cash

process, typically including the

following steps (and challenges):

A. Company A receives the invoice from

the supplier and needs to reconcile

these against the order details before

authorisation and payment. This is

time-consuming if the original

purchase order number is not shown

on the invoice.

B. The company may wish to query the

invoice and again, the better aligned

the information between itself and the

supplier, the quicker this is to resolve.

C. Once approved, which may need to be

done by one or more business

managers, the payment can be

processed. This can be an involved

process internally, particularly in the

case of multiple payment origination

systems, large numbers of “one off”

supplier payments when supplier bank

account instructions need to be set up

and approved, if there are frequent

changes to payments or if a variety of

Managing

payments is a strategic

element of working

capital to take

advantage of early

payment discounts,

manage FX risk created

by foreign currency

payment obligations

and time payments

with cash inflows to

avoid liquidity issues.

Fig 6: Purchase-to-pay processes

Source: Asymmetric Solutions Ltd

TMI170 ING info plat 3:Info plat.qxt 01/12/2008 09:46 Page 1