HTML Preview Financial Research page number 1.

FF General Algo Report (V 0.92) 1

Fisic Financial Research Report

Random Walk, Moving average cross over and PSAR study on forex price action

Abstract:

A Mathlab study which looks at the profitability of four different methods to mark a trend

and identify turnaround points is outlined.

The four methods used are Random Walk, Moving Averages Crossover, Parabolic Stop and

Reverse, PSARAdd, Data for six different forex pairs -EURUSD, GBPUSD, AUSUSD,

EURJPY, GBPJPY, USDJPY-is examined and overall performance is reported for different

period/ranges (5 min, 15 min, and 30 min over one week, 60 min and 240 min over two

weeks, and 1 day over 1 and 10 years). The PSARAdd uses 4-hour periods over 1

year.Parametric studies for optimisation are also included.

The PSAR add method gives the most promising results.

Background

The success of any market forecasting algorithm (algo) depends on identifying trends (up,

down, or sideways), and then buying long in an up market, selling short in a down

market, and holding pat during a sideways or random market. The three market states

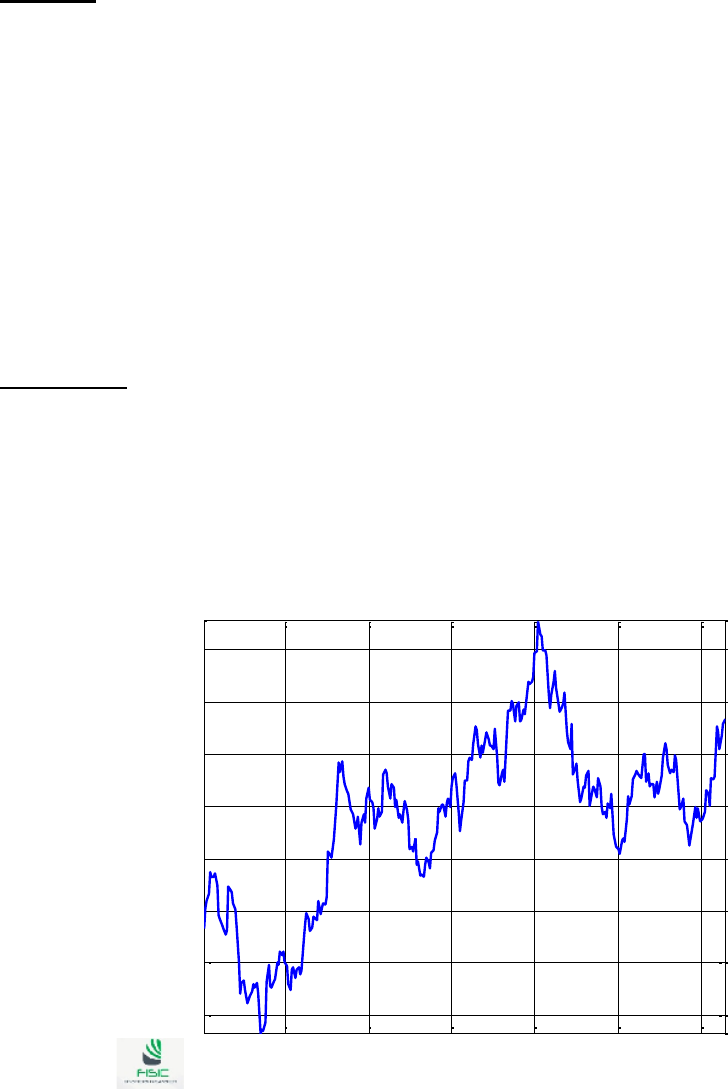

can be seen below for the euro US dollar (EURUSD) high, shown at one-day periods over a

range of one year (June 2012 – June 2013) (For source data, see Appendix C).

Figure 1 EURUSD High June 2012 – June 2013

Clearly, a long up trend existed from Day 40 to Day 200 (early July to mid November)

followed by a 50-day down trend to Day 250, which if successfully identified (entrance and

50 100 150 200 250 300

1.22

1.24

1.26

1.28

1.3

1.32

1.34

1.36

Input Data: EURUSD1DBID12.06.2012-12.06.2013

Period

High