Employee Payroll Deduction

Save, fill-In The Blanks, Print, Done!

Download Employee Payroll Deduction

Adobe Acrobat (.pdf)- This Document Has Been Certified by a Professional

- 100% customizable

- This is a digital download (640.25 kB)

- Language: English

- We recommend downloading this file onto your computer.

How to draft a Employee Payroll Deduction? Download this Employee Payroll Deduction template now!

We support you and your company by providing this Employee Payroll Deduction HR template, which will help you to make a perfect one! This will save you or your HR department time, cost and efforts and help you to reach the next level of success in your work and business!

This Employee Payroll Deduction has ways to grab your reader’s attention. It is drafted by HR professionals, intelligently structured and easy-to-navigate through. Pay close attention to the most downloaded HR templates that fit your needs.

Download this Human Resources Employee Payroll Deduction template now!

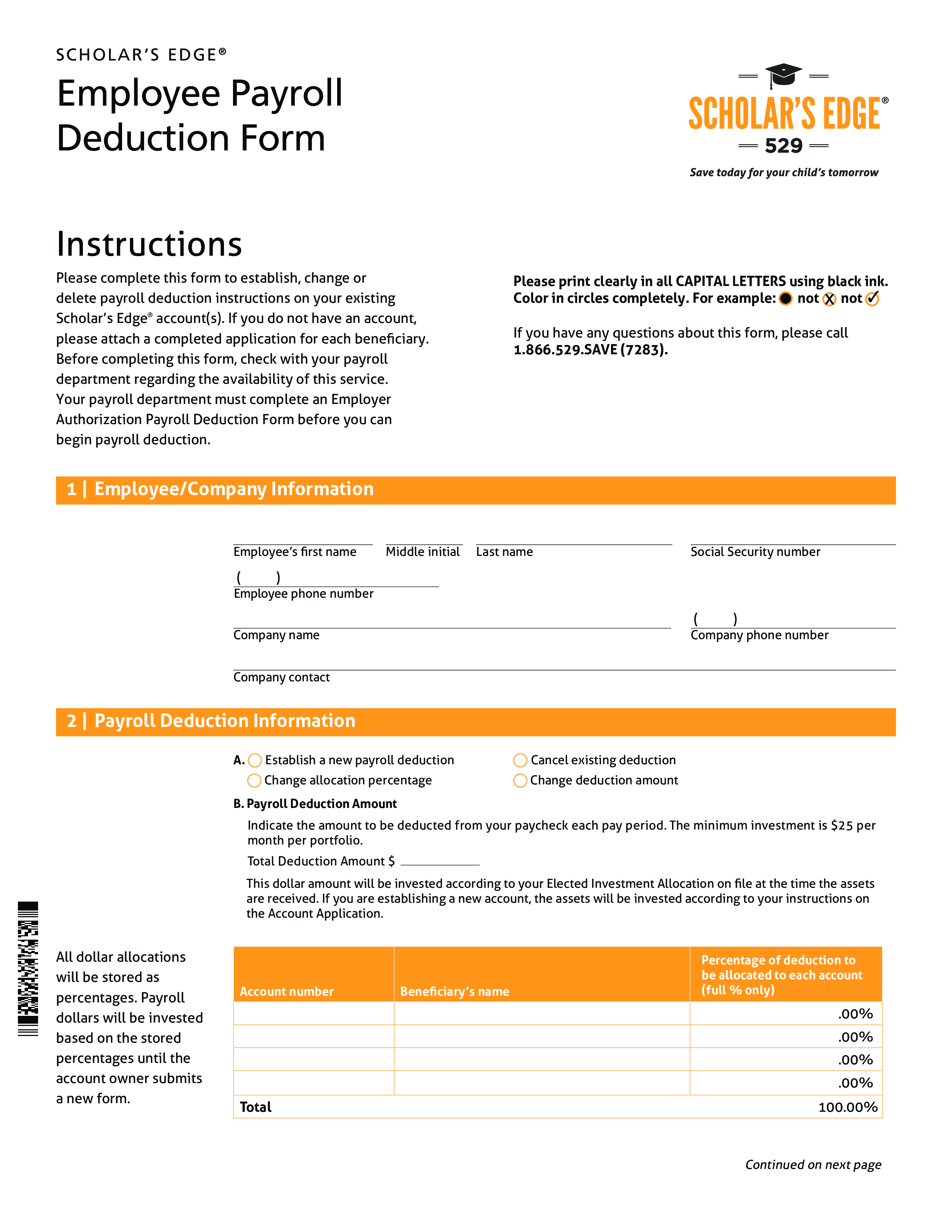

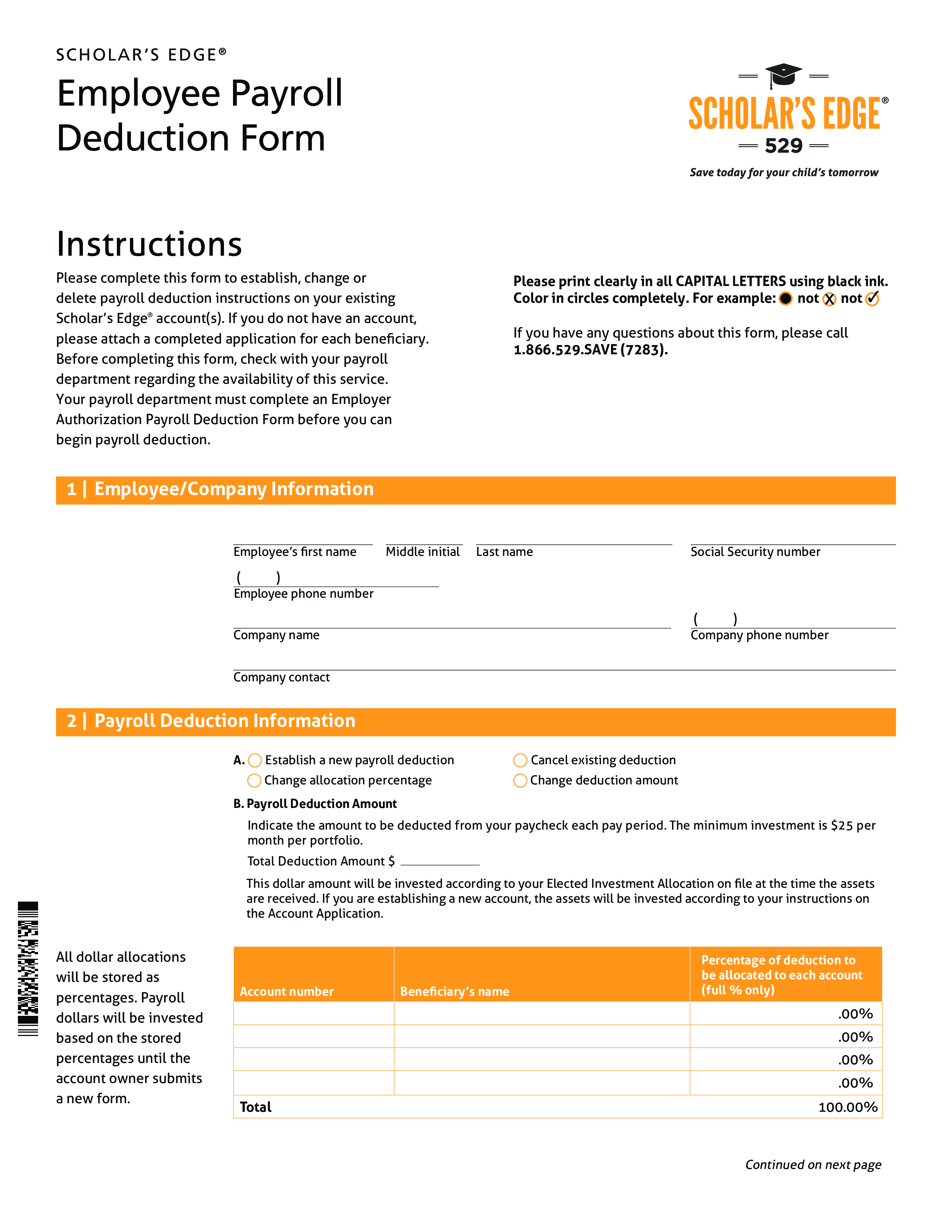

S CH OLA R’S EDGE ® Employee Payroll Deduction Form Instructions Please complete this form to establish, change or delete payroll deduction instructions on your existing Scholar’s Edge® account(s).. Account number Beneficiary’s name Percentage of deduction to be allocated to each account (full only) .00 .00 .00 .00 Total 100.00 Continued on next page

3 Authorized Signature Employee’s Signature Date All Employees Make two copies of this Employee Payroll Deduction Form and: 1..

Also interested in other HR templates? Browse through our database and have instant access to hundreds of free and premium HR documents, HR forms, HR agreements, etc

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

Leave a Reply. If you have any questions or remarks, feel free to post them below.

Related templates

Latest templates

Latest topics

- Google Sheets Templates

How to work with Google Sheets templates? Where to download useful Google Sheets templates? Check out our samples here. - Letter Format

How to format a letter? Here is a brief overview of common letter formats and templates in USA and UK and get inspirited immediately! - IT Security Standards Kit

What are IT Security Standards? Check out our collection of this newly updated IT Security Kit Standard templates, including policies, controls, processes, checklists, procedures and other documents. - Excel Templates

Where do I find templates for Excel? How do I create a template in Excel? Check these editable and printable Excel Templates and download them directly! - Google Docs Templates

How to create documents in Google Docs? We provide Google Docs compatible template and these are the reasons why it's useful to work with Google Docs...

cheese