HTML Preview Employer Status Report Form page number 1.

THIS REPORT IS REQUIRED OF EVERY EMPLOYING UNIT AND WILL BE USED TO DETERMINE LIABILITY UNDER

THE NORTH CAROLINA EMPLOYMENT SECURITY LAW, GENERAL STATUTE 96 AND DIVISION REGULATIONS.

NCUI 604 (Rev 01/2012) OVER PLEASE

Employer Status Report

Please Read Instructions!

NC Dept. of Commerce

Division of Employment Security

Post Office Box 26504

Raleigh, N.C. 27611-6504

Please Type or Print in Black Ink

or File Online www.ncesc.com

Return Within 10 Days

1.

Federal ID number:__________________

2. N.C. Dept. of Revenue withholding ID number:

3.

Enter any previously assigned North Carolina unemployment tax numbers:

4.

Employer name:

Enter exact name of legal entity – for further details see instructions)

5.

Trade name:

6.

Mailing address:

Street or P.O. Box

City

State

Zip Code

7.

Phone number: (_______)_____________________________

8. FAX number: (_______)

9.

Contact person: ________________________________________________

Title

Phone number: ( ______ )________________________ E-mail Address:

10.

N.C. business location:

Street (Do not use a post office box)

Number of Employees expected

in the next 12 months:

N.C.

City

Zip Code

County

(Attach a list of ALL NC locations, if there is no NC business location, enter the primary employee’s home address)

11.

Check type of ownership:

Individual

Sub-Chapter S Corporation

LLC taxed as Individual

General Partnership

Corporation

501(c)(3) - Attach a copy

Governmental

LLC taxed as Partnership

LLC taxed as Corporation

Limited Partnership - Attach a list of ALL General

Partners

Indian Tribal Governments/Enterprises

Disregarded Entity

Other:

12.

Enter the principal activity or services performed in your North Carolina operation:

13.

If you are part of a larger organization and are primarily engaged in providing support services to that organization,

check one of the following:

Control, Administrative (Headquarters, etc.)

Storage/Warehouse

Research, Development or Testing

Other

14.

Enter date you first employed one or more workers in North Carolina: _________/________/___________

MM DD YYYY

For Items 15 through 20, check only the ONE item that applies

15.

GENERAL EMPLOYERS:

a. Have you or will you have a quarterly payroll of $1,500 or more? Yes No

_____/_______/_______

If yes, enter the date this occurred or will occur. MM DD YYYY

b. Have you or will you employ at least one worker in 20 different calendar weeks during a

calendar year?

If yes, enter the date this first occurred or will occur. Yes No _____/_______/______

_____/_______/_______

MM DD YYYY

16.

Are you an EMPLOYEE LEASING company? Yes No

17.

AGRICULTURAL EMPLOYERS:

a. Have you or will you have a quarterly payroll of $20,000 or more?

If yes, enter the date this occurred or will occur Yes No _____/_______/_______

MM DD YYYY

b. Have you or will you employ at least 10 workers in 20 different calendar weeks during a

calendar year?

If yes, enter the date this first occurred or will occur. Yes No _____/_______/_______

MM DD YYYY

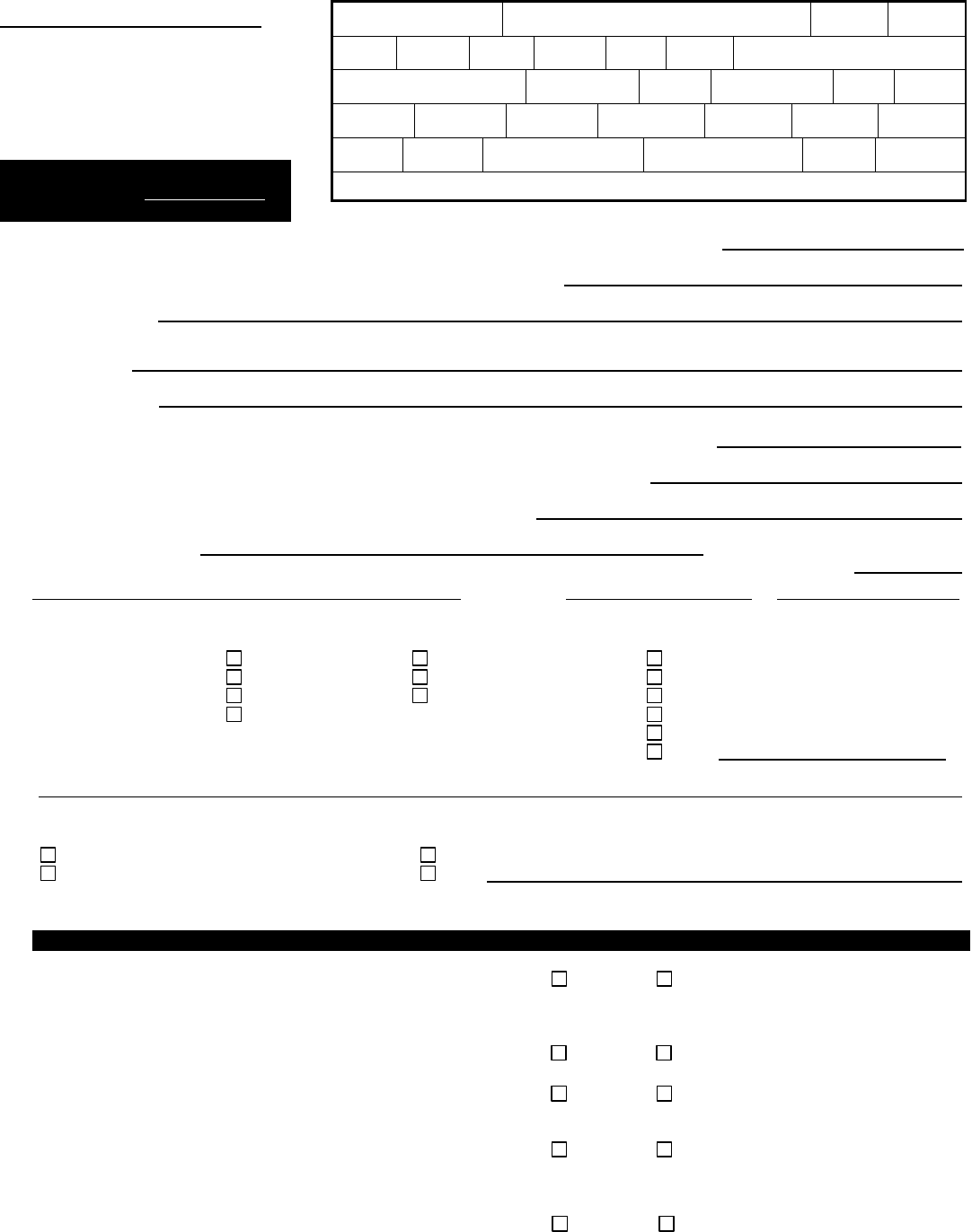

For Agency Use Only:

Account No.

Liable

Y N

A/C/AS

Root

OW/OF

S Add

ET AL

S/PR

BR

Liab Date

Del After

Law Sec

M/W

County

ERA

Own

Curr

P1

P2

P3

P4

P5

Next

Orig

Ind Ctr

React Date

L Let

St Adj

TA

PC Let