HTML Preview Income Statement Sample Format page number 1.

Sample Document

THE INCOME STATEMENT

The Income Statement (Profit and Loss) records all income and expenses of the business during a specified time period, and is

the accepted method of determining profits and losses. The Internal Revenue Service requires all businesses to submit this report

at the end of each year.

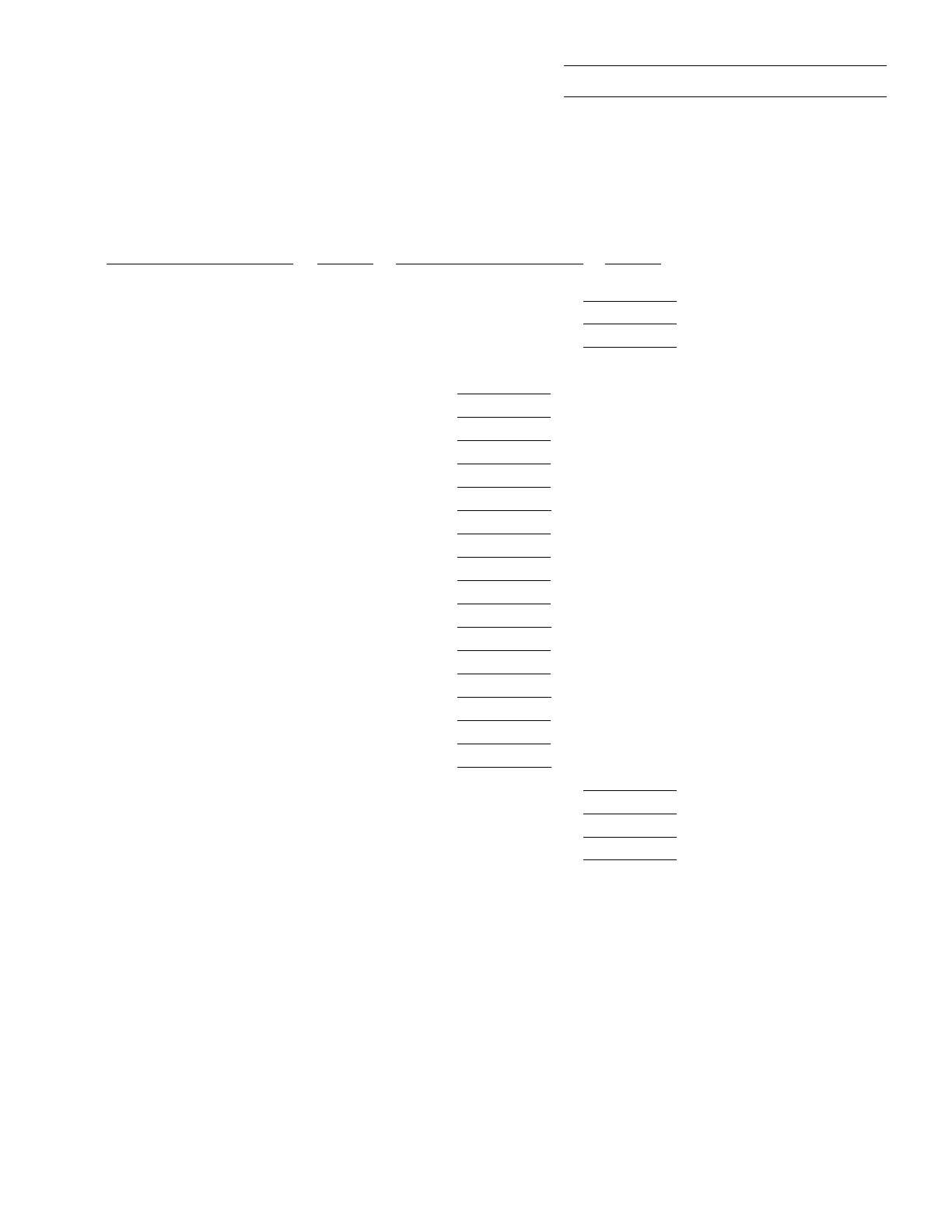

PROFIT AND LOSS STATEMENT

From:20 to 20

Sales or Gross Receipts

1

.............................................................................. $

Less Cost of Goods Sold

2

.................................................................................. $

Gross Profit...................................................................................................... $

Less Operating Expenses

3

Rent ............................................................................

Depreciation ................................................................

Repairs & Maintenance ...............................................

Salaries & Wages .........................................................

Payroll Taxes & Fringe Benefits ...................................

Taxes, Licenses & Fees ................................................

Insurance ....................................................................

Accounting, Legal and Professional Fees .....................

Bad Debts ...................................................................

Telephone ....................................................................

Utilities .......................................................................

Supplies ......................................................................

Security.......................................................................

Auto and Truck ...........................................................

Advertising and Promotion ..........................................

Interest .......................................................................

Miscellaneous..............................................................

Total Operating Expenses

$

Net Profit Before Taxes

4

............................................................................... $

Federal Income Taxes

(Corporation Only) ..................................................... $

Net Profit (or Loss)

....................................................................................... $

1

Sales or Gross Receipts

– represents total amount of money that the business makes from the sale of its merchandise, less

discounts and refunds.

2

Cost of Goods Sold

– the cost of the merchandise that the business sells. These costs differ with each type of business.

3

Operating Expenses

– all business costs other than the costs of merchandise.

4

Net Profit (Loss)

– sales less cost of goods sold less operating expenses.

............................