HTML Preview Nonprofit Annual Report page number 1.

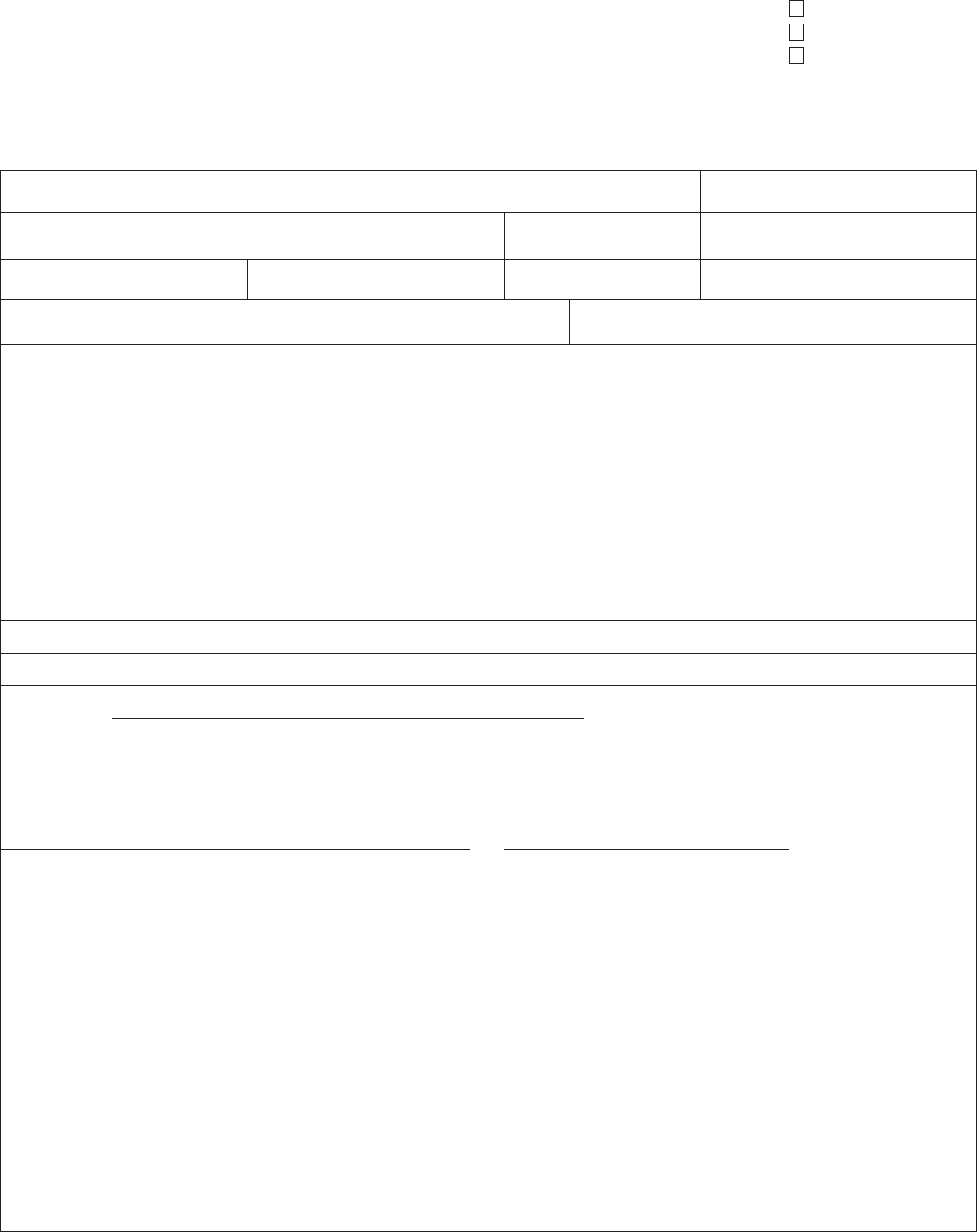

Indiana Department of Revenue

Indiana Nonprot Organization's Annual Report

For the Calendar Year or Fiscal Year

Beginning _____/_____/_____ and Ending _____/_____/_____

Due on the 15th day of the 5th month following the end of the tax year.

NO FEE REQUIRED.

Name of Organization Telephone Number

Address County IndianaTaxpayerIdenticationNumber

City State ZipCode FederalIdenticationNumber

PrintedNameofPersontoContact Contact'sTelephoneNumber

Ifyouarelingafederalreturn,attachacompletedcopyofForm990,990EZ,or990PF.

Note: Ifyourorganizationhasunrelatedbusinessincomeofmorethan$1,000asdenedunderSection 513oftheInternalRevenueCode,you

must also le Form IT-20NP.

Current Information

1.

HaveanychangesnotpreviouslyreportedtotheDepartmentbeenmadeinyourgoverninginstruments,(e.g.)articlesofincorporation,

bylaws,orotherinstrumentsofsimilarimportance?Ifyes,attachadetaileddescriptionofchanges.

2. Indicatenumberofyearsyourorganizationhasbeenincontinuousexistence.__________.

3. Attachaschedule,listingthenames,titlesandaddressesofyourcurrentofcers.

4. Brieydescribethepurposeormissionofyourorganizationbelow.

EmailAddress:

I declare under the penalties of perjury that I have examined this return, including all attachments, and to the best of my knowledge and belief, it

is true, complete, and correct.

SignatureofOfcerorTrustee Title Date

NameofPerson(s)toContact DaytimeTelephoneNumber

Important:Pleasesubmitthiscompletedformand/orextensionto:

IndianaDepartmentofRevenue,TaxAdministration

P.O.Box6481

Indianapolis,IN46206-6481

Telephone:(317)232-0129

Extensions of Time to File

TheDepartmentrecognizestheInternalRevenueServiceapplicationforautomaticextensionoftimetole,Form8868.Please forward a copy of

your federal extension, identied with your Nonprot Taxpayer Identication Number (TID), to the Indiana Department of Revenue, Tax

Administration by the original due date to prevent cancellation of your sales tax exemption.

AlwaysindicateyourIndianaTaxpayerIdentication

numberonyourrequestforanextensionoftimetole.

Reportspostmarkedwithinthirty(30)daysafterthefederalextensionduedate,asrequestedonFederalForm8868,willbeconsideredastimely

led.AcopyofthefederalextensionmustalsobeattachedtotheIndianareport.Intheeventthatafederalextensionisnotneeded,ataxpayermay

requestinwritinganIndianaextensionoftimetolefromthe:IndianaDepartmentofRevenue,TaxAdministration,P.O.Box6481,Indianapolis,

IN46206-6481,(317)232-0129.

IfFormNP-20orextensionisnottimelyled,thetaxpayerwillbenotiedbytheDepartmentpursuanttoI.C.6-2.5-5-21(d),toleFormNP-20.If

withinsixty(60)daysafterreceivingsuchnoticethetaxpayerdoesnotleFormNP-20,thetaxpayer'sexemptionfromsalestaxwillbecanceled.

NP-20

State Form 51062

(R7 / 8-13)

Checkif: Change of Address

Amended Report

FinalReport:Indicate

DateClosed______

mm/dd/yyyy mm/dd/yyyy

*25413111594*

25413111594