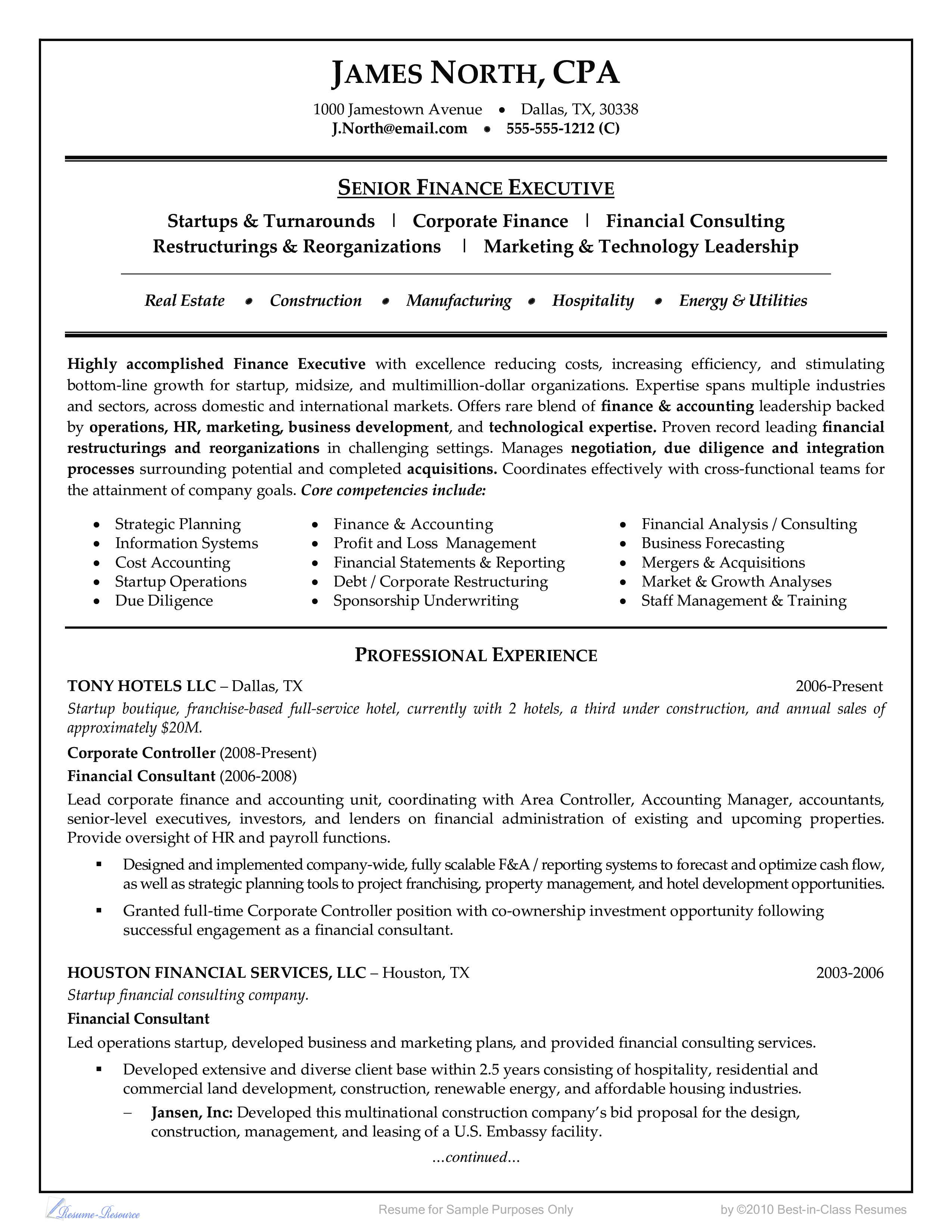

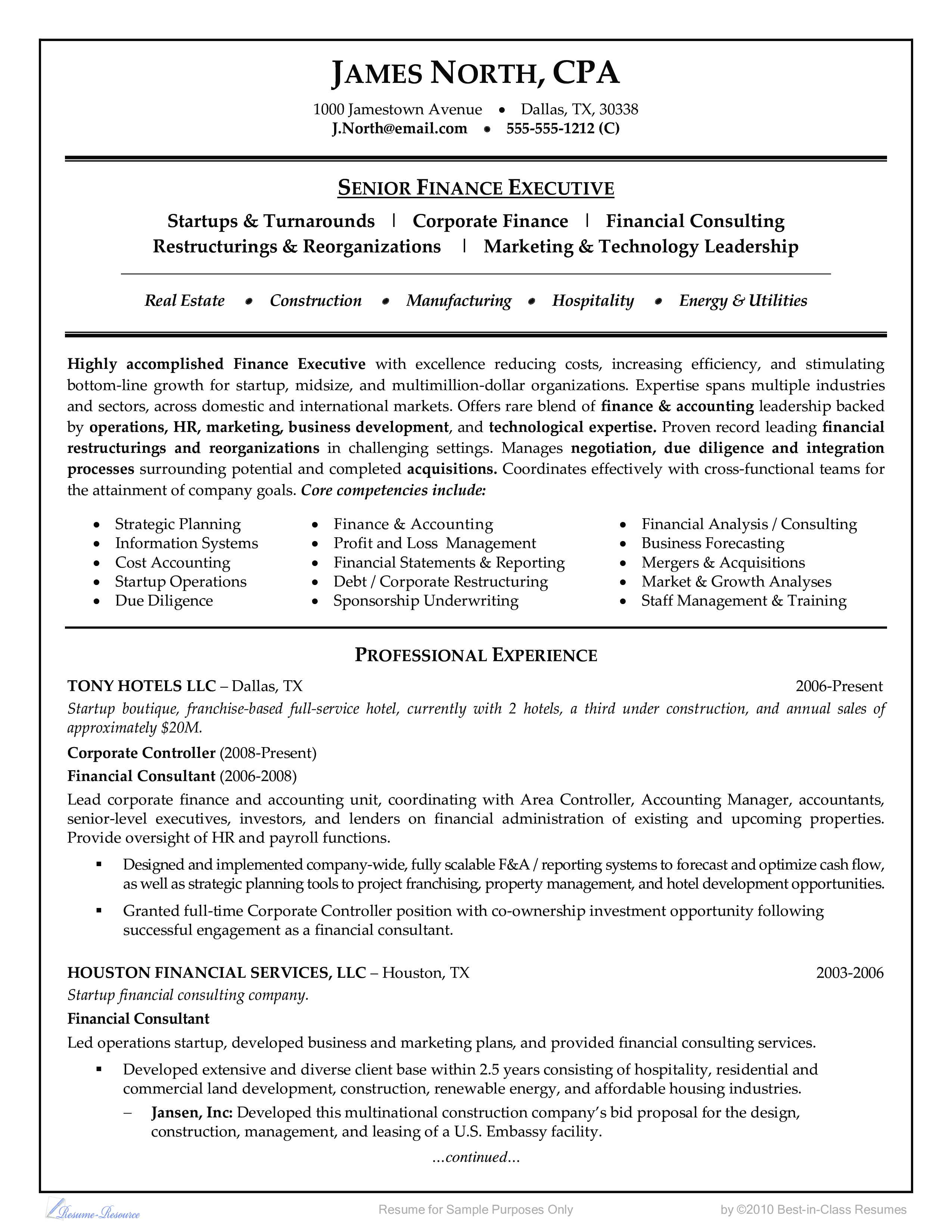

Financial Consultant Resume Example

Save, fill-In The Blanks, Print, Done!

Download Financial Consultant Resume Example

Adobe Acrobat (.pdf)- This Document Has Been Certified by a Professional

- 100% customizable

- This is a digital download (661.32 kB)

- Language: English

- We recommend downloading this file onto your computer.

Do you need a Financial Consultant Resume example? What are the best ways to write a resume for a financial consultant? Our financial consultant resume templates are designed to help you create a professional resume that highlights your skills and experience. Choose from one of our templates to get started. With a little help from us, you'll be well on your way to finding the right job. Download this professional Financial Consultant Resume example template now!

A financial consultant resume is a document that outlines the professional background, qualifications, skills, and experience of an individual seeking a position as a financial consultant. Financial consultants, also known as financial advisors or financial planners, provide expert advice and guidance to clients in managing their finances, investments, and financial goals. A well-crafted resume for a financial consultant should showcase the candidate's expertise in financial planning, wealth management, investment strategies, and client service.

Writing a compelling financial consultant resume involves presenting your qualifications, skills, and experience in a clear and persuasive manner. Here are step-by-step instructions on how to create an effective financial consultant resume:

1. Choose the Right Format:

- Start with a clean, professional format. Use a traditional chronological resume format, which lists your work experience in reverse chronological order.

2. Contact Information:

- At the top of your resume, include your full name, phone number, email address, and location (city and state).

- Ensure that your contact information is accurate and professional.

3. Write a Strong Summary or Objective:

- Craft a concise summary or objective statement at the beginning of your resume. This should capture the reader's attention and convey your career goals and the value you bring as a financial consultant.

- Tailor this section to the specific job you're applying for.

4. Highlight Core Competencies:

- Create a section listing essential skills and competencies relevant to the financial consultant role. Include skills like financial planning, investment management, risk assessment, and client relationship management.

5. Detail Work Experience:

- Start with your most recent or current position and work backward.

- For each job, provide the following information:

- Job title (e.g., Financial Consultant, Financial Advisor)

- Company name and location

- Employment dates (start and end)

- A detailed description of your responsibilities and accomplishments. Focus on your ability to provide financial advice, manage client portfolios, and help clients achieve financial goals.

- Quantify your achievements with specific metrics (e.g., "Grew client portfolio value by 20%," "Maintained a 95% client retention rate").

6. Include Education:

- Mention your educational background, including degrees earned, institutions attended, graduation dates, and any relevant certifications or licenses (e.g., Certified Financial Planner, Chartered Financial Analyst).

7. Highlight Certifications and Licenses:

- List any financial certifications, licenses, or registrations that are required or relevant to the financial consulting field.

8. Showcase Professional Achievements:

- Highlight specific accomplishments and milestones in your career as a financial consultant. This may include recognition, awards, or significant contributions to clients' financial success.

9. Emphasize Client Services and Relationship Management:

- Describe your approach to providing exceptional client service and building strong, long-term client relationships.

- Highlight your ability to understand clients' financial needs and tailor financial strategies accordingly.

10. Explain Investment Strategies and Financial Planning:

- Elaborate on your expertise in investment strategies, asset allocation, retirement planning, and financial goal setting.

- Mention any specialized areas of financial planning you excel in (e.g., estate planning, tax planning).

11. Address Risk Assessment and Management:

- Discuss your experience in assessing clients' risk tolerance and creating investment portfolios that align with their risk profiles.

12. Mention Technology and Tools:

- List any financial planning software, tools, or platforms you are proficient in, such as portfolio management software or financial modeling tools.

13. Proofread and Edit:

- Carefully proofread your resume to eliminate typos, grammatical errors, or formatting issues.

- Ask a trusted colleague or friend to review your resume for feedback.

14. Tailor Your Resume:

- Customize your resume for each job application by emphasizing experiences and qualifications that match the specific job description and company culture.

Remember that your financial consultant resume should effectively communicate your expertise and demonstrate how you can add value to potential employers and clients. Keep it concise and focused on the most relevant and impactful information.

Print out your Financial Consultant Resume Example template now!

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

Leave a Reply. If you have any questions or remarks, feel free to post them below.

Related templates

Latest templates

Latest topics

- Google Sheets Templates

How to work with Google Sheets templates? Where to download useful Google Sheets templates? Check out our samples here. - Letter Format

How to format a letter? Here is a brief overview of common letter formats and templates in USA and UK and get inspirited immediately! - IT Security Standards Kit

What are IT Security Standards? Check out our collection of this newly updated IT Security Kit Standard templates, including policies, controls, processes, checklists, procedures and other documents. - Excel Templates

Where do I find templates for Excel? How do I create a template in Excel? Check these editable and printable Excel Templates and download them directly! - Google Docs Templates

How to create documents in Google Docs? We provide Google Docs compatible template and these are the reasons why it's useful to work with Google Docs...

cheese