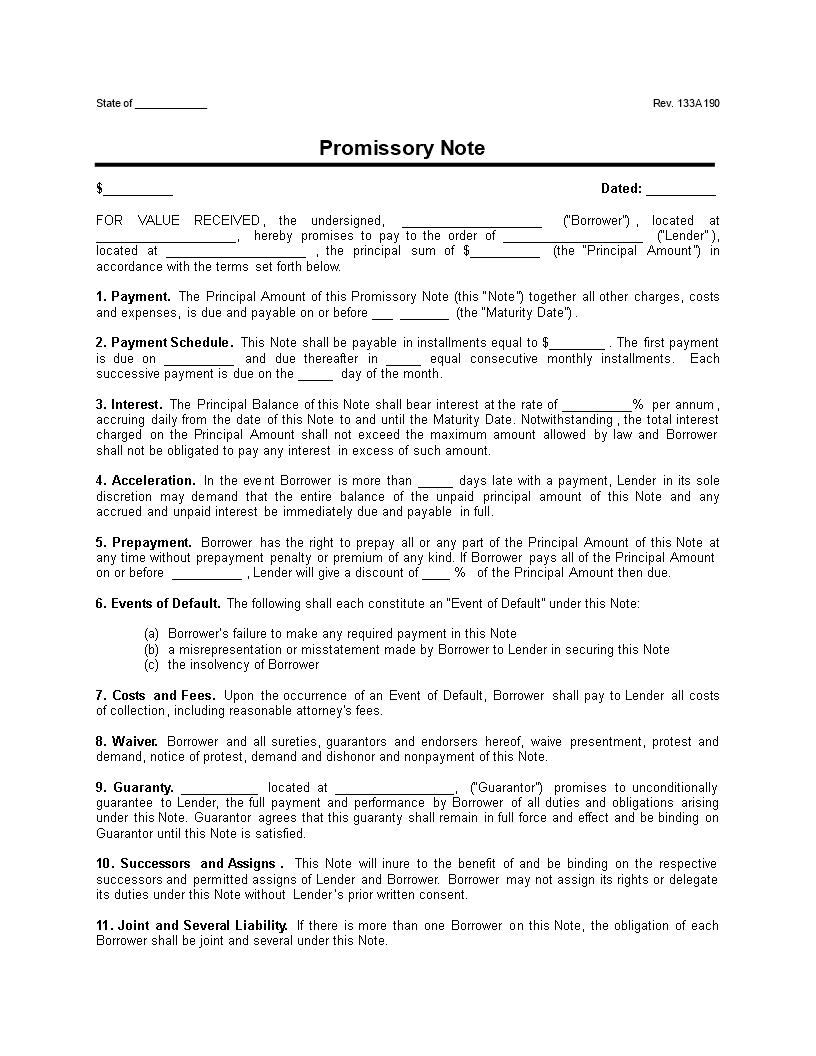

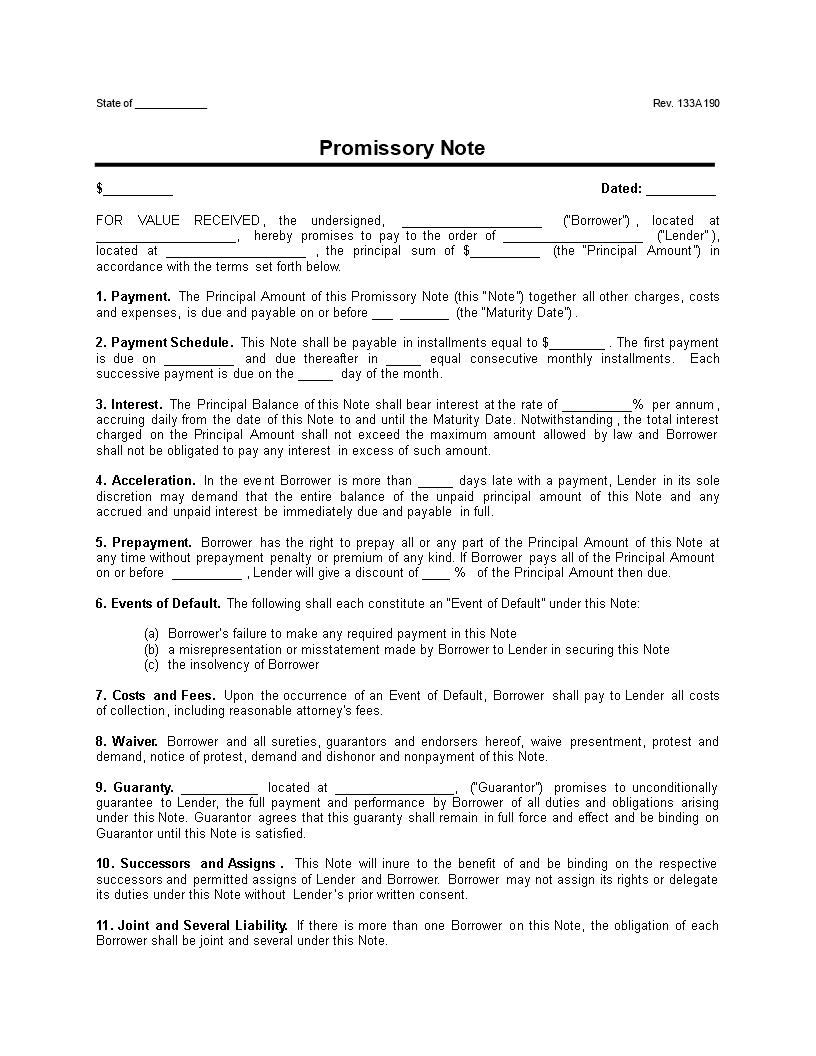

Promissory Note Installment Payment Clean Unsecured

Save, fill-In The Blanks, Print, Done!

Download Promissory Note Installment Payment Clean Unsecured

Microsoft Word (.docx)Or select the format you want and we convert it for you for free:

- This Document Has Been Certified by a Professional

- 100% customizable

- This is a digital download (22.4 kB)

- Language: English

- We recommend downloading this file onto your computer.

A promissory note is a written document that officially recognizes a legally binding relationship between two parties. Often between a lender and a borrower. True to its name, it serves as a written and enforceable promise to pay an amount of money owed. Both parties understand that money is being borrowed and must be repaid at a future date.

So what Is a Secured Promissory Note?

Unsecured versus Secured

There many different loan arrangements. We highly recommend to first understand the differences. However in general:

- IOU is a much more informal and flexible than a promissory note.

- A note is more informal and flexible than a loan agreement.

- A loan agreement is commonly used for the more complex payment arrangements and often includes a resource for the lender in case the borrower defaults or is unable to pay.

Many lenders do not provide financing without security. A promissory note is a contract between the bank and the borrower. A secured promissory note is accompanied by other documentation that pledges collateral. The borrower pledges this collateral in the event he can no longer pay and the loan is declared in default.

A secured note is accompanied by collateral. In the event the borrower fails to pay back the loan, the lender can legally seize and sell the collateral to recoup its losses. For this reason, lenders prefer notes to be secured. If an unsecured note goes unpaid, the lender can pursue legal action and file a judgment, but if the borrower does not have the means to repay, the lender will end up taking a loss.

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

Leave a Reply. If you have any questions or remarks, feel free to post them below.

Related templates

Latest templates

Latest topics

- Formal Complaint Letter of Harrasment

How do I write a formal complaint about harassment? Check out these formal complaint letter of harrasment templates here! - Google Sheets Templates

How to work with Google Sheets templates? Where to download useful Google Sheets templates? Check out our samples here. - Letter Format

How to format a letter? Here is a brief overview of common letter formats and templates in USA and UK and get inspirited immediately! - IT Security Standards Kit

What are IT Security Standards? Check out our collection of this newly updated IT Security Kit Standard templates, including policies, controls, processes, checklists, procedures and other documents. - Excel Templates

Where do I find templates for Excel? How do I create a template in Excel? Check these editable and printable Excel Templates and download them directly!

cheese