HTML Preview Print Bank Statement page number 1.

2

CURRENT TOPIC

BANKS’ CASH FLOW STATEMENTS

BIATEC, Volume XII, 12/2004

Monitoring the cash flows of a business

entity is one of the modern methods of finan-

cial analysis. The method of monitoring cash

flows was established in the Fifties of the last

century in the USA. Gradually its use has

spread to a series of other advanced market

economies where a statement on changes in

the financial situation is compiled.

Business entities in Slovakia having the

duty to have their closing of accounts audi-

ted and to publish data on these are also

under the obligation to prepare a cash flow

statement. In fulfilling this obligation they are

governed by Measure of the Ministry of

Finance of the SR No 4455/2003-92 of 31

March 2003 as later amended, laying down

the details of the arrangement, designation

and content delimitation of items of an indi-

vidual closing of accounts and scope of data

from these individual closing of accounts

that need be published. The Measure stipu-

lates methods and the content of the cash

flow statement, though it fails to stipulate

neither the specific method nor the fixed

structure of cash flow statement. The choice

of a method for reporting cash flows and the

structure of individual fields of activity is

conditional upon the subjective approach of

the business entity compiling the statement.

As regards banks and branches of foreign

banks (hereinafter simply “banks”), issues of

the compilation of the closing of accounts

and the publication of information are gover-

ned by Measure of the Ministry of Finance

SR No 21832/2002-92. According to this

Measure however banks are not obliged to

compile, in the framework of an individual

closing of accounts, a cash flow statement.

Despite this some banks do so and include

a cash flow statement in the framework of

their individual closing of accounts and

annual reports. The statement shows chan-

ges in their assets and the financing sources

for a certain period.

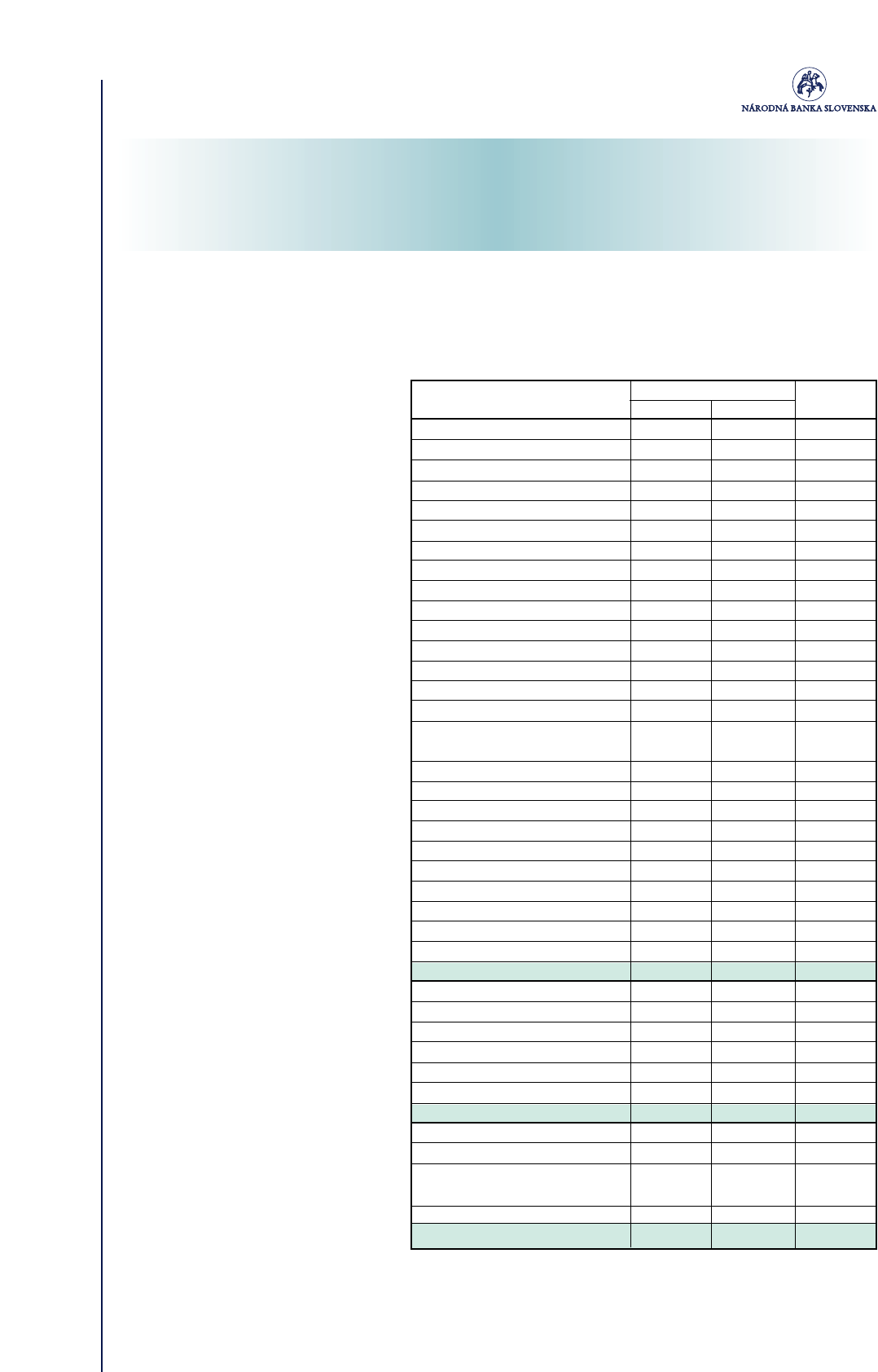

Table 1 presents the current solution of

the structure of the cash flow statement,

using an indirect method. It contains data of

the Slovak banking sector for the period

BANKS’ CASH FLOW STATEMENTS

RNDr. Jozef Pleška, CSc.

Balance as at

DifferenceActivity

31.12.2003 01.01.2003

Operating activity

Depreciation 31 790 635 29 275 106 2 515 529

Provisions 34 006 513 33 020 474 986 039

Economic result 34 577 036 22 167 087 12 409 949

Cash and cash equivalent 15 217 054 14 245 934 -971 120

Accounts of central banks/at central banks -12 662 312

Assets 132 434 809 123 963 796 -8 471 013

Liabilities 9 098 251 13 289 550 -4 191 299

Accounts of banks / at other banks 33 784 387

Assets 60 708 620 94 625 585 33 916 965

Liabilities 87 331 302 87 463 880 -132 578

Receivables and liabilities towards clients -37 287 267

Assets 383 516 754 332 757 070 -50 759 684

Liabilities 662 986 023 649 513 606 13 472 417

Securities issued by the accounting unit 18 728 117 8 333 109 10 395 008

Accounts of state bodies,

territorial authorities and funds 4 141 261

Assets 11 637 891 11 357 338 -280 553

Liabilities 42 105 364 37 683 550 4 421 814

Securities intended for sale 39 632 111 44 596 161 4 964 050

Securities intended for trading 97 249 962 69 097 537 -28 152 425

Accruals 1 012 332

Assets 1 128 573 2 352 820 1 224 247

Liabilities 4 070 210 4 282 125 -211 915

Other operating activity -1 016 916

Assets 15 347 513 9 997 768 -5 349 745

Liabilities 19 569 751 15 236 922 4 332 829

Cash flows from operating activity -9 881 485

Investment activity

Financial investment 221 854 255 213 372 617 -8 481 638

Tangible/Intangible assets 61 388 198 59 352 172 -2 036 026

Branches and representative offices 30 566 268

Assets 11 127 115 14 940 358 3 813 243

Liabilities 42 449 356 15 696 331 26 753 025

Cash flows from investment activity 20 048 604

Financial activity

Reserves 9 723 515 21 345 906 -11 622 391

Reserve funds and other funds

set aside from profit 9 733 181 9 189 653 543 528

Registered capital and capital funds 45 073 601 44 161 857 911 744

Cash flows from financial activity -10 167 119

Table 1 BANK’S CASH FLOW STATEMENT

Reporting bank: banks excl. NBS

Start of period 31.12.2003 End of period 01.01.2003

[in SKK thousands]