HTML Preview Company And Financial Status page number 1.

OMB Approved No. 2900-0165

Respondent Burden: 1 hour

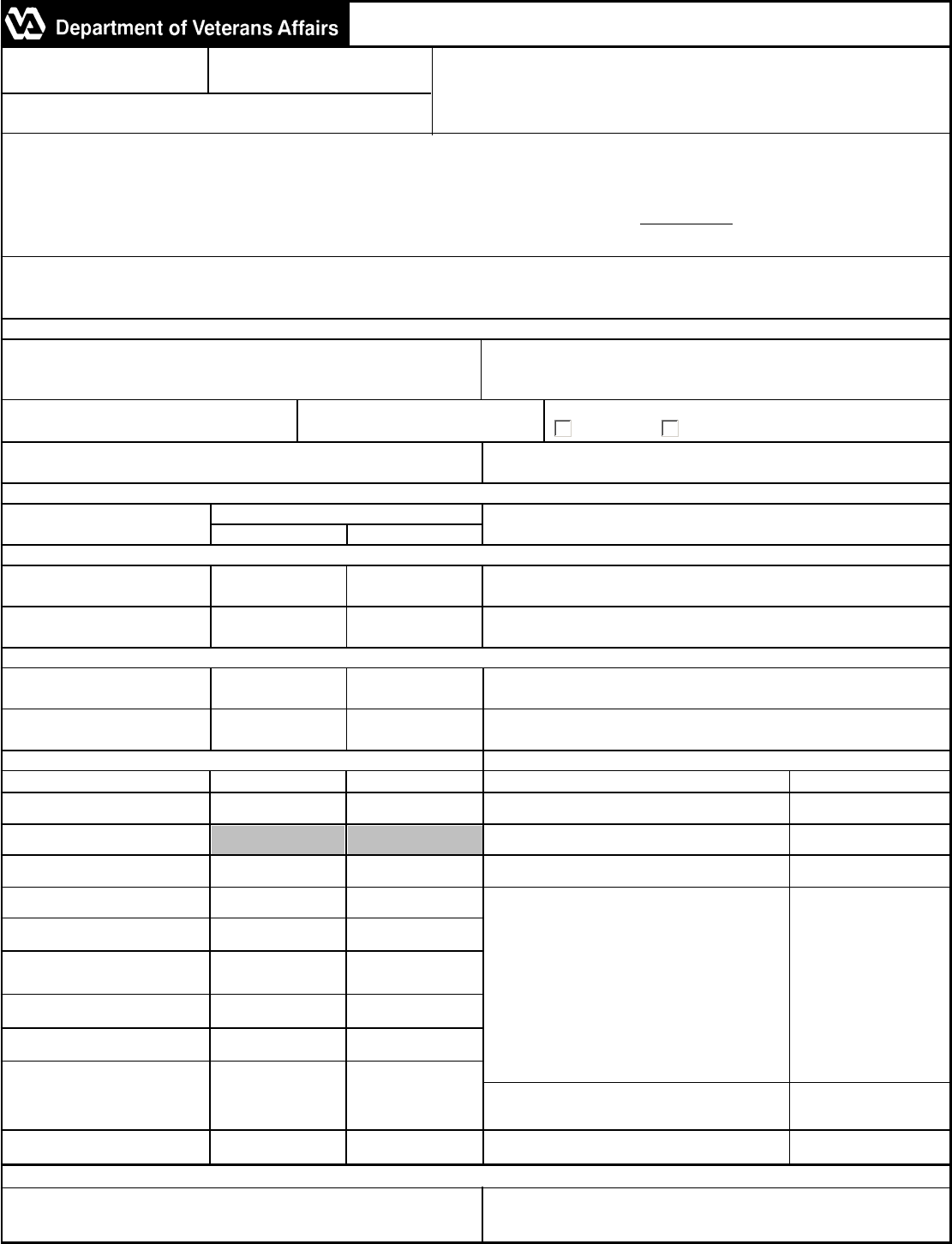

FINANCIAL STATUS REPORT

1. SOCIAL SECURITY NO. 2. FILE NO.

(Type or print all entries. If more space is needed for any item, continue

under Section VII, Additional Data, Item 36 or attach separate sheet)

3. SPECIFY WHY YOU ARE COMPLETING THIS FORM

(Waiver, Compromise, Payment Plan or Other)

PRIVACY ACT INFORMATION: The information you furnish on this form is almost always used to determine if you are eligible for waiver of a debt, for the

acceptance of a compromise offer or for a payment plan. Disclosure is voluntary. However, if the information is not furnished, your eligibility for waiver, compromise

or a payment plan may be affected. The responses you submit are confidential and protected from unauthorized disclosure by 38 U.S.C. 5701. The information may be

disclosed outside the Department of Veterans Affairs (VA) only when authorized by the Privacy Act of 1974, as amended. The routine uses for which VA may disclose

the information can be found in VA systems of records, including 58VA21/22, Compensation, Pension, Education and Rehabilitation Records-VA, and 88VA244,

Accounts Receivable Records-VA. VA systems of records and alterations to the systems are published in the Federal Register. Any information provided by you,

including your Social Security Number, may be used in computer matching programs conducted in connection with any proceeding for the collection of an amount owed

by virtue of your participation in any benefit program administered by VA.

RESPONDENT BURDEN: VA may not conduct or sponsor, and respondent is not required to respond to this collection of information unless it displays a valid OMB

Control Number. Public reporting burden for this collection of information is estimated to average 1 hour per response, including the time for reviewing instructions,

searching existing data sources, gathering and maintaining the data needed, and completing and reviewing the collection of information. If you have comments regarding

this burden estimate or any other aspect of this collection of information, call 1-800-827-0648 for mailing information on where to send your comments.

SECTION I - PERSONAL DATA

4. FIRST-MIDDLE-LAST NAME OF PERSON 5. ADDRESS (Number and street or rural route, City or P.O. Box, State, and ZIP Code)

6. TELEPHONE NO. (Include Area Code) 7. DATE OF BIRTH (MM-DD-YYYY)

8. MARITAL STATUS

MARRIED NOT MARRIED

9. NAME OF SPOUSE 10. AGE(S) OF OTHER DEPENDENTS

COMPLETE RECORD OF EMPLOYMENT FOR YOURSELF AND SPOUSE DURING PAST 2 YEARS

11. YOUR EMPLOYMENT EXPERIENCE

KIND OF JOB

DATES (MM-YYYY)

FROM TO

PRESENT TIME

NAME AND ADDRESS OF EMPLOYER

12. YOUR SPOUSE'S EMPLOYMENT

PRESENT TIME

SECTION II - INCOME

AVERAGE MONTHLY INCOME

13. MONTHLY GROSS SALARY

(Before payroll deductions)

SELF

$

SPOUSE

$

14. PAYROLL DEDUCTIONS

A. FEDERAL, STATE AND

LOCAL INCOME TAXES

B. RETIREMENT

C. SOCIAL SECURITY

D. OTHER (Specify)

E. TOTAL DEDUCTIONS

(Items 14A through 14D)

15. NET TAKE HOME PAY

(Subtract Item 14E from Item 13)

16. VA BENEFITS, SOCIAL

SECURITY, OR OTHER INCOME

(Specify source)

17. TOTAL MONTHLY NET

INCOME (Item 15 plus Item 16)

$ $

SECTION III - EXPENSES

AVERAGE MONTHLY EXPENSES

18. RENT OR MORTGAGE PAYMENT

$

AMOUNT

19. FOOD

20. UTILITIES AND HEAT

21. OTHER LIVING EXPENSES

22. MONTHLY PAYMENTS ON INSTALLMENT

CONTRACTS AND OTHER DEBTS (Include amount

from Section VI, Line 34I - Column E.)

23. TOTAL MONTHLY EXPENSES

$

SECTION IV - DISCRETIONARY INCOME

24A. NET MONTHLY INCOME LESS EXPENSES (Item 17 less Item 23)

$

24B. AMOUNT YOU CAN PAY ON A MONTHLY BASIS TOWARD YOUR DEBT

$

VA FORM

JUN 2009 (RS)

5655