HTML Preview Monthly Income And Expense Report page number 1.

saskatchewan.ca | Page 1 of 3 | 1214 Rev. 12/12

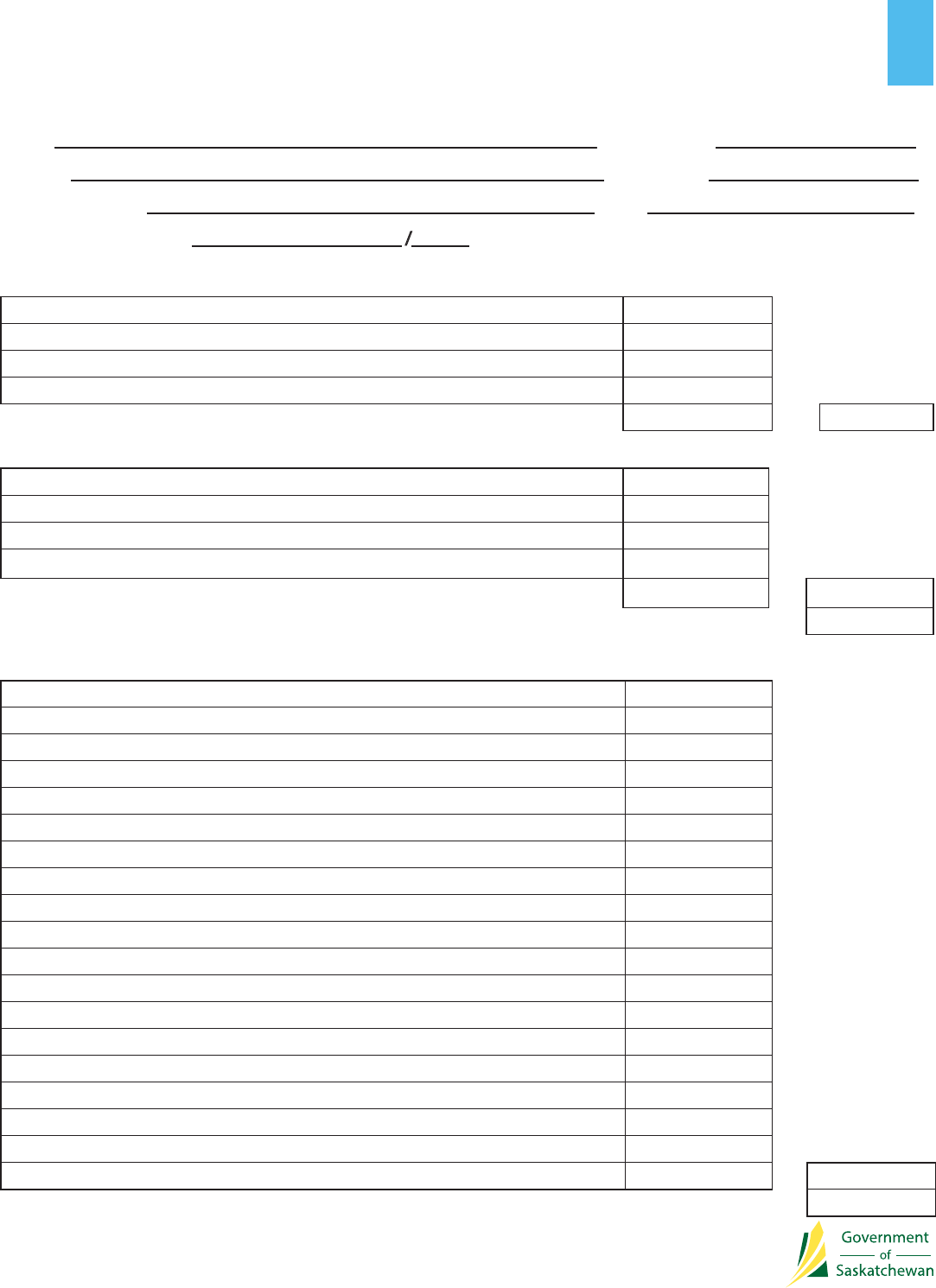

Monthly Business Income and Expense Report

Name: _________________________________________________________ Case Number: _____________________

Address:

________________________________________________________ Postal Code: ______________________

Name of business:

_______________________________________________ Type: ____________________________

Report for the month of

______________________ /______

Income

Sales, Gross Revenue

Less: Returns and Allowances

Less: Provincial Sales Tax (if included in sales)

Add: Other Income - specify (include cash draw)

Gross Income =

Cost of Goods Sold

Value of inventory at beginning of month

Add: Purchased (including delivery, express, freight)

Less: Value of inventory at end of month (total from page 2)

Less: Cost of items withdrawn for purposes such as demonstration

Cost of Goods Sold (

deduct from Gross Income) =

Gross Prot (Gross Income less Cost of Goods Sold)

Business Expenses - Please submit receipts

Accounting, Legal, Collection, Consulting

Business vehicle (maintain any leasing/rental agreement in force at time of application)

Mortgage interest or business holdings in existence at time of application

Delivery, express, freight

Oce expenses (postage, stationery, etc.)

Rental on business property

Minor equipment costs/rental for essential business operations

Fuel/maintenance/repairs for business vehicles

Wages

Contributions to employees (C.P.P., E.I., Workers’ Compensation)

Business property tax

Licenses

Insurance

Utilities

Advertising (Newspaper, Business pages, telephone directories, etc.)

Mileage, Meals, and Accommodation for business trips

Goods and Services Tax

Other - specify

Total Expenses =

Net Income (Gross Income less Total Expenses)

(If above is zero or

less, go to page 2)