HTML Preview Printable Business Tax Receipt Application page number 1.

61055-v5 Business Tax Receipt Application Form

The City of Weston

17200 Royal Palm Boulevard

Weston, Florida 33326

954-385-2000

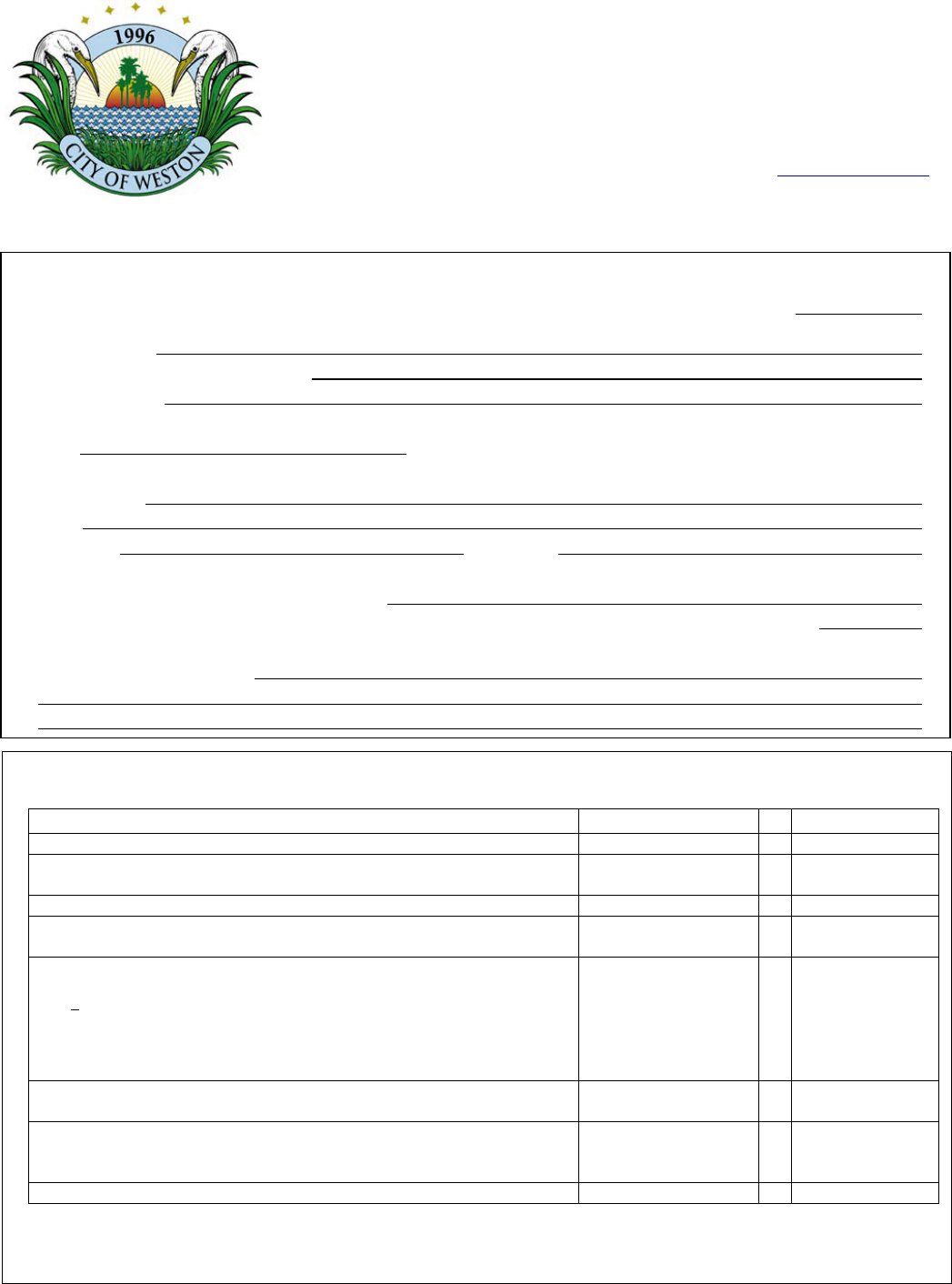

BUSINESS TAX RECEIPT

APPLICATION

1. MY BUSINESS INFORMATION

□ New Application □ Address Change □ Ownership Transfer □ Change of DBA BTR #

Company Name:

DBA (if applicable/must match signage):

Business Address:

Weston, Florida _________________________ (zip code) Is this a Virtual or residential office? □ Yes □ No

FEIN: ________________________________________ (Federal Employee Identification Number)

Contact Name:

Email:

Phone No.: Fax No.:

Mailing Address (if different than business address):

City: _____________________________________________________ State: __________________________ zip:

Description of Services offered:

________________________________________________________________________________________________________

________________________________________________________________________________________________________

2. M

Y BUSINESS CATEGORY & TAX:

Select Only One

TAX*

Category

Fiscal Year

(1)

Partial Year

(2)

□ Hotels, Motels, Apartments or Timeshares with 250 units or more $6,077.52 $3,038.76

□ Warehouse, Manufacturing Facility or Pharmacy with 50,000 square feet or

more

$4,051.68 $2,025.84

□ Supermarkets

$3,183.46 $1,591.73

□ Warehouse, Manufacturing Facility or Pharmacy between 20,000 square feet

and 49,999 square feet

$2,431.01 $1,215.51

□ Warehouse, Manufacturing Facility or Pharmacy between 10,000 square feet

and 19,999 square feet;

• Apartments or Timeshares with 100 – 249 units;

• Hotels or Motels with 150-249 rooms;

• Country Clubs and Golf Course(s);

• Athletic/Fitness Club with Pool

$1,447.02 $723.51

□ Limited Business: Home Occupation; Business with only a Post Office,

Private Mail Box or Registered Office in the City

$173.63 $86.82

□ Individual Professional

To qualify please provide the BTR number of the business you are affiliated with

at this location: _________________ (must be business in good standing).

$86.80 $43.40

□ General Business (all other Businesses with a commercial address) $260.46 $130.23

(1)

Applicants that apply after the beginning of the fiscal year (October 1) but before April 1 of that fiscal year shall pay the full tax for one year.

(2)

Applicants that apply on or after April 1 of the fiscal year but before September 30 of that fiscal year shall pay one-half the full tax for one year.