HTML Preview Personal Installment Loan Agreement page number 1.

Lender :

Alpha Omega Consulting Group, Inc.

716 Vauxhall Drive

Nashville, TN 37221

(615) 662-9537

Borrower:

1015 EAST BOBBY COURT

MILLERSVILLE, TN 37072-

Home Phone: (615) 855-1999

Work Phone: 615-662-9537

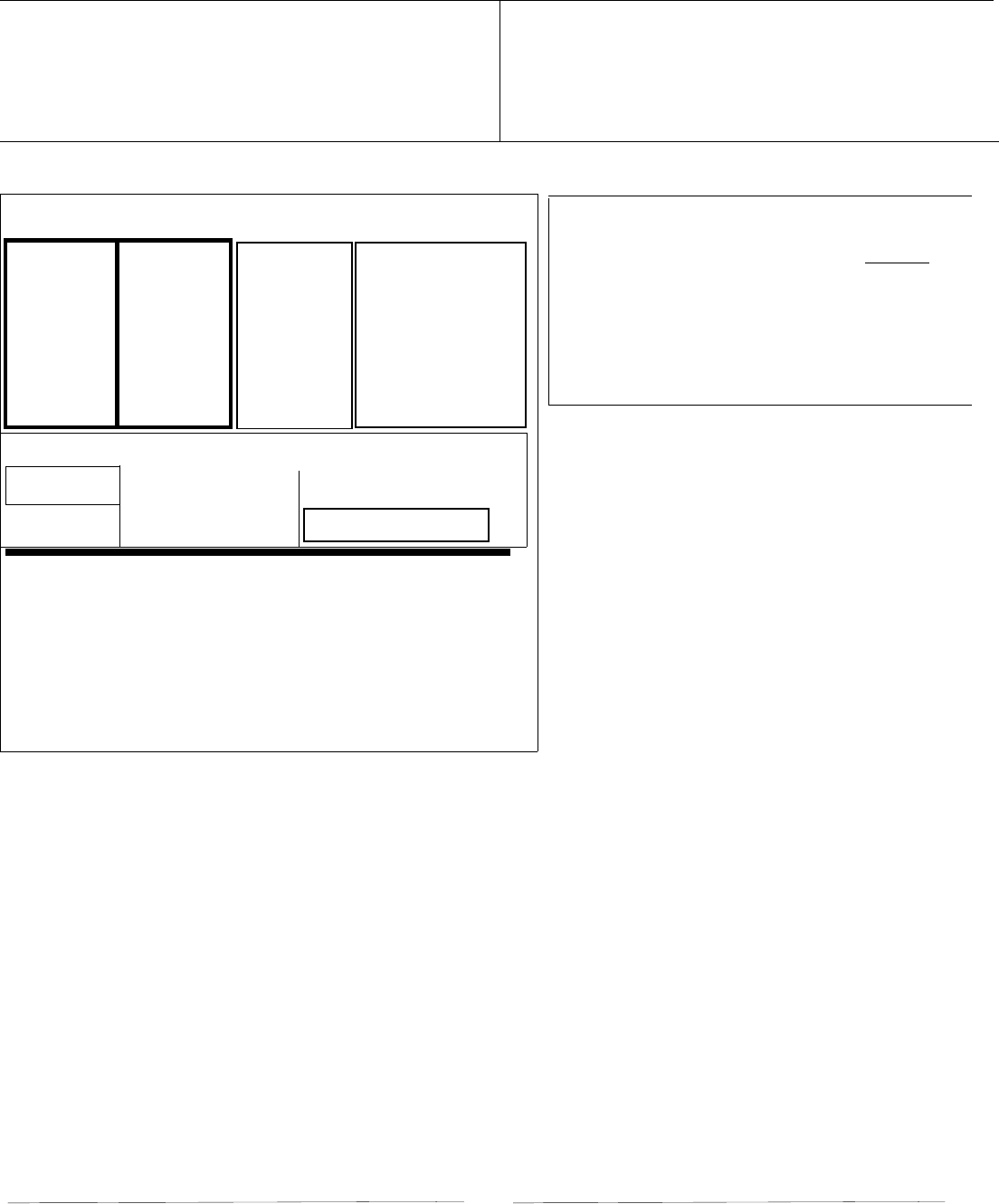

DISCLOSURES REQUIRED UNDER THE FEDERAL TRUTH-IN-LENDING ACT

ANNUAL

PERCENTAGE

RATE

FINANCE

CHARGE

AMOUNT

FINANCED

TOTAL OF PAYMENTS

The cost of

your credit

as a yearly

rate

The dollar

amount the

credit will cost

you

The amount of

credit provided

to you or on

your behalf.

The amount you will

have paid after you have

made all payments as

scheduled

Loan Date:

11/14/2005

Contract Number:

TL13R

INSTALLMENT LOAN AGREEMENT

ITEMIZATION OF AMOUNT FINANCED

Borrower's Signature

Address:

Name :

Address:

Your Payment Schedule Will Be

Security:

Prepayment:

If you pay off early you will not have to pay a penalty. See the

terms of this contract for additional information about

prepayment, nonpayment, default, and prepayment penalites.

12/14/2005

When Payments Are Due:

(PAYMENT DUE DATE)

Number of

Payments:

Amount given to you directly. $1,000.00

METHOD OF PAYMENT AND SECURITY INTEREST: Today you gave us one or more personal checks ("check") for the payments show in the Payment Schedule of

the disclosure Statement and dated as of the final Payment Due Date. You request and we agree to wait to present the Check(s) to your financial institution until the final

Payment Due Date, except that you agree we do not need to wait and that we may immediately present the check to your financial institution if you do not make any

other payments on or before their applicable Payment Due Date. You agree that we may process your check electronically (make an electronic withdrawl from your

checking account) on or after the final Payment Due Date, if you do not process your check electronically (make an electronic withdrawl from your checking account) on

or before their applicable Payment Due Date. If you do make an alternative payment of the full amount owing, we will accept it in substitution of the uncashed Check(s)

and return the uncashed check to you. Your post-dated check(s) and Wave Assignment are security for this loan. You do not grant us any security interest in, and we

waive any rights wihc may arise in, the deposit account upon which the Check(s) is/are drawn.

Ammount paid on account.

N/A

This Consumer Loan Agreement (the "Agreement") states the terms of your loan with us. By singing, you agree to all the terms in this Agreement. In this

agreement, the words, "you" and "your" mean the borrow shown above. The words, "we", "us", and "our" mean the Lender shown above.

Illinois

Amount of Payments

Your post dated check(s) number 32132132132132112 is

security for this loan. Your wage assignment is also security for

this loan.

Late Charges

If you fail to make all or any part of a scheduled payment more

than ten days after its due date, you may be charged a late

charge of 10$ or 5% of the unpaid amount of the Total

Payments, whichever is greater.

YOUR PROMISE TO REPAY: To repay the loan we have made to you, you promise to pay Alpha Omega Consulting Group, Inc.("Lender") the amount financed shown

in the Federal Truth in Lending Disclosure Statement ("Disclosure Statement") plus interest on the unpaid amount financed. We will begin charging interest on the date

of this Agreement shown above. We will calculate the interst on a daily basis using the annual Percentage Rate by multiplaying the daily rate times the unpaid balance

of the Amount Financed each day. We figure the daily rate by dividing the Annual Percentage Rate by 365 (or 366, in any leap year). You agree to repay the loan on the

payment due date(s) shown in the Disclosure Statement ("Payment Due Dates"). If you have not repaid the loan after the Payment Due Date, you agree to pay interest,

as provided by applicable law at the annual Percentage Rate shown in the disclosure Statement. Any payments you make will be applied first to any accrued interest,

then to the principal, then to any other charges you owe us. You promise to pay us at the address shown above or at any other address we tell you in writing.

RETURNED CHECK FEE/COST OF COLLECTION: I agree to pay a service charge of $25.00 for any returned check. If I fail to reimburse the creditor for the bad

check, I understand I shall be held liable for all reasonable costs of collection as awarded by the court, including attorney fees which shall not exceed the amount of the

loan

ELECTRONIC FUNDS TRANSFER: Customer hereby agrees that the Company may choose to electronically debit their bank account for any and all monies due and

owing to Company in lieu of present the Customer's check insturment for payment.

NOTICE: See additional terms on page two of this Agreement for the more important information. This Agreement also contains an Arbitration Agreement.

THE ARBITRATION PROVISION LIMITS CERTAIN RIGHTS, INCLUDING YOUR RIGHT TO PURSUE A CLAIM IN COURT AND YOUR RIGHT TO A JURY TRIAL

AND YOUR RIGHT TO PURSUE A CLAIM AS A CLASS ACTION.

Lender's Signature

11/14/2005

11/14/2005

Date

Date

RON W JONES SSN:545-45-4544

24.00%

$20.00

$1,000.00

$1,020.001

$1,020.00

By signing below, you state that you have received a completed copy of this form. By signing, you also state that you have read, understand, and agreed to all terms of

this entire Agreement, including additional pages. You agree that each page and its terms constitute the Agreement.