HTML Preview Simple Budget Worksheet For Family page number 1.

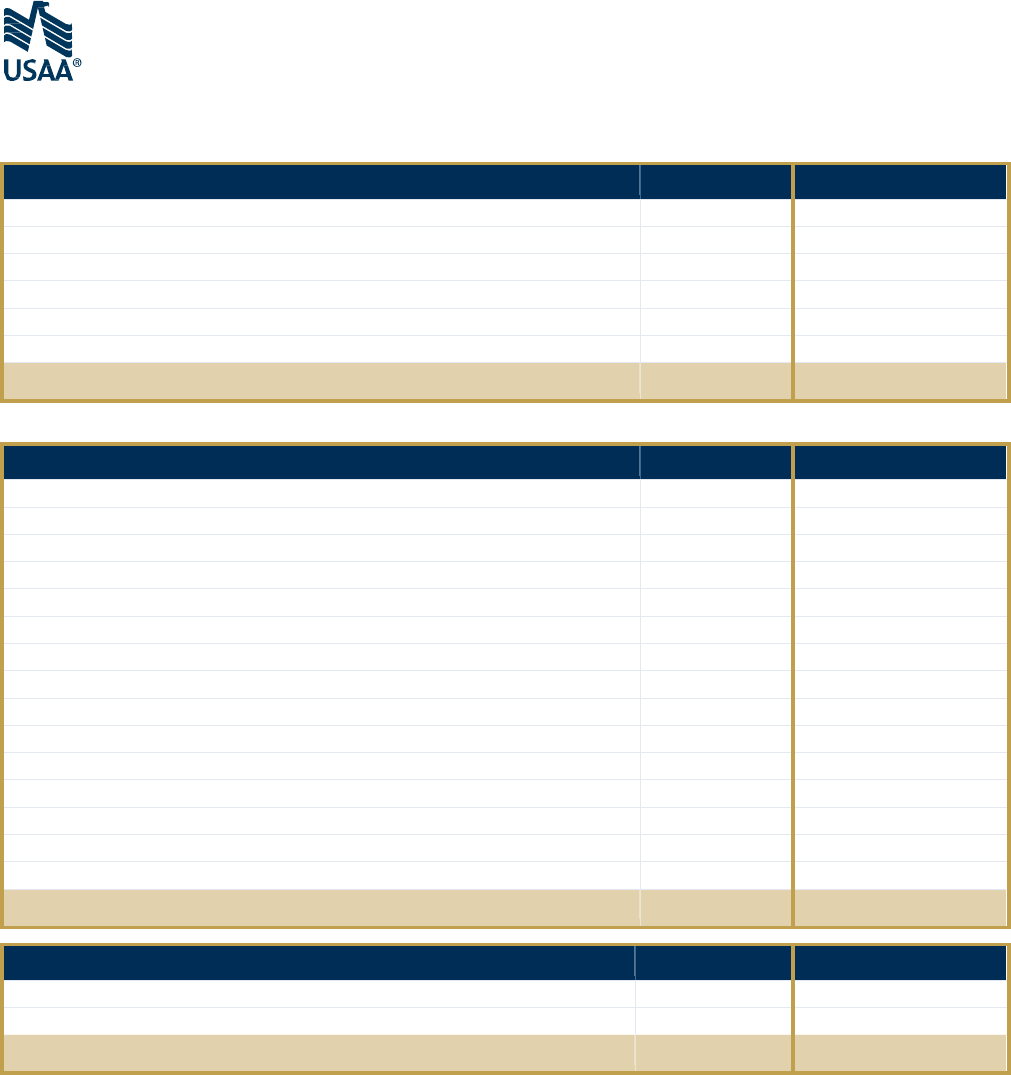

Simple Budget Worksheet

A budget can help you reduce your debt and save for goals. Complete this worksheet to figure out your budget.

Account for every dollar of income including money saved and invested so that your bottom line equals $0.

Month: ______________________

Income

Amount

USAA Suggestion

Gross Income (before taxes and other withholdings)

$

- Saving for Retirement

$

10% of gross income

- Taxes (Federal, State, FICA/Social Security, other)

$

-

$

-

$

-

$

(A)

Net Income (Left for Expenses & Goals)

$

Expenses & Goals

Amount

USAA Suggestion

- Housing (Mortgage/rent, internet, TV, repairs, utilities, phone, insurance, taxes)

$

25-36%

- Food (Groceries, Restaurants)

$

10-15%

- Healthcare Co-pays and Deductibles

$

5%

- Transportation (Insurance, loan payments, fuel, repairs, fees)

$

10-15%

- Entertainment (Fun, travel)

$

5%

- Personal Care/Clothing (Clothing, shoes, hair, makeup, laundry, dry cleaning)

$

5%

- Miscellaneous (Cash, dues, subscriptions, general merchandise, gifts, pets, fees, other)

$

10-15%

- Charitable Giving (Charity, church, other)

$

5-10%

- Debt Payments (credit card, loans)

$

5%

- Insurance Premiums (Life, Health, Dental and other insurance)

$

5%

- Saving for Goals

$

5%

-

$

-

$

-

$

-

$

(B)

Total Expenses

$

Budget Summary

Amount

USAA Suggestion

Net Income (A)

$

Minus Total Expenses (B)

- $

Total

=$0

Should equal $0

For a more detailed, online budget use My Budget on usaa.com. Or use the USAA Mobile App that lets you use

your personal budgeting tool to track spending and edit transactions wherever you are.

USAA means United Services Automobile Association and its affiliates.

216024-0315