HTML Preview Annual Sales Tax Report page number 1.

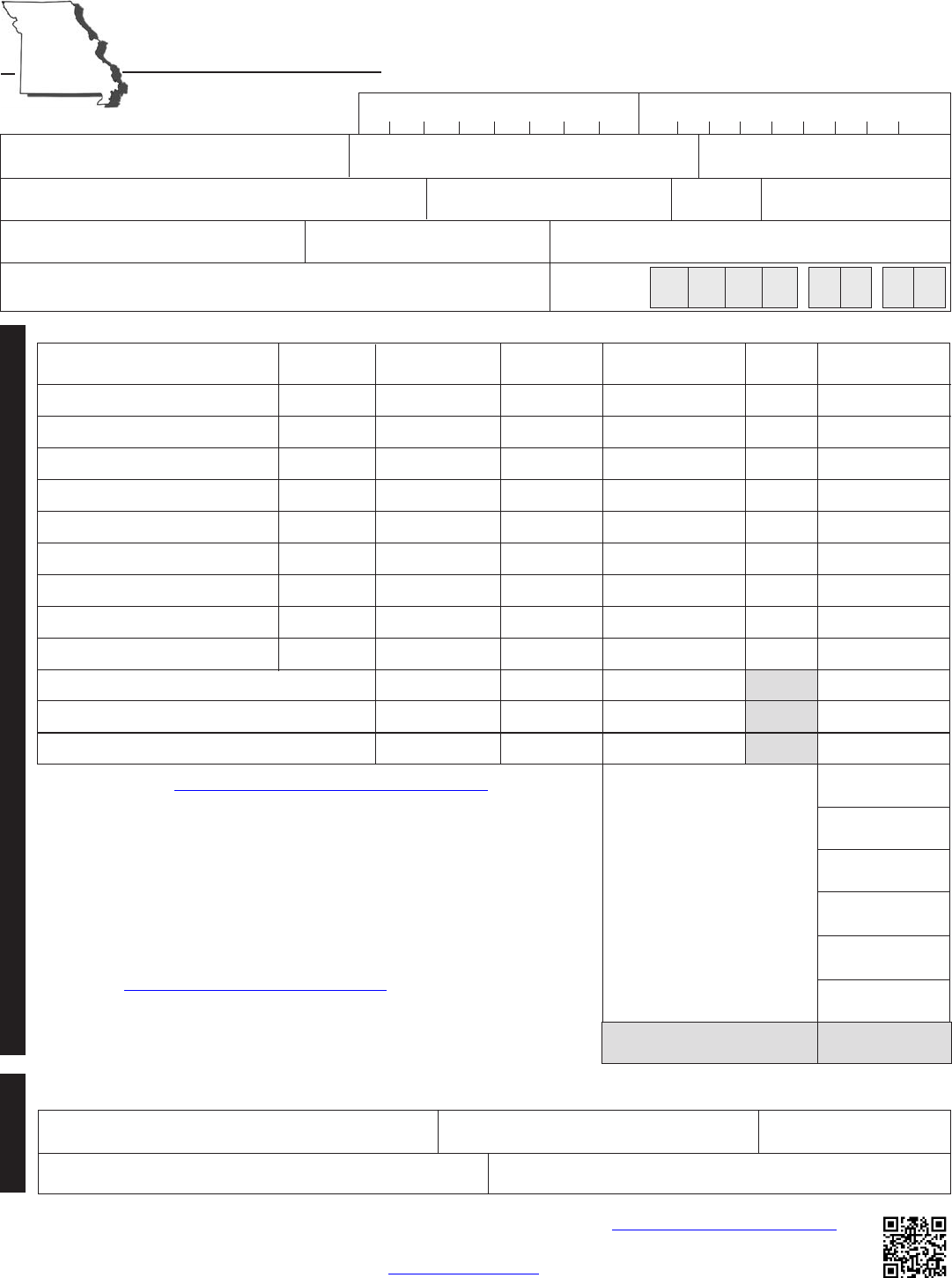

Form

53-1

Missouri Department of Revenue

Sales Tax Return

Code

Taxable Sales

Business Location

Rate (%)

Amount of Tax

Add: additions to tax

.........................

Page 1 Totals ...................................................

Page -- Totals ..................................

Totals (All Pages) .............................................

t

2.

-

3.

=

4.

+

5.

+

6.

-

7

=

1.

This return must be filed for the reporting period indicated even if you have no gross receipts or tax to report.

Address Correction: r Mailing Address r Reporting Location

Pay this amount

(U.S. Funds only) ........................

Subtract: approved credit ...............

Add: interest for late payments

(See Line 4 of Instructions) ............

Select one if:

r Amended Return r Additional Return

Visit http://dor.mo.gov/business/creditinquiry to determine if

you have a credit for which you may be entitled to a refund.

RETE

Mail to: Taxation Division Phone: (573) 751-2836

P.O. Box 840 TTY: (800) 735-2966

Jefferson City, MO 65105-0840 Fax: (573) 526-8747

E-mail: [email protected]

Visit http://dor.mo.gov/business/sales/

for additional information.

Form 53-1 (Revised 01-2017)

Sales Information

Visit https://dors.mo.gov/tax/busefile/login.jsp

to file your sales tax return electronically.

Final Return: If this is your final return, enter the close date below and check

the reason for closing your account. Missouri law requires any person selling

or discontinuing business to make a final sales tax return within fifteen (15)

days of the sale or closing.

Date Business Closed (MM/DD/YYYY): ___ ___ / ___ ___ / ___ ___ ___ ___

r Out of Business r Sold Business r Leased Business

Gross

Receipts

Adjustments

(Indicate + or -)

Subtract: 2% timely payment

allowance (if applicable)

..................

Total sales tax due .......................

If you pay by check, you authorize the Department of Revenue to process the check

electronically. Any check returned unpaid may be presented again electronically.

Department Use Only

t

Department

Use Only

Owner Name Business Name Reporting Period

Mailing Address City State ZIP Code

Business Phone Number Due Date E-mail Address

(___ ___ ___)___ ___ ___-___ ___ ___ ___

___ ___ / ___ ___ / ___ ___ ___ ___

Missouri Tax Identification Number Federal Employer Identification Number

Taxpayer or Authorized Agent’s Signature Title Date (MM/DD/YYYY)

Printed Name Tax Period (MM/DD/YYYY) though (MM/DD/YYYY)

Signature

Under penalties of perjury, I declare that the above information and any attached supplement is true, complete, and correct. I have direct control,

supervision, or responsibility for filing this return and payment of the tax due. I attest that I have no gross receipts to report for locations left blank.

__ __ /__ __ /__ __ __ __ through __ __ /__ __ /__ __ __ __

__ __ /__ __ /__ __ __ __

Have you considered filing electronically? Click here for more information.

Reset Form

Print Form

CLICK HERE

RETE

for instructions to complete this form.

-

-

-

-

-

-

-

-

-

-

-

-