Cash Payment Process Flow Chart

Save, fill-In The Blanks, Print, Done!

Download Cash Payment Process Flow Chart

Adobe Acrobat (.pdf)- This Document Has Been Certified by a Professional

- 100% customizable

- This is a digital download (407.73 kB)

- Language: English

- We recommend downloading this file onto your computer.

How to draft a Cash Payment Process Flow Chart? An easy way to start completing your document is to download this Cash Payment Process Flow Chart template now!

Every day brings new projects, emails, documents, and task lists, and often it is not that different from the work you have done before. Many of our day-to-day tasks are similar to something we have done before. Don't reinvent the wheel every time you start to work on something new!

Instead, we provide this standardized Cash Payment Process Flow Chart template with text and formatting as a starting point to help professionalize the way you are working. Our private, business and legal document templates are regularly screened by professionals. If time or quality is of the essence, this ready-made template can help you to save time and to focus on the topics that really matter!

Using this document template guarantees you will save time, cost and efforts! It comes in Microsoft Office format, is ready to be tailored to your personal needs. Completing your document has never been easier!

Download this Cash Payment Process Flow Chart template now for your own benefit!

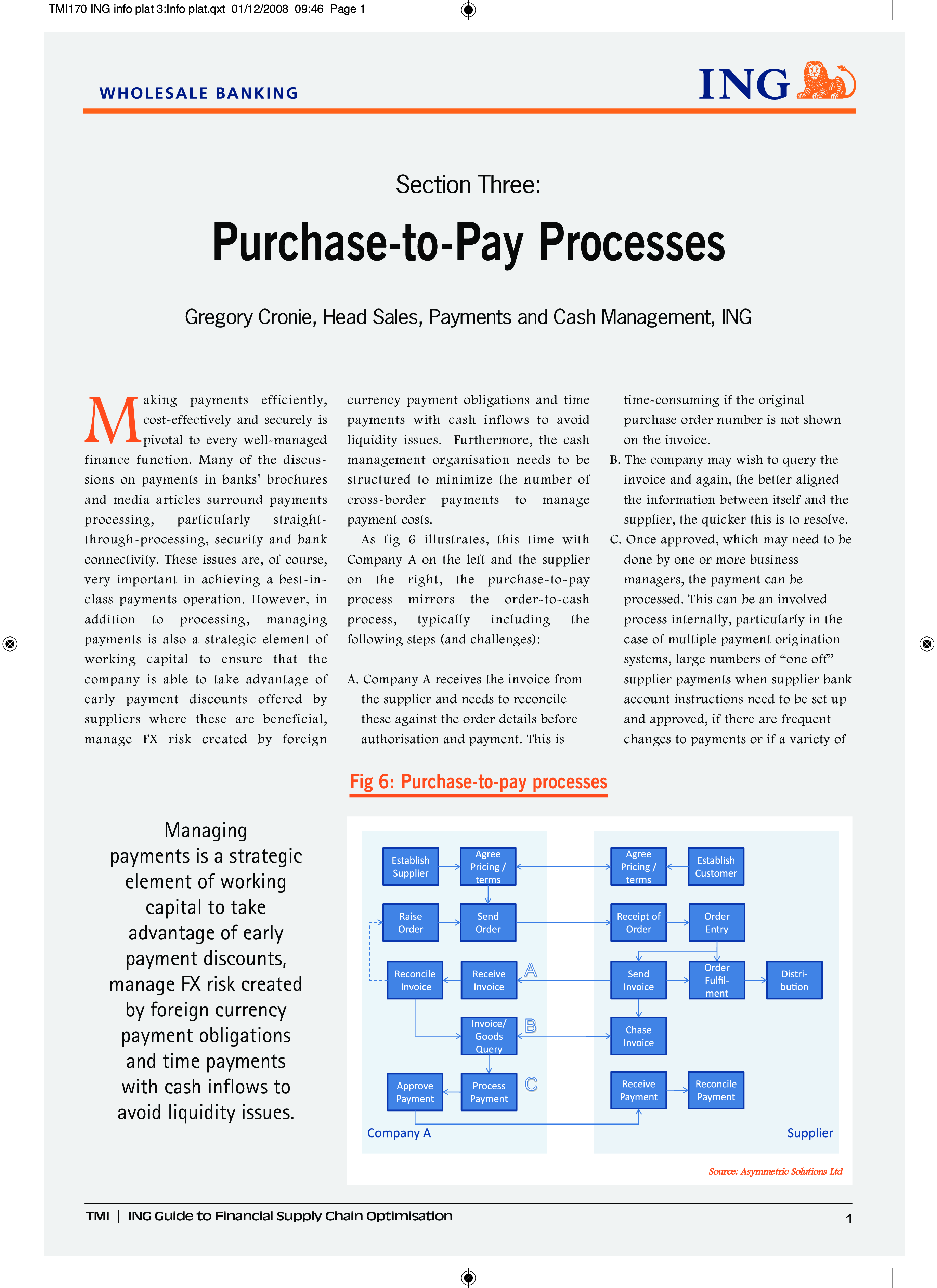

TMI170 ING info plat 3:Info plat.qxt 01/12/2008 09:46 Page 1 Section Three: Purchase-to-Pay Processes Gregory Cronie, Head Sales, Payments and Cash Management, ING M aking payments efficiently, cost-effectively and securely is pivotal to every well-managed finance function.. This can be an involved process internally, particularly in the case of multiple payment origination systems, large numbers of “one off” supplier payments when supplier bank account instructions need to be set up and approved, if there are frequent changes to payments or if a variety of Fig 6: Purchase-to-pay processes Managing payments is a strategic element of working capital to take advantage of early payment discounts, manage FX risk created by foreign currency payment obligations and time payments with cash inflows to avoid liquidity issues.. A variety of challenges can be satisfied by addressing four main areas to achieve greater consistency: l Consistent security l Payments centralisation l Consistent processes l l Multiple payments origination systems Payments system to manage routing, approvals and file formats l Multiple payment types l Cash management centralisation/ bank rationalisation l Banking interfaces and formats l Single approach to bank connectivity TMI ING Guide to Financial Supply Chain Optimisation n TMI170 ING info plat 3:Info plat.qxt 01/12/2008 09:46 Page 3 the need to standardise the way in which data is communicated to avoid the need to set up different formats for interfacing data between various counterparties..

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

Leave a Reply. If you have any questions or remarks, feel free to post them below.

Related templates

Latest templates

Latest topics

- Excel Templates

Where do I find templates for Excel? How do I create a template in Excel? Check these editable and printable Excel Templates and download them directly! - GDPR Compliance Templates

What do you need to become GDPR compliant? Are you looking for useful GDPR document templates to make you compliant? All these compliance documents will be available to download instantly... - Daily Report Sheets For Preschool

How do you create a kindergarten schedule or write a daily report for a preschool? Check out these preschool templates here. - Celcius To Farenheit Chart

How to Download our temperature Celsius to Fahrenheit conversion charts and streamline your temperature calculations and conversions here. - Play Money Template

Where to download cool Play Money templates? Download below our printable and customizable Play Money templates for fun or with space for your face template now!

cheese