HTML Preview Retail Banking Experience Resume page number 1.

45 Pearl Court, Davies, Iowa ― 512.555.3345 ― turnerj5255@yahoo.com

ROBERT M. TURNER

CHIEF EXECUTIVE OFFICER & PRESIDENT

― Maximizing Revenue, Liquidity, & Earnings While Dampening Costs ―

PROGRESSIVE BANK CEO & CATALYST FOR LASTING, SIGNIFICANT PROFITS

■■■

Cultivating Ties with Boards, Customers, Regulators, Employees, & Community

Strategic community banking leader recognized for sweeping

improvements to efficiency, product development, and marketing, with

oversight of $860M in deposits and loans, plus $140M investment portfolio.

Trusted Board advisor conceptualizing and creating revenue opportunities

by leveraging “Main Street Bank” theme. Champion for significant expansion

including 6 new branches (from $500K–$2.2M) generating $45M+ deposit

growth and 12,000-square-foot, $1.2M operations facility.

Respected banking industry official skilled in attaining peak deposit levels,

stabilizing operations, addressing volatile regulatory requirements, and

topgrading product offerings to deliver optimal ROI.

AREAS OF EXPERTISE

Strategic Planning

Leadership Development

Market Research

Product Development

Regulatory Compliance

Marketing Campaigns

Asset Liability Oversight

Risk Mitigation

Change Management

Board Collaboration

Facilities Expansion

Customer Engagement

“Robert has an open style that

creates productivity, yet requires

accountability at every level.”

― Board Member, HSM Bank

“A gifted leader of people… Robert

always faced any situation, no matter

how difficult, with openness,

honesty, and integrity.”

― AVP & Director, HSM Bank

“Robert took the reins of our

association to drive much-needed

change.” ― VP, Iowa Association

of Community Bankers

“As a colleague, I have long noted

Robert’s ability to lead by example

and with passion… an individual of

great integrity and commitment to

his community and his customers.”

― VP, Midwestern Bank

EXECUTIVE PERFORMANCE BENCHMARKS

51% first-quarter 2009 earnings increase from process improvements that slashed $700K in costs.

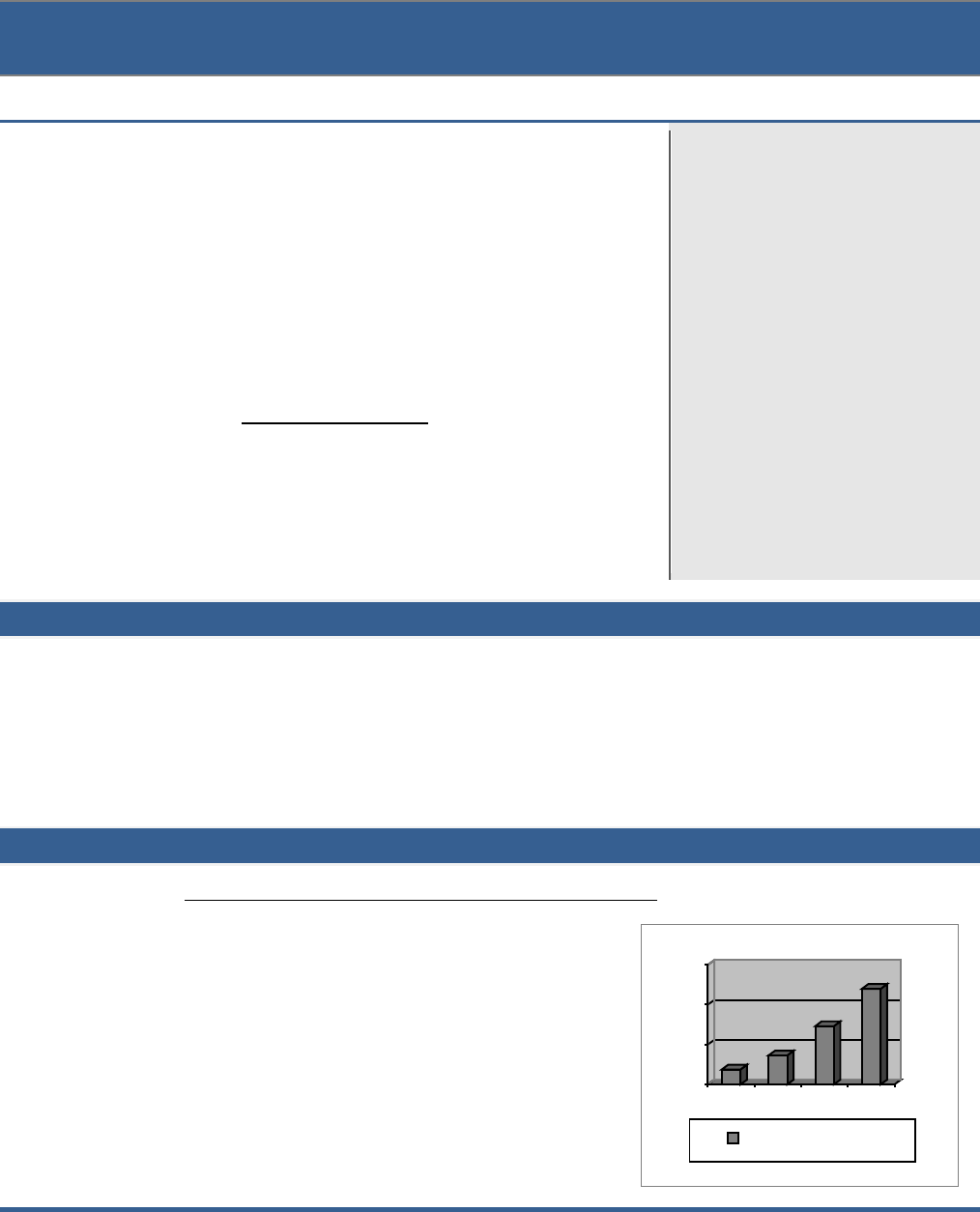

Administration for $550M in assets and $5.2M net profit representing 630% growth over tenure.

60% rise in Primary/Secondary Liquidity to $100M, improving regulatory perception of bank stability.

Increased profit ($4.6M decrease in cost of funds)—even with economic pressures and declining rates.

Workflow and technology efficiencies placing bank among the forefront in electronic offerings.

PROFESSIONAL HISTORY

HSM Bank Corporation (HSMBC), Davenport, Iowa ■ 1985 – 2009

Chairman, President, & CEO, 2007 – 2009

President & CEO, 2003 – 2007

EVP & Retail Banking Officer, 2001 – 2003

SVP & Retail Banking Officer, 1991 – 2001

Helmed bank throughout periods of industry change and growth, leading 7-

member Board of Directors and spearheading profitability by designing

customer-centric products, limiting expenses, and identifying areas of

opportunity. Oversaw and led improved compliance, internal/external

alliances, asset management, regulatory relationships, performance,

security, and PR. Managed 16 direct and 175 dotted-line reports.

0

200

400

600

1985 1996 2005 2009

Assets (in Millions)