HTML Preview Payroll Deduction Instruction Form page number 1.

1

New York’s 529 College Savings Program Direct Plan

Payroll Deduction Instruction Form

NY529PDI

Complete this form to establish, change, or delete payroll deduction instructions on your existing accounts. You may also provide your

payroll deduction instructions by logging on to our Web site at www.nysaves.org.

After we process this form, you will receive a confirmation statement, which you must sign and submit to your employer’s payroll department.

Your payroll deduction instructions will not take effect until your employer has accepted your signed confirmation. You can receive this

confirmation immediately by accessing your account online.

Contributions made through payroll deductions are after-tax contributions.

Print clearly, preferably in capital letters and black ink.

Forms can be downloaded from our Web site at www.nysaves.org. Or you can call us toll-free to order any form—or get assistance in filling

out this one—at 1-877-NYSAVES (1-877-697-2837) on business days from 8 a.m. to 9 p.m., Eastern time. Return this form and any other required

documents in the enclosed postage-paid envelope, or mail to: New York’s 529 College Savings Program Direct Plan, P.O. Box 55441,

Boston, MA 02205-5441. For overnight delivery or registered mail, send to: New York’s 529 College Savings Program Direct Plan,

95 Wells Avenue, Suite 155, Newton, MA 02459-3204.

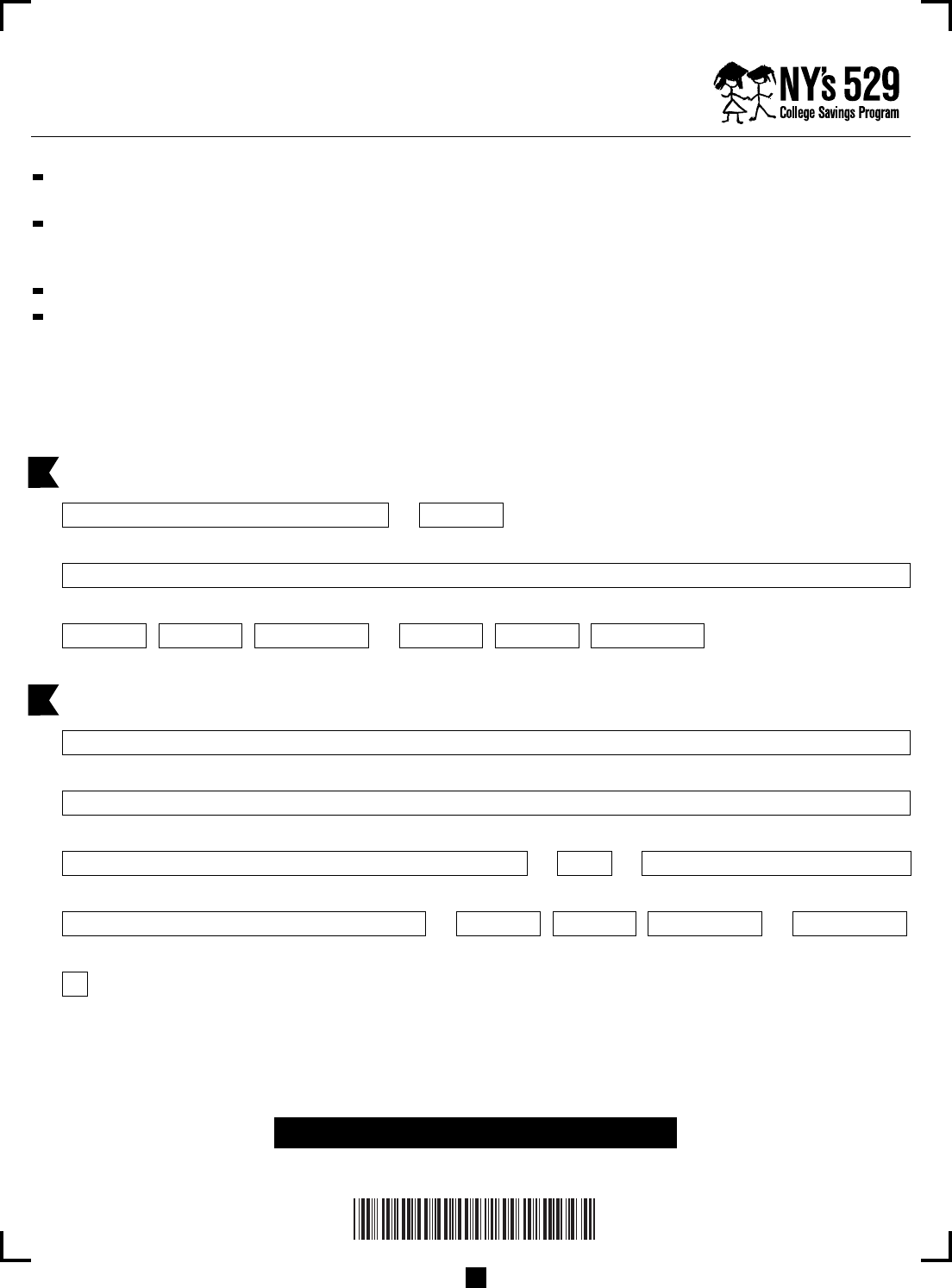

1. Account Owner Information

Account Number Last Four Digits of Social Security Number or Individual Taxpayer ID Number

Name of Account Owner (first, middle initial, last)

– – – –

Daytime Telephone Number Evening Telephone Number

2. Employer Information

Name of Employer

Mailing Address

City State Zip

– –

Payroll Department Contact Name Telephone Number Extension (if any)

Important: Check here if you are an employee of the State of New York.

00-66614-001

REMEMBER TO SIGN IN SECTION 4.

Clear All