HTML Preview Business Equipment page number 1.

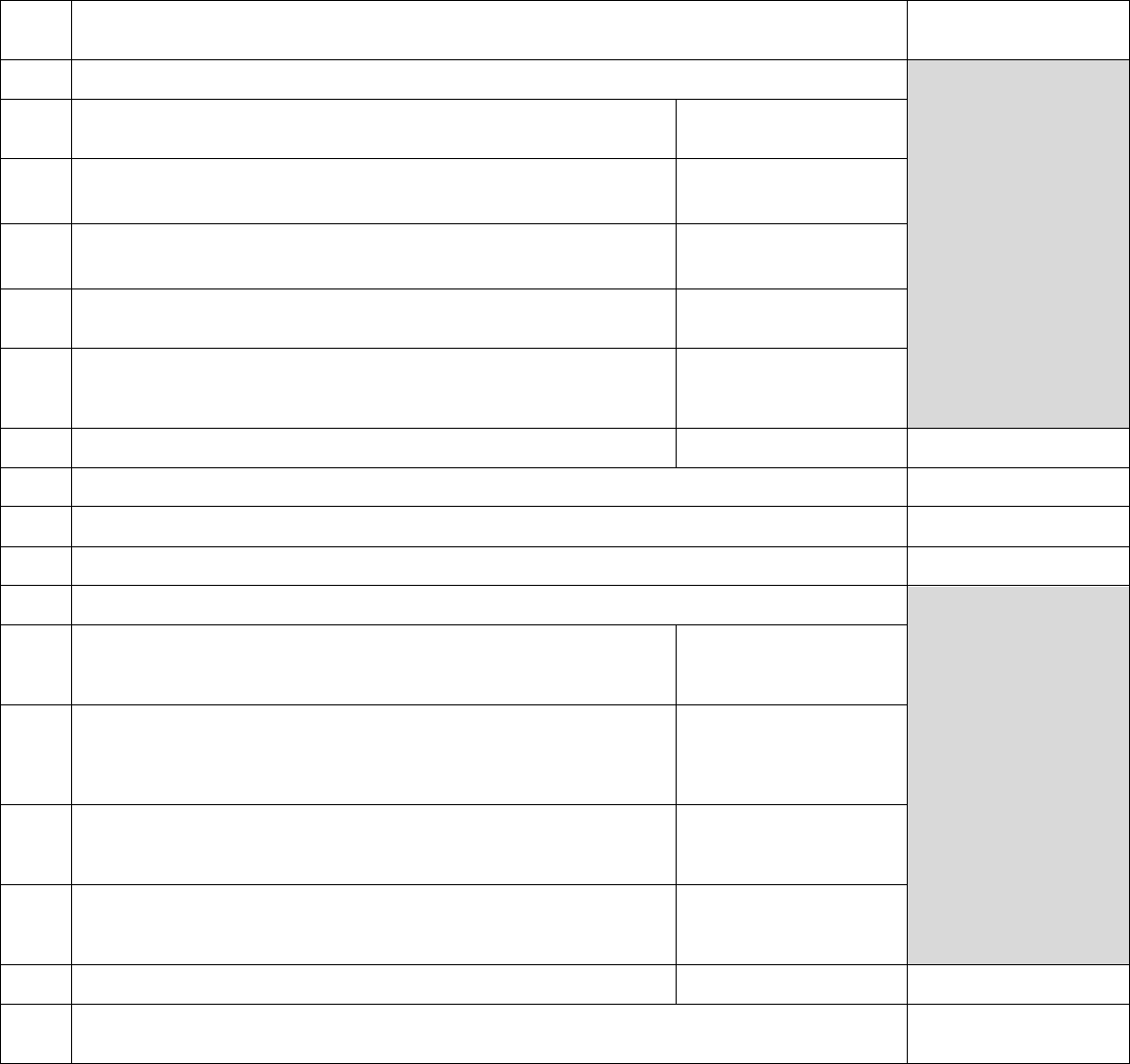

VEHICLE, MOTORBOAT AND FARM EQUIPMENT DEALER’S INVENTORY WORKSHEET

Dealer’s Name: ____________________________________

Address: ____________________________________

____________________________________

County: ____________________________________

I.

Gross Sales: Total Annual Vehicle, Motorboat and Farm Equipment Gross Sales for Calendar Year Beginning

January 1, 2015 and Ending December 31, 2015. (Enter gross sales. Do not enter the value of the property.)

$

II.

Less Excluded Sales of Specified Vehicles, Motorboats and Farm Equipment

A. Fleet Sales (Enter gross sales 1-1-15 to 12-31-15. Do not enter the

value of the property.)

$

B. Trucks Over 16,000 lbs. GVW (Enter gross sales 1-1-15 to 12-31-15.

Do not enter the value of the property.)

$

C. Transactions Between Dealers (Enter gross sales 1-1-15 to 12-31-15.

Do not enter the value of the property.)

$

D. Drop Shipments (Enter gross sales 1-1-15 to 12-31-15. Do not enter

the value of the property.)

$

E. Other Vehicles and Equipment Not Subject To Valuation Under West

Virginia Code § 11-6C-1 et seq. (Enter gross sales 1-1-15 to 12-31-15.

Do not enter the value of the property.) (See instructions.)

$

III.

Sub Total Excluded Vehicles and Equipment (A Through E)

Less (-)

$

IV.

Annual Dealer’s Inventory Subject To Valuation Under § 11-6C-1 et seq. (I Less III)

$

V.

Divided by 12 or the Number of Months You Were in Business During Calendar Year 2015

VI.

Sub Total Dealer Inventory (Line IV divided by 12 or months in business)

$

VII.

Add Other Inventory Subject to Valuation

A. Heavy Duty Trucks Over 16,000 lbs. GVW in Dealer’s Possession as

of July 1, 2016. (Enter the value of property in your possession on

July 1, 2016, not sales.)

$

B. Other Vehicles and Equipment in the Dealer’s Possession as of July 1,

2016 Not Subject To Valuation Under West Virginia Code § 11-6C-1

et seq. (Enter the value of property in your possession on July 1, 2016,

not sales.) (See instructions.)

$

C. Dealer’s Inventory of Parts and Supplies Held for Resale as of July 1,

2016. (Enter the value of property in your possession on July 1, 2016,

not sales.)

$

D. Dealer’s Inventory of Parts and Supplies Held for Owner’s Use as of

July 1, 2016. (Enter the value of property in your possession on July 1,

2016, not sales.)

$

VIII.

Sub Total Other Inventory (A Through D)

$

IX.

Total Dealer’s Inventory (Vehicle, Motorboat and Farm Equipment Inventory Plus Other Inventory – VI and

VIII)

$

Note: A copy of the dealer’s income statement for the year ending December 31, 2015 must be attached with the worksheet. Sole proprietors who do not

have an income statement must submit a Schedule C – Profit and Loss Statement from your Federal Income Tax Return for 2015. Failure to attach

the income statement may be grounds upon which the assessor may reject this return.

Revised 3/2016