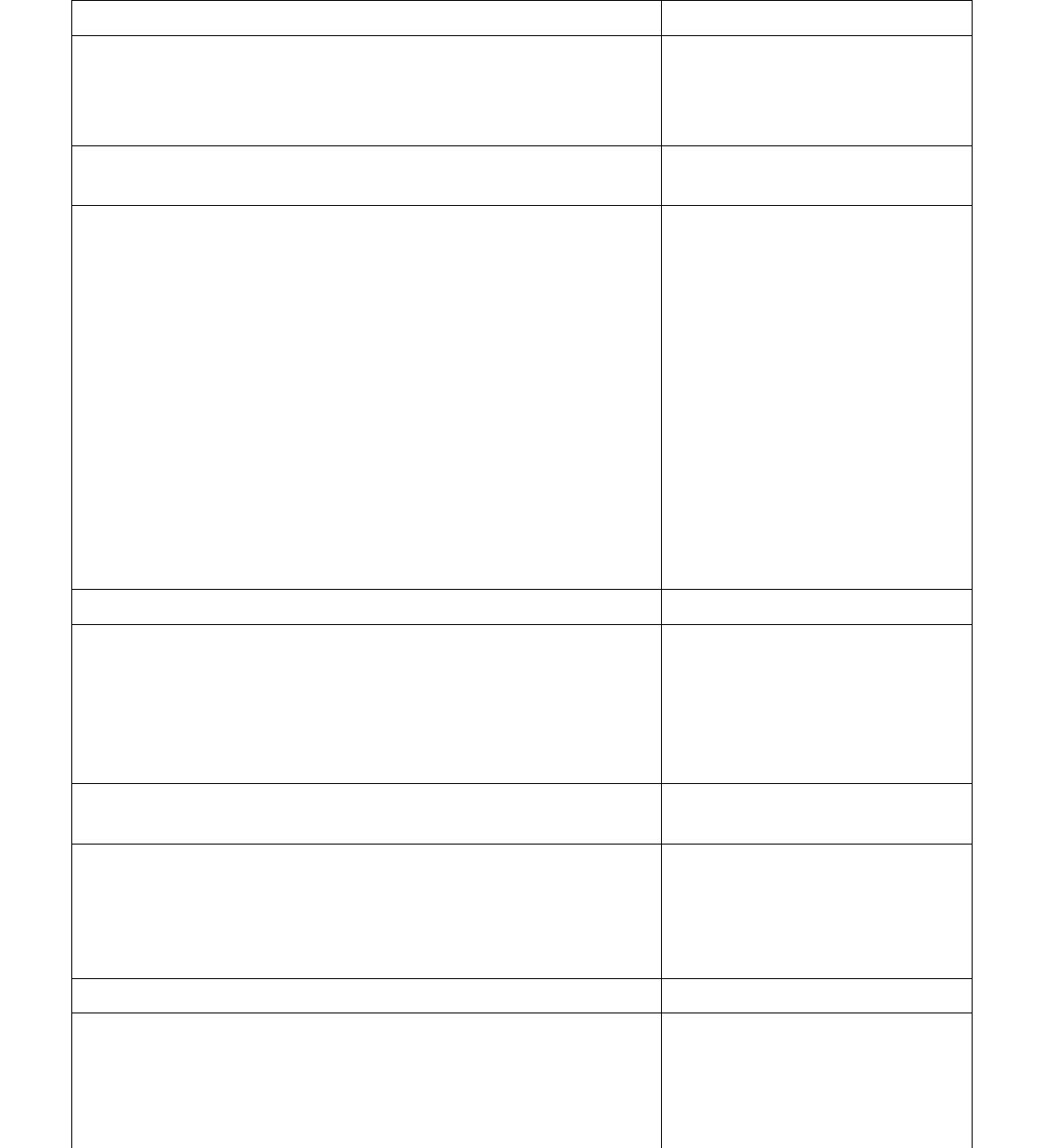

HTML Preview Fundraiser Donation page number 1.

Email Donation Receipts

Speech Cursor Actions

Sumac can generate encrypted, government compliant electronic

tax receipts that can be sent to donors. This can help reduce your

organizational costs as you do not need to print and mail as many

tax receipts.

Before you can email your receipts, your Sumac Administrator

needs to configure Sumac to send email.

Creating receipts works just like a mail merge, and requires the

use of a template. You can generate receipts using any kind of

document template – docx, rtf, or pdf – and send them as

electronic receipts. Some government regulations require that

electronic receipts be unchangeable, and these can only be created

with a pdf template.

You can use a variety of programs, like Adobe Acrobat tools or

Libre Office, to create a pdf template. There is a sample PDF

template available on the Sumac website, which you can

customize for your organization. I have downloaded the template

from the Sumac website, and will use it for these receipts.

Remember, when using a template, test it first to make sure that

everything works properly.

Show slide.

Once you have your template ready to go, generate your receipts. Show console.

In your Donations list, search for the donations you want to create

receipts for.

Click to expand Fundraising.

Click on Donations.

Choose “Receipt Status” from

Search Type drop-down menu.

Point to “Unreceipted.”

Click Search.

Expand Mailing, and click Make Receipts. Expand Mailing.

Click Make Receipts.

Choose which donations you want to create receipts for. For

example, you may want to exclude any annual donation receipts,

or donations that were created from a pledge, as it may not be the

appropriate time of year to make annual receipts, or you use a

different template for donations that relate to a pledge.

Click OK.

Choose the box for “not annual

receipts” and “not created from a

pledge.”

Click OK. Click OK.

Sumac asks you to enter the next donation receipt number. When

Sumac suggests the receipt number to use, it looks at all the

receipt numbers recorded in your database, and suggests the next

highest number to use for this batch of receipts. This helps ensure

that the receipt numbers in your database are sequential.

Point to suggested receipt number.