SME Cash Flow Excel Template

Save, fill-In The Blanks, Print, Done!

Download SME Cash Flow Excel Template

Microsoft Spreadsheet (.xlsx)- This Document Has Been Certified by a Professional

- 100% customizable

- This is a digital download (81.8 kB)

- Language: English

- We recommend downloading this file onto your computer.

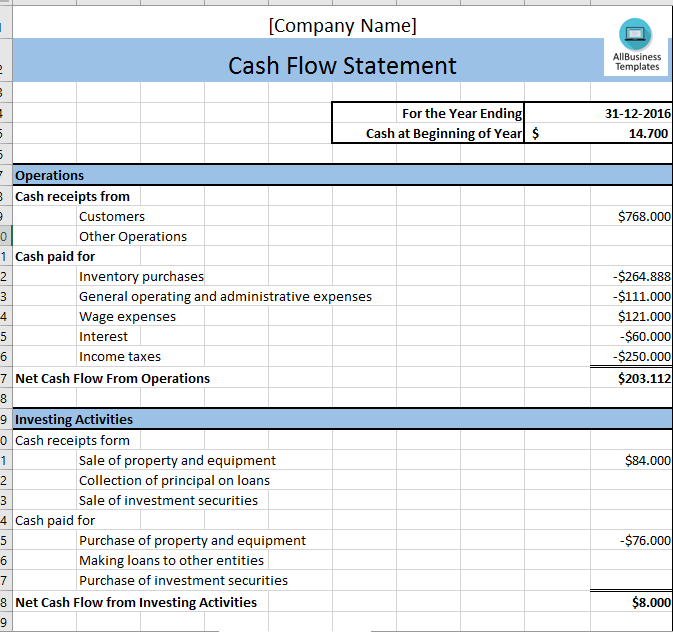

Why is it important for SMEs to have a cash flow statement? What are the steps for creating a cash flow in Excel? This template is a handy tool for SMEs to help manage their finances. It includes a comprehensive cash flow statement, as well as a budget planner. The template is easy to use and download.

SME Cash Flow refers to the management and monitoring of cash inflows and outflows within a Small and Medium-sized Enterprise (SME). It's a critical aspect of financial management for businesses of this size, as maintaining a healthy cash flow is essential for their survival and growth. SMEs often have limited resources compared to larger corporations, making effective cash flow management crucial to meet their operational needs and financial obligations.

Here's what SME cash flow entails:

- Cash Inflows: These are the sources of cash coming into the SME. Cash inflows typically include revenue from sales of products or services, loans, investments, and any other sources of funds entering the business.

- Cash Outflows: These are the expenditures and payments made by the SME. Cash outflows encompass various expenses, such as salaries and wages, rent or lease payments, utility bills, supplier payments, loan repayments, and other operating costs.

- Cash Flow Forecasting: SMEs often create cash flow forecasts or projections to estimate their future cash inflows and outflows. These forecasts help businesses plan for upcoming expenses, allocate resources effectively, and identify potential cash shortages.

- Working Capital Management: Effective cash flow management involves optimizing working capital, which is the difference between a company's current assets (e.g., cash, accounts receivable) and current liabilities (e.g., accounts payable, short-term debt). Maintaining a healthy working capital position is crucial for meeting short-term obligations.

- Debt Management: SMEs may have loans or lines of credit to support their operations or expansion. Managing these debts, including timely repayments, is vital to avoid late fees and maintain creditors' trust.

- Inventory and Supplier Management: SMEs often invest in inventory. Efficient inventory management ensures that capital isn't tied up in excess stock and that the business can meet customer demand while controlling costs.

- Customer Credit Management: Extending credit to customers is common, but it can impact cash flow if not managed properly. SMEs should monitor accounts receivable and implement credit policies to ensure timely customer payments.

- Contingency Planning: Unforeseen events, such as economic downturns or unexpected expenses, can disrupt cash flow. SMEs should have contingency plans or access to emergency funds to address such situations.

- Cash Flow Statements: SMEs typically prepare cash flow statements as part of their financial reporting. These statements detail the cash generated and used during a specific period, providing insight into the liquidity of the business.

- Profit vs. Cash Flow: SMEs should understand the distinction between profit and cash flow. While profitability is important, a business can experience cash flow issues even when it's profitable, particularly if there are delays in receiving payments from customers or if large upfront expenses are required.

Effective cash flow management is essential for SMEs to ensure they can meet their financial obligations, invest in growth opportunities, and maintain financial stability. It requires ongoing monitoring, planning, and financial discipline to navigate the challenges that can arise in the course of business operations.

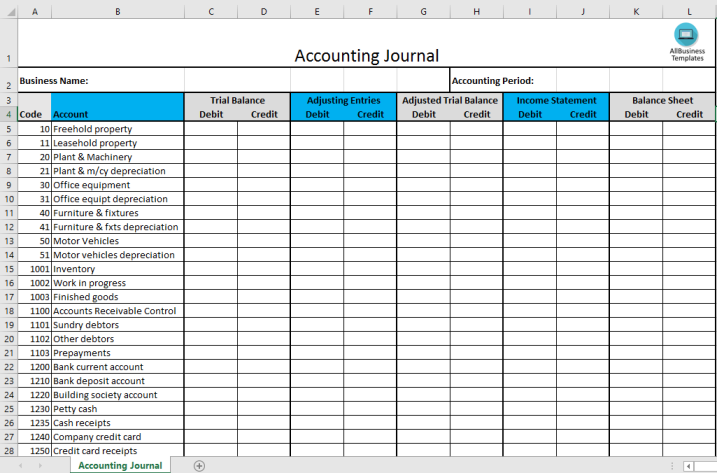

This cash flow template includes two additional worksheets to track month-to-month and year-to-year cash flows. Keep track of your financials to be successful. This Microsoft Excel Cash Flow template includes several accounting templates to help you do business.

Use this cash flow statement template to keep a high overview of your company’s assets, liabilities, and equity, and give investors an idea of the health of the startup or SME business. This Excel file contains many useful accounting templates.

When making large purchases for items like supplies, products, machinery, inventory, or other equipment, it may be necessary to do so on credit, which can result in multiple monthly payments made to different vendors or suppliers, due on different dates. Using this accounts payable Excel template will help to keep track of what you owe to each vendor or supplier, and will provide a quick look at the total outstanding balances and due dates. This template also contains an accounting journal for free.

Nicely formatted and ready to print. Easy to customize to your business style. Feel free to edit and change the formulas to your needs. Using this financial and accounting cash flow statement template guarantees you will save time, cost, and effort!

Download this basic financial cash flow statement template and after downloading you will be able to customize every detail and appearance and finish it in minutes.

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

Leave a Reply. If you have any questions or remarks, feel free to post them below.

Related templates

Latest templates

Latest topics

- Hourly Weekly Schedule Template

How do I make an hourly schedule? Streamline your daily planning with our versatile hourly daily weekly schedule templates - Excel Templates

Where do I find templates for Excel? How do I create a template in Excel? Check these editable and printable Excel Templates and download them directly! - GDPR Compliance Templates

What do you need to become GDPR compliant? Are you looking for useful GDPR document templates to make you compliant? All these compliance documents will be available to download instantly... - Daily Report Sheets For Preschool

How do you create a kindergarten schedule or write a daily report for a preschool? Check out these preschool templates here. - Celcius To Farenheit Chart

How to Download our temperature Celsius to Fahrenheit conversion charts and streamline your temperature calculations and conversions here.

cheese